Revenue-Driven Product Roadmap Development That Works

Stop building features nobody wants. Learn revenue-driven product roadmap development to prioritize what truly matters, align stakeholders, and grow your SaaS.

Product roadmap development isn't just about planning what to build next. It’s the strategic process of laying out how your product will grow and change over time to hit your most important business goals. This guide is all about taking a revenue-aware approach—turning your roadmap from a simple feature list into a serious engine for growth.

Moving Beyond The Feature Factory Mindset

Let’s be real for a second. Too many product roadmaps are just glorified wish lists. They become a dumping ground for every feature request, a frantic attempt to match a competitor's latest release, or a capitulation to the loudest voice in the room. This is the classic "feature factory" trap, and it leads to a vicious cycle of building stuff without any real connection to business outcomes.

What's the end result? Wasted engineering cycles, a bloated product that’s hard to maintain, and a ton of missed revenue opportunities. Your teams might be working incredibly hard, but they aren't actually moving the needle on what matters: keeping customers happy and growing the business.

The Dangers of a Disconnected Roadmap

When your roadmap is just a list of features with no clear link to revenue, you're setting yourself up for some serious problems, especially in a SaaS business.

- Resource Misallocation: Your development team's time is one of your most expensive assets. Every hour spent on a low-impact feature that doesn't drive acquisition, expansion, or retention is a direct hit to your bottom line.

- Reactive Prioritization: Without a solid strategic framework, it's easy to fall into the trap of just reacting. You end up chasing competitor updates or building a one-off feature to appease a single large customer, completely losing sight of the broader market needs.

- Lack of Alignment: If your sales, marketing, and success teams can't see the why behind the product's direction, how can they build a cohesive go-to-market strategy? They can't. You end up with a disconnected message and confused customers.

A great roadmap is a communication tool first and a planning document second. It should tell a clear story about where the product is going and how that journey creates tangible value for both the customer and the business.

Adopting a Revenue-Aware Approach

Switching to a revenue-aware mindset fundamentally changes how you think about product roadmap development. You stop just listing features and start asking much better questions. How will this initiative reduce churn? What's the potential expansion revenue tied to this customer request? This forces you to link every single development effort to a business metric you can actually measure.

This isn't just a theoretical shift; it has a real impact. It’s estimated that by 2025, this kind of smart, data-driven product development will boost efficiency by 19% and slash time-to-market by 17%. That’s the power of using data to focus on high-impact work—the absolute core of revenue-aware roadmapping.

Ultimately, it all comes back to understanding the core "job" a customer is trying to get done. When you focus on solving their real problems, you create value they are more than willing to pay for. A great way to get started is by using a Jobs to Be Done template to frame these customer needs. This focus is what transforms your roadmap from a simple document into a strategic asset that actively drives business growth.

Defining Your North Star: What Are We Actually Trying to Achieve?

A roadmap without a clear destination is just a fancy to-do list that burns through cash. Before you even think about prioritizing a single feature, you have to get brutally honest about where the company is headed. This means setting strategic, revenue-focused goals that will anchor every decision you make from here on out.

This isn't about vague aspirations like "improve user satisfaction." A roadmap that actually works is built on specific, measurable targets. We need to be thinking in terms of KPIs that directly signal the financial health of the business.

Connecting Business Goals to Product Work

High-level business objectives—the stuff the C-suite talks about—are the "why" behind your entire product strategy. They're the big-picture results like boosting annual recurring revenue (ARR) or cracking a new market. Your job as a product leader is to translate that ambition into actual work for your teams.

When you do this right, you create a clear line of sight from a developer's daily tasks all the way up to the company's biggest goals. Everyone, from engineering to sales, can see how their piece of the puzzle fits.

Let's see how this plays out:

- The Business Goal: We need to cut customer churn by 5% this fiscal year.

- The Product Initiative: Okay, let's overhaul the user onboarding experience to get people to their "aha!" moment faster.

- The Key Result: We'll know we're succeeding when the percentage of new users completing the core setup workflow jumps from 60% to 75% within their first week.

A great North Star metric isn't just about this quarter's revenue; it's a leading indicator of future success. It focuses on creating long-term customer value. If you obsess over a metric like "weekly active users who perform a key action," you're measuring deep engagement that naturally leads to retention and, down the line, more revenue.

Tying Every Metric Back to Revenue

This is where the "revenue-aware" part really kicks in. Every goal you set should have a clear, traceable path back to a financial outcome. While you can't slap a price tag on every single feature, you absolutely must be able to quantify its impact on acquisition, retention, or expansion revenue. This is what separates a standard roadmap from a strategic financial plan.

Imagine your company wants to grab more market share in the enterprise space. That's a great high-level goal, but we need to break it down into revenue-centric product goals.

Here’s a real-world scenario:

A SaaS company needs to increase expansion MRR from its enterprise customers by 15% in the next six months.

- How do we get there? You start listening. The sales team keeps telling you they're losing big deals because the product lacks a key compliance feature. Meanwhile, customer success data shows your biggest existing clients are constantly asking for better reporting tools.

- What are the product goals? Now you have clear, revenue-tied objectives.

- Launch a SOC 2 compliance feature to unblock the $500k currently stuck in the sales pipeline.

- Build an advanced analytics module designed to drive a 10% upsell rate among our top 20% of enterprise accounts.

This approach transforms your roadmap from a collection of "good ideas" into a concrete, measurable plan for hitting serious business targets.

The Ultimate Goal: Customer Lifetime Value

At the end of the day, the most powerful goals are the ones that increase the total value a customer brings to your business over their entire relationship with you. Metrics like churn reduction and expansion MRR are just inputs into this all-important number: Customer Lifetime Value (LTV).

Understanding what drives LTV is fundamental to building a sustainable business. To get a better handle on it, you can dig into the specifics of how to calculate the lifetime value of a customer in SaaS and use those insights to shape your North Star goals. When you align your product initiatives with LTV, you stop chasing short-term wins and start building a business that lasts.

Turning Customer Signals Into Revenue Insights

Your customers are talking. Constantly. Every support ticket, sales call, and product review is a goldmine of information about what they need, what drives them crazy, and—most importantly—what they'd happily pay more for.

The real challenge today isn't a lack of feedback; it's the overwhelming noise. Without a system to capture and make sense of it all, you're left guessing. A single, loud customer can hijack your priorities, while a quiet, widespread issue that's bleeding revenue goes completely unnoticed. This is where you shift from reacting to anecdotes to building a system that ties customer needs directly to business outcomes.

It all starts with creating a continuous feedback loop. You need a way to funnel all that rich data from your customer-facing platforms—think Zendesk, Intercom, and Salesforce—into one central place for analysis. Learning how to collect customer feedback effectively is the first, crucial step in this process.

From Unstructured Data to Quantified Opportunities

So, you've got this mountain of raw, unstructured data. Now what? Manually sifting through thousands of support tickets or listening to hundreds of hours of sales calls just isn't feasible. This is where modern AI-powered platforms are completely changing the game.

These tools can digest massive amounts of text and audio, automatically spotting patterns, sentiment, and recurring themes. They can connect a feature request mentioned on a sales demo to a bug reported in a support chat, and then link both of those back to the customer accounts involved. Suddenly, you're not just looking at isolated comments; you're seeing the whole picture.

The goal is to attach a dollar value to every piece of feedback. When you can say, "This bug is affecting 15 enterprise accounts with a combined ARR of $450,000," prioritization becomes a strategic business decision, not a guessing game.

This process shines a light on high-value opportunities that were previously hidden, turning fuzzy qualitative feedback into something tangible and financially grounded.

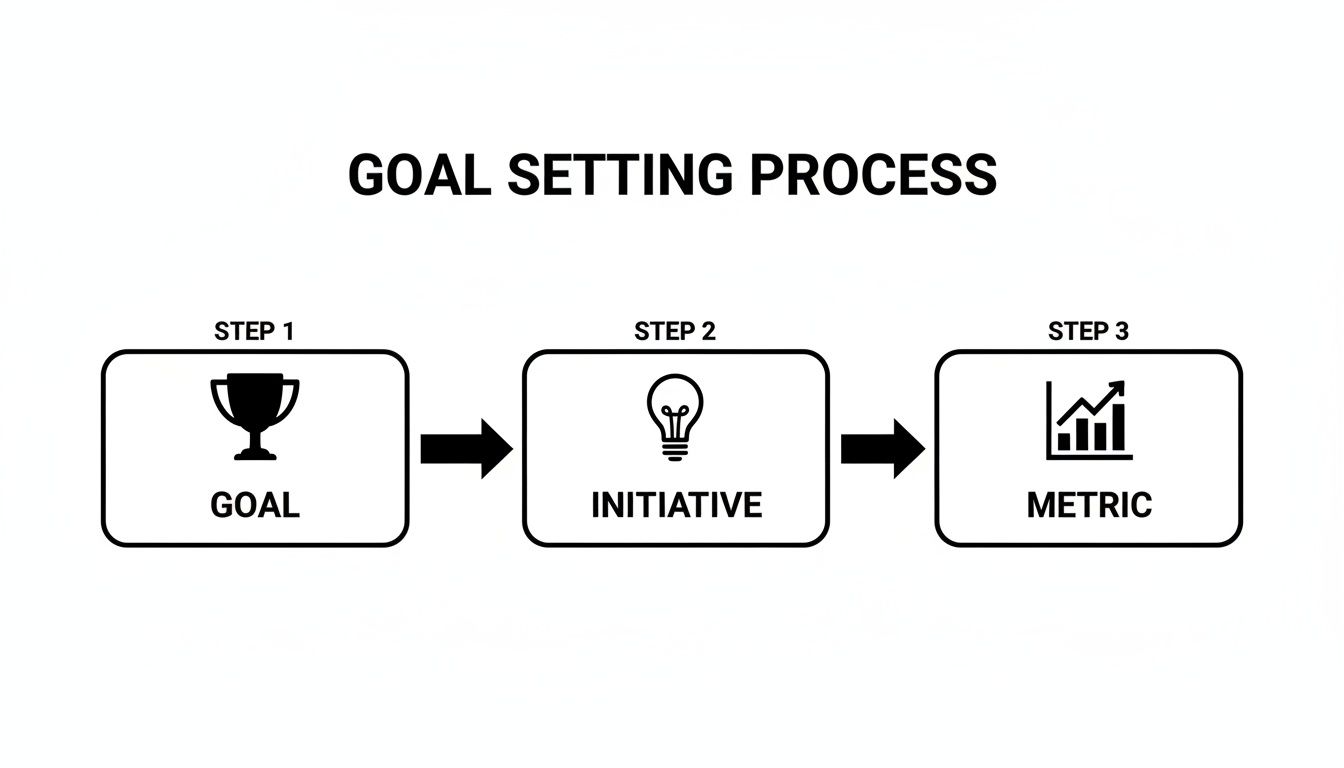

This infographic lays out the simple, powerful connection between your company's big-picture goals, the product initiatives you launch, and the metrics you use to measure success.

It’s a great reminder that every feature on your roadmap should be a direct answer to a strategic goal, with its success proven by a specific, trackable metric.

Both qualitative and quantitative feedback channels offer unique insights. The key is knowing how to use each one to build a complete, revenue-focused picture of your customer needs.

| Qualitative vs Quantitative Feedback Sources | | :--- | :--- | :--- | :--- | | Source Type | Example Channels | Type of Insight | How to Quantify Impact | | Qualitative | • Support Tickets• Sales Calls• User Interviews• Open-Ended Surveys | The "why" behind user behavior. Rich, contextual stories about pain points and desired outcomes. | Tie feedback to customer accounts (e.g., Salesforce, CRM) to link it to ARR, deal size, or churn risk. | | Quantitative | • NPS/CSAT Scores• Product Analytics• Feature Adoption Rates• A/B Test Results | The "what" and "how many." Hard data on user behavior, sentiment scores, and engagement levels. | Segment data by customer tiers (e.g., Enterprise vs. SMB) or user personas to see where the biggest impact lies. |

By combining these sources, you get both the emotional story and the financial data needed to make truly informed roadmap decisions.

A Real-World Scenario Uncovering Hidden Revenue

Let's walk through a common example. A B2B SaaS company starts seeing a small uptick in support tickets about their reporting dashboard. On their own, each ticket looks pretty minor—a user asking how to export data, another complaining that a report is slow to load.

In a traditional product workflow, these get triaged as low-priority bugs and tossed into the backlog, likely to be forgotten. But with an intelligent feedback system, a completely different story starts to unfold.

The system aggregates all these signals and reveals a critical pattern:

- Source: A whopping 73% of these tickets are coming from users at enterprise-level accounts.

- Impact: These accounts represent over $1.2 million in annual recurring revenue.

- Risk: Digging into usage data, it finds that users who submit these tickets have a 40% higher churn rate within the next 90 days.

All of a sudden, a handful of "minor" issues is exposed as a major churn risk threatening over a million dollars in ARR. The system has quantified the cost of doing nothing.

But it doesn't stop there. The same system analyzes sales call transcripts and finds that prospects from similar enterprise companies are frequently asking about more advanced reporting capabilities during demos. It connects the dots, turning a retention problem into an expansion opportunity.

By building out the advanced reporting features these high-value customers are asking for, the company can not only plug a leaky revenue bucket but also create a new premium tier. The analysis projects this could unlock an additional $300,000 in expansion revenue over the next year. Now that's a revenue-aware roadmap.

Prioritizing Features With Revenue-Aware Frameworks

Alright, you’ve done the hard work of collecting and quantifying customer signals. Now comes the moment of truth where strategy meets execution: prioritization.

Without a solid system, this is where even the best data can fall apart. Decisions get made based on gut feelings, the loudest voice in the room, or the most recent customer complaint. A revenue-aware approach demands a more disciplined, objective process to cut through the noise.

The goal here is simple but profound: stop building what customers ask for and start building what drives measurable business results. This requires a framework that forces you to weigh every idea against your core financial goals, creating a clear, defensible "why" behind every single item on your roadmap.

Moving Beyond Standard RICE

Many teams start with the RICE scoring model—Reach, Impact, Confidence, and Effort. It’s a decent entry point, but in its standard form, it’s often too subjective. "Impact" can become a vague score from 1 to 3, which doesn't really help when you're making tough trade-offs.

To make it truly revenue-aware, we need to inject it with the hard data we've gathered.

- Reach: Don't just estimate user numbers. Tie this directly to the number of paying accounts a feature or bug fix will affect.

- Impact: This is where the magic happens. Replace that generic 1-3 scale with a real financial metric. Think in terms of the total ARR of customers requesting a feature or the potential expansion revenue from a new module.

- Confidence: Your confidence score is no longer a guess. It’s a percentage backed by data. For example, if 60% of your at-risk enterprise accounts are all mentioning the same missing feature, your confidence in addressing it is sky-high.

- Effort: This stays as a measure of engineering time (person-months), but now it's being weighed against tangible revenue figures. The ROI calculation becomes incredibly clear.

A revenue-aware RICE score transforms prioritization from a subjective exercise into a business case. You're no longer just comparing features; you're comparing potential financial outcomes. This shift is fundamental.

The Power of Quantifying Cost of Delay

One of the most potent concepts in a revenue-focused product org is the Cost of Delay. This framework asks a brutally honest question: What is the financial cost to the business for every week or month we don't ship this?

Suddenly, the whole conversation changes. It's not just about what you gain by building something; it's about what you are actively losing by postponing it. This creates a sense of urgency and clarifies trade-offs like nothing else.

Imagine your sales team tells you a missing integration is blocking five enterprise deals worth a combined 250,000 in ARR. The Cost of Delay is immense. Every month you wait, you're potentially forfeiting over ****20,000 in new MRR. When you see it that way, pushing that integration back a quarter for a "nice-to-have" feature looks like a terrible business decision.

This framework is also brilliant for balancing different kinds of value. A project might not generate new revenue, but it could be critical for retaining a major customer. Cost of Delay helps you quantify that retention value and compare it apples-to-apples against a new sales opportunity.

Choosing the Right Framework for Your Team

No single framework is a silver bullet. The best choice depends on your company's stage, how good your data is, and the kinds of decisions you're facing daily. A larger organization might need a more structured process, while a startup can get by with something more agile.

If you’re juggling multiple products, effective product portfolio management also requires a consistent way to evaluate opportunities across different roadmaps.

Choosing the right framework depends on your goals and data maturity. This table compares popular methods for revenue-aware roadmapping.

Comparison of Prioritization Frameworks

| Framework | Best For | Key Inputs | Potential Pitfall |

|---|---|---|---|

| Revenue-Aware RICE | Teams new to data-driven prioritization who want a simple, structured formula. | Customer ARR, deal sizes, support ticket volume, engineering estimates. | Can oversimplify complex decisions; effort estimates can be inaccurate. |

| Cost of Delay | Mature teams making high-stakes decisions between revenue-generating, cost-saving, and risk-reducing initiatives. | New revenue opportunities, churn risk data, operational efficiency gains. | Can be complex to calculate accurately without reliable financial data. |

| Value vs. Effort | Early-stage teams needing a quick, visual way to find low-hanging fruit and avoid high-effort, low-impact work. | Qualitative value assessment (high, medium, low), rough effort estimates. | Highly subjective and can be easily influenced by personal bias if not grounded in data. |

Ultimately, the specific tool you choose is less important than the discipline it instills. The best framework is the one your team will actually use consistently. Start with one, tweak it for your needs, and never lose sight of the core principle: every roadmap decision should tie directly to a measurable business impact. This is how you stop just being busy and start building a product that truly drives sustainable growth.

Communicating The Roadmap To Align Stakeholders

Let’s be honest. A brilliant, data-backed roadmap is useless if it just sits in a folder. If you can't get genuine buy-in from your stakeholders, that roadmap is nothing more than a well-researched document gathering digital dust. Your real job begins after the roadmap is drafted: communicating the "why" and getting everyone, from the C-suite to the front lines, pulling in the same direction.

This isn't about just walking through a timeline of features. It's about telling a compelling story—a story about where the product is headed and how that journey is going to fuel the business. You have to translate your strategic priorities into a narrative that clicks with different teams, each with their own goals and pressures.

Think of the roadmap as your most powerful communication tool. Without alignment, you're heading for friction between teams, missed sales targets, and confused customer messaging that undermines all your hard work.

Tailor Your Message To The Audience

A one-size-fits-all roadmap presentation will have half the room checking their email. Different departments care about different outcomes, so you need to create different "views" of your roadmap that speak their language. To do this well, many product leaders find that investing in executive communication skills training pays off, as it teaches you how to frame the perfect message for each specific audience.

Consider the unique perspectives in your company:

- For the C-Suite: They need the 30,000-foot view. Focus on business outcomes, revenue impact, and how you’re positioning against competitors. Use a theme-based roadmap that ties directly to company goals, like an initiative to "Increase Enterprise Market Share by 15%."

- For Sales: They live and die by what’s coming next. Give them a timeline-focused view that highlights key features they can start talking about to unblock deals. Be crystal clear about the specific customer problems these features solve.

- For Marketing: They’re building the go-to-market plan. They need a view that details launch timing, target personas, and the unique selling points of upcoming features so they can get a head start on campaigns and messaging.

- For Engineering: This is where the rubber meets the road. They need a view that connects high-level initiatives to specific epics in a tool like Jira, with a clear focus on dependencies and technical requirements.

By customizing your presentation, you show each stakeholder how the roadmap directly helps them win. That’s the fastest path to building true company-wide buy-in.

Tell A Story Backed By Data

Don't just list features. Build a narrative. Start by grounding everyone in the current reality—the customer problems you’ve uncovered and the business challenges you're up against. This is where you bring your quantified data to life.

Instead of saying, "We're building a new reporting dashboard," tell a story that grabs their attention:

"Last quarter, we saw a 40% spike in churn from our enterprise accounts, which cost us $1.2 million in ARR. When we dug in, we found that 73% of those customers cited our reporting limitations as a key reason for leaving. This new advanced analytics module isn't just another feature; it's our direct response to stop the bleeding and fix our biggest retention problem."

This approach instantly connects a product decision to a painful business metric. The conversation shifts from a debate over which features are "cooler" to a strategic discussion about solving problems and capturing real value. You're not just presenting a plan anymore; you're making a business case that’s nearly impossible to ignore.

Handling Objections And Managing Expectations

No roadmap presentation is a smooth ride. Stakeholders will have questions, lobby for their pet projects, and raise legitimate concerns. How you handle these moments is crucial for maintaining trust and authority.

Here are a few tactics that have worked for me:

- Acknowledge and Validate. When someone pushes back, don’t get defensive. Start by validating their point. "That's a great point, and I completely see why adding X would be a huge win for the sales team." This simple step shows you're actually listening.

- Redirect to the Data. Gently bring the conversation back to the agreed-upon strategy and the data you used. "Right now, our number one priority as a company is reducing churn. While X would definitely help land new logos, the data shows that fixing Y will save $500k in at-risk revenue this quarter alone."

- Offer a Clear "Parking Lot." Don't let new ideas derail the entire meeting. Have a clear, transparent process for submitting and reviewing new requests. This assures people their input is valued and will be considered in the next planning cycle, without derailing the current strategy.

Ultimately, great roadmap communication turns a static document into a living, breathing conversation. It builds trust, forges alignment, and gets the entire company excited about the future you’re building together.

Your Product Roadmapping Questions, Answered

Even with the best frameworks in hand, the daily grind of product management throws curveballs. We all face the same struggles—from that last-minute "urgent" request to juggling priorities that all feel like P1s. This section is all about tackling those common questions with direct, practical advice.

Think of this as your field guide for applying those revenue-aware principles when the pressure is on.

How Often Should We Update The Product Roadmap?

There’s no magic number here. The best approach is to think of your roadmap as a living document with different review cycles for different zoom levels. Your big-picture, strategic themes? You’ll probably only revisit those annually or semi-annually, in lockstep with your company's major planning cycles.

On the other hand, your tactical, near-term priorities—the stuff in the “Now” column—should be under a much more frequent microscope. Think quarterly or even monthly reviews. This rhythm keeps you agile enough to react to fresh data, like a sudden spike in churn risk from a key segment, without getting thrown off your long-term course. The goal is consistency, not rigidity.

Handling Urgent Feature Requests From Major Customers

Ah, the classic dilemma. A big-name customer is threatening to walk unless you build their pet feature, and they need it yesterday.

Before you sound the alarm, pause and go to your data. A demand from a 500,000 ARR account is a fundamentally different conversation than one from a ****5,000 account. Your job is to turn this fire drill into a data-informed decision.

Use your product intelligence to find the answers:

- Is this a one-off or a trend? Dig in and see if other high-value customers are hitting the same wall.

- What’s the real cost of delay? Is the churn risk credible and immediate, or is it a negotiating tactic?

- What’s the opportunity cost? If you pull the trigger on this, what other high-impact initiative gets pushed to the back burner?

If the data shows a clear and present danger to your revenue, you might have to pivot. But this approach arms you to make a strategic call, not a knee-jerk reaction. It also gives you the ammunition to negotiate. Maybe this becomes a paid, custom project or a beta feature for a specific cohort.

One customer's request is a data point, not a directive. Even if it's a powerful one, it's your job to weigh it against the broader market signals and your strategic goals before letting it hijack the roadmap.

Making Data-Driven Decisions On A Small Team

So many small teams think "data-driven" means you need a dedicated data scientist and a six-figure software budget. That's just not true. You can start small and still be incredibly effective.

The first step is simply creating a central place for all your feedback. This doesn't have to be fancy; it could be a dedicated Slack channel that pipes into a well-organized spreadsheet.

The single most important thing you can do is to start tagging every piece of feedback with customer and revenue data right from the beginning. Just manually adding a customer's ARR to their feature request in your backlog immediately gives you a powerful way to sort and prioritize. It's not about having flawless, big data; it's about building the habit of connecting what people are asking for with what they're paying you.

By turning qualitative feedback into actionable, revenue-driving insights, SigOS helps product teams cut churn, speed up expansion, and build the features customers are happy to pay for. See how our AI-driven platform can put a dollar value on every customer signal and bring financial clarity to your product roadmap. Learn more about SigOS and see how it works.

Keep Reading

More insights from our blog

Ready to find your hidden revenue leaks?

Start analyzing your customer feedback and discover insights that drive revenue.

Start Free Trial →