Your Guide to Customer Churn Prediction

A complete guide to customer churn prediction. Learn to build models, gather data, and use predictive insights to keep your most valuable customers.

Customer churn prediction is all about using data to figure out which customers are on the verge of leaving. Think of it as a financial early warning system for your business. It gives you a crucial window to step in and save those valuable relationships before they walk out the door for good.

The Hidden Costs of Losing a Customer

When a customer leaves, it's not just one lost sale. The impact sends ripples across your entire business, quietly siphoning profits and stalling growth in ways that are dangerously easy to miss. Imagine it like a slow, steady leak in a boat—one small drip might not seem like a big deal, but over time, it can absolutely sink you.

The most obvious hit is the lost revenue. Every customer who churns takes all their future spending with them. But the financial bleeding doesn't stop there. We all know it costs a lot more to acquire a new customer than to keep an existing one. This forces your sales and marketing teams into a constant grind, working harder just to replace who you've lost and keeping you stuck in place.

Beyond the Balance Sheet

High churn rates inflict damage that goes far beyond the numbers on a spreadsheet. A constant flow of departing customers can tarnish your brand's reputation and chip away at the trust you've built in the market. Unhappy former customers are often the most vocal, and their negative stories can scare off new prospects, making your acquisition efforts even more difficult and expensive.

The Proactive Advantage

Now, picture a business that actively predicts customer churn. By spotting at-risk customers early, the team can roll out targeted retention campaigns. This shifts the entire dynamic from reactive damage control to proactive relationship building. Instead of constantly asking, "Why did they leave?" the conversation becomes, "What can we do to convince them to stay?"

Understanding who is likely to churn—and why—unlocks some serious advantages. You can:

- Allocate Resources Efficiently: Focus your retention budget and effort on high-value customers who are actually at risk of leaving, getting a much better return on your investment.

- Improve Your Product: Churn signals are often a direct pointer to pain points, missing features, or friction in your user experience. It's invaluable feedback.

- Strengthen Customer Relationships: Reaching out before there's a problem shows customers you care, which can build incredible loyalty and even turn a potential churner into a brand champion.

This challenge isn't the same for everyone; churn rates can vary wildly by industry. For example, consumer packaged goods can see churn as high as 40%, while industries like telecommunications and SaaS often hover between 5% and 20%. These numbers drive home a painful truth: it can cost five times more to acquire a new customer than to keep an existing one.

Ultimately, predicting churn isn't just a fancy data science project. It's a core business strategy for building a more resilient, profitable, and customer-focused company.

How Churn Prediction Models Actually Work

Customer churn prediction isn't about gazing into a crystal ball. It’s far more practical—and powerful. At its heart, a churn prediction model is a machine learning algorithm trained to spot the subtle patterns that separate customers who stay from those who are about to leave.

Think of it like a detective building a case. The model sifts through mountains of historical data, looking for "clues" left behind by past customers. These clues could be anything: how often they log in, their history with customer support, which features they use (or ignore), and their payment history. By analyzing thousands of these data points, it learns to recognize the profile of an at-risk customer.

Once trained, the model applies this profile to your current customer base to flag individuals who fit the pattern, assigning each a churn risk score.

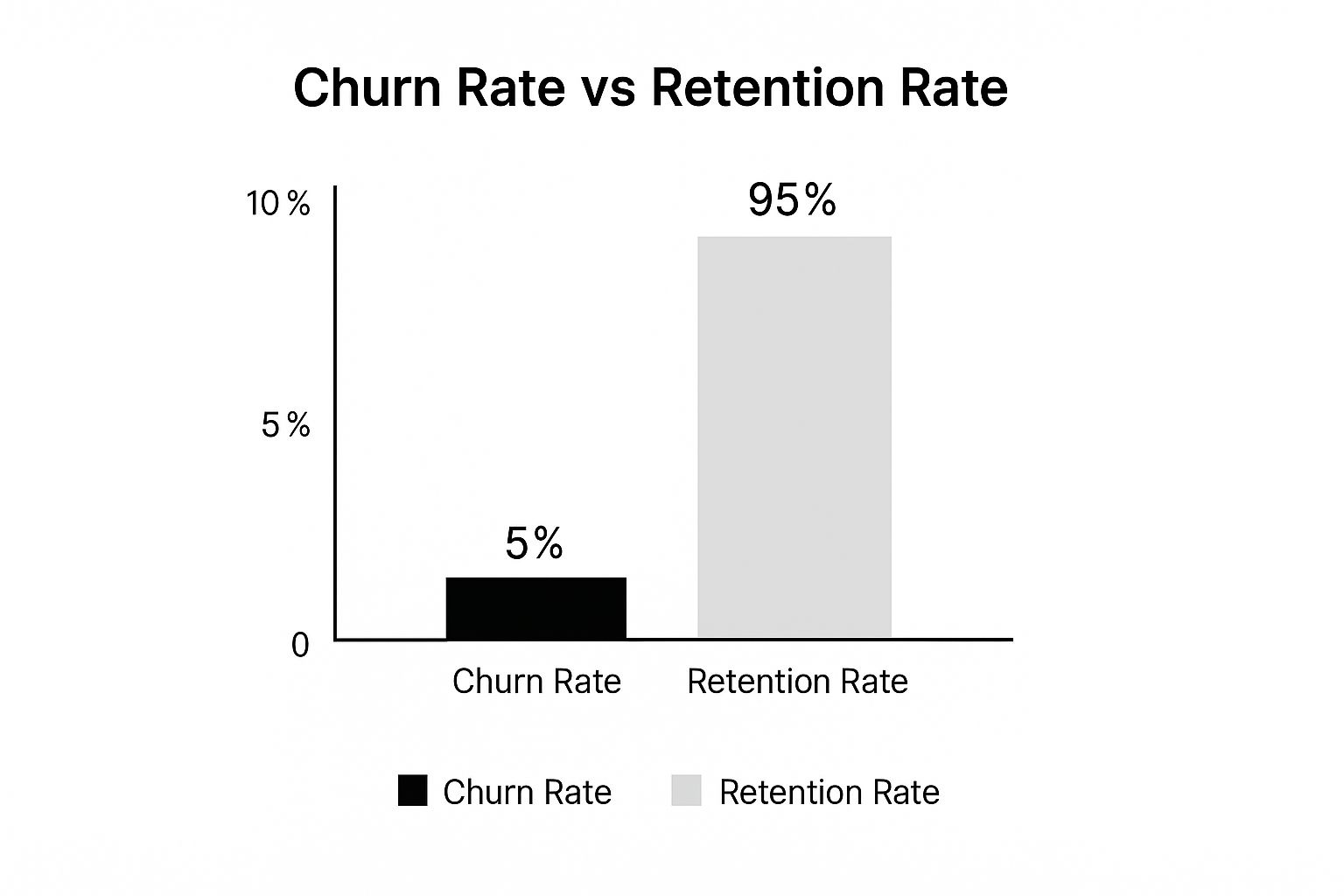

This is all about shifting from being reactive to proactive. The image below shows why even a small number of at-risk customers is a big deal.

While 95% of your customers might be loyal, that 5% who are considering leaving represent a massive, preventable loss of revenue. That's where prediction comes in.

A Look at Common Churn Prediction Models

You don't need a Ph.D. in data science to grasp how these models "think." Different algorithms approach the problem from different angles, and some are better suited for certain situations than others.

Here’s a quick breakdown of the most common types:

Comparing Common Churn Prediction Models

This table offers a high-level comparison of the different machine learning models you'll likely encounter, using simple analogies to explain how they work.

| Model Type | How It Works (Analogy) | Best For | Complexity |

|---|---|---|---|

| Logistic Regression | A simple on/off switch. It calculates the probability of one of two outcomes (churn vs. no churn). | Establishing a quick, clear baseline and understanding which factors are most influential. | Low |

| Decision Trees | A game of '20 Questions'. It asks a series of yes/no questions to sort customers into churn risk buckets. | Explaining why a customer is at risk in simple, business-friendly terms. | Medium |

| Gradient Boosting | An expert team. It builds a simple model, finds its flaws, then builds another to fix them, repeating the process. | Squeezing out the highest possible accuracy from large, complex datasets. | High |

Each model offers a trade-off between simplicity and power. Logistic Regression is fantastic for a first pass, while Gradient Boosting is what you bring in when every percentage point of accuracy matters.

The field is always evolving, too. While older models often relied on static datasets, customer behavior changes fast. Newer approaches can learn from real-time customer data streams, adapting on the fly. This is especially critical in fast-paced industries like banking and telecom. You can explore the research on these advanced methods to see how they’re pushing prediction accuracy even further.

Making Machine Learning Make Sense

A model is only useful if your team can actually understand and act on its predictions. The technical output needs to be translated into plain English.

For example, a data scientist might see, "the model's feature importance for 'session_duration' is 0.87." But for your customer success team, that's meaningless. The real value comes from translating it into an actionable insight like, "Customers who spend less than five minutes per session are three times more likely to churn next month." Now that is something you can work with.

By focusing on the "why" behind every prediction, you empower your entire organization. Your product team can design better onboarding for users showing risky behavior, and your success team can proactively reach out to high-value accounts whose engagement is dipping. The model stops being a black box and starts being a practical tool for making smarter decisions every single day.

What Kind of Data Do You Need to Predict Churn?

Any predictive model is only as good as the data you feed it. Think of it like a detective trying to solve a case—the more clues they have, and the better the quality of those clues, the more likely they are to crack it. The same principle applies here. Your model's accuracy lives and dies by the information you provide.

The old saying "garbage in, garbage out" is the absolute truth in machine learning. Your goal isn't just to collect data, but to assemble a complete picture of the customer experience. You're looking for the subtle signals that separate a loyal advocate from a customer who's already mentally checked out.

This data usually breaks down into four key categories. Each one gives you a different piece of the puzzle.

Core Customer Demographics

This is the "who" of your customer base. While demographics alone rarely tell the full story of why someone churns, they are fantastic for segmenting your audience and spotting patterns you might otherwise miss.

For a B2C company, this could be:

- Age and Location: Are you seeing a spike in churn among younger users in a specific city?

- Acquisition Channel: Are the customers you brought in from that big ad campaign leaving faster than your organic sign-ups?

For B2B businesses, the focus is more on firmographics:

- Company Size and Industry: Do startups churn at a higher rate than established enterprises?

- Subscription Plan: Are customers on your entry-level plan more likely to cancel?

Purchase and Transactional History

Money talks. A customer's spending habits are often one of the strongest predictors of their loyalty. A change in their financial relationship with your company is a massive red flag.

You’ll want to track data points like:

- History of subscription renewals and any failed payments.

- The date of their last purchase or a drop in how often they buy.

- Their average order value—is it trending up or down?

User Behavior and Product Engagement

This is where the magic really happens. How people actually use your product is the clearest window into the value they get from it. When engagement drops, churn is often just around the corner.

Be sure to monitor metrics such as:

- Login Frequency: Is a daily user now logging in weekly? Or not at all?

- Session Duration: Are they still spending meaningful time in your app, or are they just popping in and out?

- Key Feature Adoption: Are they using the "sticky" features that you know correlate with long-term value?

- Onboarding Completion: Did they ever finish the critical setup steps to get fully up and running?

Tracking these behaviors helps you answer the most important question: Is my customer succeeding with my product?

Customer Support and Feedback Data

Your support channels are a goldmine of raw, unfiltered customer sentiment. Every support ticket, live chat, and survey response is a clue about user friction points and overall happiness.

Look for data like:

- Ticket Volume: Is a specific customer suddenly flooding your support team with issues?

- Resolution Time: Are their problems getting solved quickly, or are they left waiting?

- Satisfaction Scores (CSAT): How do they rate their support interactions?

- NPS Scores: What’s their overall feeling about your company?

By weaving these four data streams together, you can create a detailed, 360-degree view of each customer. This rich dataset is the foundation you need to build a model that can see churn coming and give you the chance to step in before it's too late.

How Do You Know If Your Churn Model Actually Works?

So, you’ve built a customer churn prediction model. That’s a huge milestone, but the real work is just beginning. How can you be sure it's any good? How do you know its predictions are trustworthy?

Simply looking at a single "accuracy" score is a classic rookie mistake, and it can be dangerously misleading.

Think of your churn model as a sophisticated fire alarm for your customer base. An overall accuracy score might tell you it's "95% accurate." That sounds fantastic, right? But what if only 5% of your customers churn in a given year? A fire alarm that never goes off would also be 95% accurate, but it would be completely useless when a real fire breaks out.

To get the real story, you have to dig deeper and look at the types of mistakes the model makes. This is where we stop chasing a single vanity metric and start asking smarter questions about the model's true business value.

The Big Trade-Off: Precision vs. Recall

When it comes to churn models, the two most important metrics you'll hear about are Precision and Recall. They’re the key to understanding the critical trade-off between the different kinds of errors your model can make.

Let's stick with our fire alarm analogy.

- Precision asks: When the alarm rings, is there really a fire? In churn terms, it measures how many of the customers your model flagged as "at-risk" actually ended up leaving. High precision means your retention team isn't wasting time on false alarms.

- Recall asks: Of all the real fires that happened, how many did our alarm actually catch? This measures what percentage of the customers who truly churned were successfully identified by the model. High recall means your alarm is sensitive and doesn't miss real threats.

These two concepts are in a constant tug-of-war. If you crank up the sensitivity to catch every potential churner (high recall), you’re bound to get more false alarms from perfectly happy customers (low precision). On the other hand, if you tune it to only flag the most certain cases to avoid false alarms (high precision), you risk missing the subtle signs from customers who are quietly slipping away (low recall).

So, Which One Matters More for Your Business?

There's no single "correct" answer here. The right balance between precision and recall boils down to your business strategy and the cost of your retention efforts.

Here’s how this plays out in the real world:

- When to Prioritize High Precision: Imagine your retention strategy involves offering a hefty 25% discount or assigning a dedicated (and expensive) account manager. The cost of acting is high, so you need to be very sure the customer is a genuine flight risk. In this case, you optimize for high precision. You’re willing to miss a few churners to ensure your costly interventions are directed only at those who truly need them.

- When to Prioritize High Recall: Now, what if your retention tactic is cheap and easy to scale, like sending an automated "we miss you" email campaign? The cost of a "false alarm" is virtually zero. Here, you want to cast a wide net and prioritize high recall. It’s better to email a few happy customers by mistake than to miss the opportunity to save even one who was about to leave. This is also the right move for your most valuable, high-LTV accounts, where failing to detect a churn signal would be a massive financial blow.

A Few More Tools for Your Measurement Kit

While Precision and Recall are the headliners, a few other metrics are essential for getting a complete picture of your model's performance. You’ll almost always find them in a good model performance report.

Before diving into the metrics, it's worth noting that they all come from a simple but powerful tool called a Confusion Matrix. This is just a table that shows a direct comparison between the model's predictions and what actually happened. It gives you a clear count of every correct guess (True Positives, True Negatives) and every mistake (False Positives, False Negatives).

With that foundation, here are the other key metrics to know.

| Metric | What It Measures | Business Question It Answers |

|---|---|---|

| F1-Score | A balanced average of Precision and Recall. | "What's the overall effectiveness of the model if I care about both false alarms and missed churners equally?" |

| AUC-ROC Curve | The model's ability to distinguish between a churning and a non-churning customer. | "How much better is this model than just flipping a coin?" |

| Confusion Matrix | A detailed breakdown of the four prediction outcomes (TP, TN, FP, FN). | "Can I see a raw count of all the correct predictions and all the different types of errors the model made?" |

Once you get comfortable with this set of metrics, your conversations about model performance will change dramatically. You can finally move past asking, "Is the model accurate?" and start asking the much more important question: "Is this model helping us make smarter business decisions?" This is how you fine-tune your customer churn prediction strategy and ensure it’s perfectly aligned with your company's most important goals.

Turning Churn Predictions into Retention Wins

An accurate churn prediction model is a bit like a weather forecast warning of a coming storm. It’s incredibly valuable, but only if you use that information to grab an umbrella. A model that just tells you who is likely to leave, without a clear plan to stop them, is more of an academic exercise than a real business strategy.

The real magic—and the return on your investment—happens when you connect the dots between data science insights and concrete retention efforts. It’s about translating a raw churn score into a human-centric plan your teams can actually use.

Your customer success, marketing, and product folks need a playbook that turns a churn alert into a saved customer. This isn't about a one-size-fits-all approach. It’s about tailoring your outreach based on how serious the risk is for each specific customer. A successful program isn’t about just throwing discounts at everyone; it’s about delivering the right help to the right person at exactly the right time.

Crafting Your Retention Playbook

A great way to start is by thinking of your customer base in three distinct risk categories: low, medium, and high. Each group needs its own unique strategy. If you try to treat them all the same, you’ll end up wasting resources on happy customers or, worse, failing to save those who are truly teetering on the edge.

For your most loyal, low-risk customers, the game plan is simple: keep doing what you’re doing. They’re happy, so no special intervention is needed. The real work begins with the other two groups, where proactive engagement can make all the difference.

Strategies for High-Risk Customers

When a customer gets flagged as high-risk, the clock is ticking. These are people who are actively pulling away, logging in less, or have hit a major roadblock. Your response needs to be direct, personal, and focused on solving their immediate problem.

- Proactive Support Outreach: Don't wait for them to file a support ticket. Have a customer success manager reach out with a simple, disarming message like, "Hey, I noticed you haven't used [Key Feature] in a while. Is there anything I can do to help you get more value from it?"

- Targeted Incentives: If the data suggests the issue is price or value, a well-timed offer can work wonders. This could be a temporary discount, a free upgrade for a few months, or early access to a premium feature.

- Direct Feedback Sessions: For high-value B2B accounts, nothing beats scheduling a call. That personal touch shows you genuinely care about their business and gives you priceless feedback on what’s causing the friction.

With high-risk customers, the goal isn't just to stop them from canceling. It's to solve the underlying problem that put them in this position. This approach can turn a near-disaster into a moment that actually makes the relationship stronger.

Nurturing Medium-Risk Customers

Folks in the medium-risk category aren't heading for the exits tomorrow, but their engagement is definitely slipping. They might be logging in less often or ignoring new features. The strategy here is less of an emergency intervention and more of a gentle reminder of the value your product brings to their lives.

Consider these re-engagement tactics:

- Educational Content Campaigns: Send them case studies or quick tutorials that show how other customers just like them are getting great results. This reinforces the product's value and might spark their interest in features they’ve overlooked.

- New Feature Announcements: When you launch an update that solves a common problem, make sure this group hears about it. A personalized email highlighting a new feature that's relevant to them can be a powerful nudge to come back.

- Value Reinforcement Emails: Set up an automated email that triggers after a period of inactivity. You can remind them of the initial problem they signed up to solve and highlight some of the key wins they've already achieved with your tool.

By building a structured retention plan based on these risk segments, you turn your churn prediction model from a passive report into an active, revenue-saving engine. You start making data-driven decisions that not only cut down on attrition but also help you build a more resilient and loyal customer base.

Why Churn Prediction Is a Competitive Edge

In a crowded market, your fiercest competitor isn’t another company—it’s customer indifference. Winning new business is hard enough, but holding onto the customers you already have is the real challenge for long-term growth. This is where customer churn prediction stops being a technical exercise and becomes a serious competitive advantage.

Predicting churn is like getting a glimpse into your company's financial future. It lets you shift from a defensive, reactive stance—asking "why did they leave?"—to an offensive, proactive strategy focused on "how do we get them to stay?" That simple change allows you to protect your most valuable asset: your existing customer base.

Instead of just accepting churn as a cost of doing business, smart companies see it as an opportunity. They know that identifying customers who are about to walk away is the first step toward building a more resilient, profitable business.

The Rise of Retention Technology

The subscription economy has completely rewritten the rules. Customers can switch providers with a few clicks, meaning loyalty is no longer locked in by a contract. It has to be earned, over and over again.

This new reality has sparked a massive investment in technologies designed to understand and predict customer behavior. Just look at the global market for customer churn software. In 2023, it was valued at around USD 1.5 billion and is expected to explode to nearly USD 4.8 billion by 2032. This isn't just a trend; it's a clear signal that businesses are banking on retention tech to survive. You can explore the full market analysis to see this growth in detail.

Churn prediction isn't just for big corporations anymore. It's a critical tool for survival that lets companies of all sizes compete on the quality of their customer experience, not just their price tag.

A Global Strategic Imperative

This laser focus on managing churn isn't happening in just one corner of the world; it’s a global movement. North America is currently leading the pack, with a market share of roughly USD 600 million in 2023. This is largely fueled by intense competition in sectors like banking, retail, and telecom, where even a tiny drop in churn rates can have a huge impact on the bottom line.

But the real story is the explosive growth expected in the Asia Pacific region, which is projected to grow at a compound annual rate (CAGR) of 15%. It’s a worldwide acknowledgment that lasting success is built on retention, not just acquisition.

When you embrace churn prediction, you unlock several key advantages:

- Smarter Resource Allocation: You can stop guessing and start focusing your retention budget and marketing efforts on the specific customers who are actually at risk of leaving.

- Better Product Development: Churn signals are raw, honest feedback. Use them to pinpoint and fix the frustrating parts of your product or service.

- Stronger Customer Loyalty: Reaching out proactively shows customers you care about their business, which can turn a potential churner into a loyal advocate.

At the end of the day, predicting churn is far more than a data science project—it's a core business strategy. It gives you the tools to protect revenue, build loyalty, and carve out a lasting competitive edge.

Common Questions About Churn Prediction

Even with a solid plan, jumping into customer churn prediction for the first time usually brings up a bunch of practical questions. Let's tackle some of the most common ones we hear from business leaders, product managers, and data teams as they get started.

How Long Does It Take to Build a Churn Prediction Model?

There’s no single answer here—it really depends. A project can take anywhere from a few weeks to several months. The timeline hinges on three main things: how clean and accessible your data is, the complexity of the model you’re aiming for, and the size of your data science team.

If you have well-organized data and you're starting with a straightforward model, you might get a first version up and running in just 2-4 weeks. But if you’re building something more sophisticated that needs a ton of data prep, feature engineering, and testing, it could easily take 3-6 months to get it right. A smart way to start is with a smaller pilot project to prove the concept and show value quickly.

Can Small Businesses Use Churn Prediction?

Absolutely. It used to be that only big companies with deep pockets and large data teams could even think about this stuff, but that has completely changed. The wave of user-friendly machine learning tools and analytics platforms has made churn prediction accessible for just about everyone.

Many of the CRM and marketing platforms you might already be using have built-in predictive features. A small business can start by looking at basic data it already collects, like how often a customer buys something or when they last logged in. The trick is to start simple, find patterns you can act on, and build from there. The core idea—spotting warning signs and stepping in—works for any size business.

The most common mistake isn't a technical one; it's a strategic one. Companies often build a highly accurate model but fail to create a clear plan for how business teams will use its predictions to actually intervene and save customers.

What Is the Most Common Mistake in Churn Prediction?

The single biggest pitfall we see is an obsessive focus on model accuracy while completely forgetting about the action plan. You can have the most technically brilliant model in the world, but it’s worthless if your customer success and marketing teams don't have a clear way to use its insights to save at-risk customers.

This usually happens when the project is siloed as a "data science thing." For a churn prediction program to actually work, the people building the model and the people on the front lines have to be in lockstep. A model that tells you who is likely to churn is only half the battle. The other half is having a playbook ready to go to do something about it.

Ready to turn customer feedback and behavior into actionable retention strategies? SigOS is an AI-driven intelligence platform that identifies which customer issues are directly impacting your revenue. By analyzing support tickets, usage data, and sales calls, SigOS pinpoints the signals that predict churn, enabling your team to act before it's too late. Prioritize your product roadmap with confidence.

Ready to find your hidden revenue leaks?

Start analyzing your customer feedback and discover insights that drive revenue.

Start Free Trial →