Mastering Product Portfolio Management

A strategic guide to product portfolio management. Learn proven frameworks, resource allocation tactics, and AI-driven strategies to boost your business growth.

Product portfolio management is the art and science of looking at all of a company's products as one big picture. Instead of getting bogged down in the success or failure of a single product, it’s about making the entire collection—the portfolio—as valuable as possible by lining it up with the company's biggest goals. This means making some tough, strategic calls about which products get more investment, which ones are kept steady, and which ones are phased out.

Understanding Product Portfolio Management

A great way to think about it is like managing an investment fund. You wouldn't put all your money into a single, high-risk stock, right? A smart fund manager balances the portfolio with a mix of stable, income-generating assets (your "cash cow" products), high-growth stocks (your emerging stars), and some speculative bets on new opportunities (your innovative new ventures). The goal is a healthy, balanced portfolio that delivers returns today while being positioned for future growth.

This discipline gives you that crucial bird's-eye view of your entire product lineup. Of course, to manage the whole portfolio, you first need a solid grasp of what product management entails for a single product. While a product manager is deep in the trenches, fighting for their product's success, the portfolio manager is the general on the hill, deciding where to send troops and resources to win the entire war.

This strategic oversight is what separates companies that thrive from those that just survive. Without it, you end up spreading resources too thin, pouring money into pet projects that go nowhere, or completely missing the next big market shift.

The Core Objective

At its heart, the main goal of product portfolio management is to put your resources—money, people, and time—where they’ll generate the biggest bang for your buck across all products. It's a constant balancing act between risk and reward, making sure the company is set up for both immediate wins and long-term dominance.

This process forces decision-making out of the realm of gut feelings and into a structured, data-driven framework. It helps you answer the really tough questions:

- Are we placing enough bets on future growth, or are we playing it too safe?

- Which products are just resource drains with little to show for it?

- Does our collection of products actually match where we say we want to go as a company?

- How do we mix things up to protect ourselves if one market suddenly goes south?

This table breaks down the core activities involved:

Core Activities in Product Portfolio Management

A summary of the primary functions involved in managing a product portfolio, from strategic alignment to performance tracking.

| Activity | Objective | Example Action |

|---|---|---|

| Strategic Alignment | Ensure the portfolio directly supports the company’s vision and long-term business goals. | Mapping each product initiative to a specific corporate objective, like market expansion. |

| Resource Allocation | Distribute budget, talent, and time effectively across all products to maximize overall return. | Shifting development resources from a legacy product to a new high-growth opportunity. |

| Risk Management | Balance the portfolio to mitigate market, technical, and financial risks. | Diversifying the portfolio with products in different markets or lifecycle stages. |

| Performance Tracking | Continuously monitor the health and contribution of each product using clear, consistent metrics. | Using a dashboard to track KPIs like revenue, market share, and customer satisfaction. |

| Product Prioritization | Decide which new product ideas or features to pursue, delay, or discard based on strategic value. | Scoring and ranking potential projects against predefined criteria like ROI and alignment. |

| Lifecycle Management | Actively manage products from launch to retirement, making decisions to invest, maintain, or sunset them. | Creating a plan to phase out an underperforming product and migrate its users. |

By taking a structured approach to these activities, you shift the entire conversation. You stop asking, "Are we building this product right?" and start asking the more powerful question: "Are we building the right products?"

Ultimately, effective portfolio management provides the clarity needed to confidently double down on your winners, nurture your rising stars, and make the tough—but necessary—call to pull the plug on products that no longer fit. This is what builds a resilient, focused, and more profitable business.

Aligning Your Portfolio with Business Strategy

Think of a product portfolio that isn't tied to your business strategy. It's like a fleet of ships sailing without a common destination—plenty of activity, but no real, unified progress. For product portfolio management to actually work, every single product investment must directly support the company's bigger mission.

Without that clear connection, you end up with teams working hard on projects that might seem interesting but ultimately fail to move the needle for the business. True strategic alignment acts as a powerful filter, giving you the confidence to say 'no' to good ideas that just aren't the right ideas for your company at this moment. It turns a random collection of products into a purpose-built engine for growth.

Translating Objectives into Action

The first real step is breaking down those lofty, high-level business goals into tangible strategic themes that your teams can actually work with. A corporate objective like "Increase market share in Europe by 15%" is a great start, but it isn't directly actionable for a product team. You have to translate it into guiding principles for the portfolio.

For example, that single objective could be broken down into concrete strategic themes:

- Localize Core Products: Adapt our most successful products for European languages, currencies, and regulations.

- Develop Region-Specific Features: Build new functionality that solves unique pain points for customers in the European market.

- Acquire a Local Competitor: Integrate a smaller, regional company to gain an instant foothold and an established user base.

These themes become the guardrails for your portfolio decisions. From this point on, when a new product idea comes up, the first question is simple: "Does this support one of our core strategic themes?" If the answer is no, it's immediately pushed down the priority list, protecting your most valuable resources for the work that truly matters.

Establishing Strategic Filters

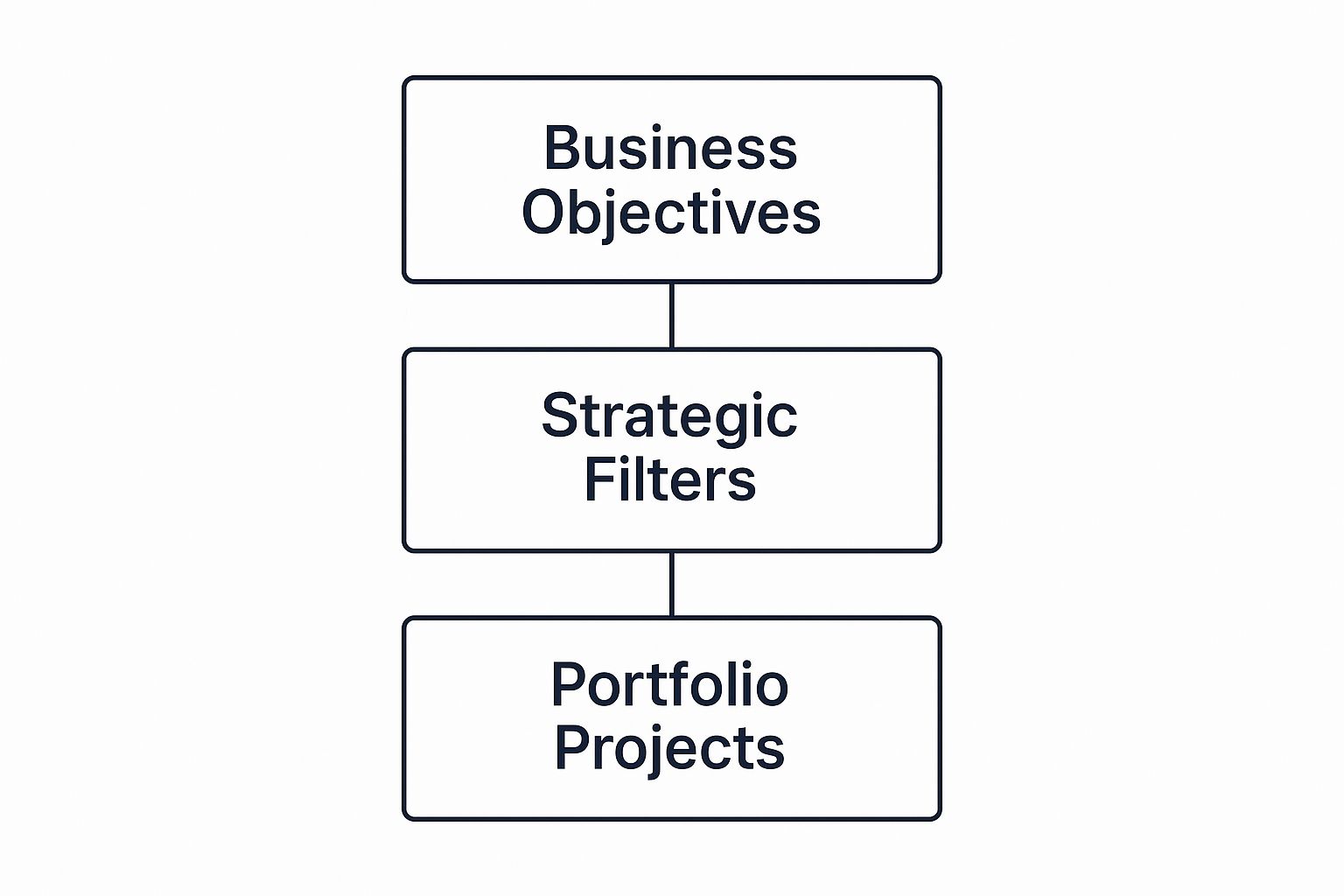

Once you have your themes, you can build out a more formal evaluation framework. This framework creates a clear hierarchy, flowing from the broad business objectives all the way down to the specific projects that get funded and staffed.

This infographic shows exactly how those high-level goals are systematically broken down into filters that decide which projects get the green light.

As you can see, portfolio projects aren't just random bets. They're the direct output of a disciplined process designed to execute corporate strategy. This top-down approach ensures that every dollar spent and every hour of development time has a purpose. We're seeing this methodical alignment become critical across industries. For instance, firms in asset management are actively redefining product strategies to align with major corporate trends and capture new market opportunities on mcksey.com.

Building a Strategically Aligned Roadmap

With your goals translated and your filters in place, the final step is to make sure your portfolio roadmap actually reflects this strategy. A great roadmap isn't just a list of features and timelines; it's a visual declaration of your company's strategic intent. It needs to clearly show how every planned initiative connects back to the business objectives it serves.

This process involves a few key actions:

- Categorize All Initiatives: Tag every single project—both current and proposed—with the strategic theme it supports. This gives you a quick, at-a-glance view of whether your resource allocation actually matches your stated priorities.

- Score and Rank Projects: Use a weighted scoring model based on your strategic filters to rank all initiatives objectively. You can factor in things like market potential, competitive advantage, and the resources required to get it done.

- Visualize the Balance: Create a view of your portfolio that shows the investment balance across your different strategic themes. Are you putting 70% of your budget into "Market Expansion" when it's only one of five key goals? Seeing it visually makes these kinds of imbalances impossible to ignore.

A well-crafted roadmap becomes your communication cornerstone. It shows every stakeholder, from the engineering team to the C-suite, not just what you're building, but more importantly, why. For a hands-on guide to putting this together, take a look at our article on creating a technical roadmap template that aligns with business goals.

Proven Frameworks for Portfolio Analysis

Making objective, high-stakes decisions about your product portfolio requires more than a hunch. You need a structured, visual way to cut through the noise, remove emotion, and see where each product really stands. This is exactly where analysis frameworks prove their worth.

Think of these frameworks as strategic maps for your entire product lineup. They help you plot every product based on consistent, data-backed criteria, making it obvious where to invest, what to maintain, and which assets might be holding you back.

Instead of getting bogged down in debates based on gut feelings, these models anchor the conversation in what truly matters: how well your product is doing and how attractive its market is.

The Classic BCG Matrix

The Boston Consulting Group (BCG) Matrix is one of the most foundational tools in product portfolio management. It's a simple but incredibly insightful 2x2 grid that organizes your products based on two key dimensions: Relative Market Share and Market Growth Rate.

In other words, how strong is your product compared to its top competitor, and how fast is the overall market growing? Plotting your products on this grid sorts them into four distinct categories, each with a clear strategic playbook.

- Stars: These are your high-growth, high-share products. They’re leaders in a booming market, bringing in a lot of revenue but also needing significant investment to stay ahead. The strategy is simple: invest aggressively.

- Cash Cows: These are low-growth, high-share products. They dominate a mature, stable market and generate a steady stream of cash without needing much investment. The goal here is to harvest and maintain them to fund your other ventures.

- Question Marks: Sitting in the high-growth, low-share corner, these products are your biggest gamble. They’re in an exciting market but haven't grabbed a strong foothold yet. The decision is to analyze carefully—either invest heavily to turn them into Stars or cut your losses.

- Dogs: These are your low-growth, low-share products. They exist in a stagnant market with no real competitive edge and can drain resources. The most common strategy is to divest or phase out.

The GE McKinsey Nine-Box Matrix

While the BCG Matrix is perfect for a high-level overview, sometimes you need a bit more depth. That’s where the GE/McKinsey Nine-Box Matrix comes in. It expands on the same core concept but uses more comprehensive, multi-factor dimensions: Industry Attractiveness and Business Unit Strength.

This approach provides a richer, more nuanced analysis because each axis is a composite of several different factors.

Industry Attractiveness Factors:

- Market size and growth rate

- Industry profitability

- Competitive intensity

- Technological factors

- Pricing trends

Business Unit Strength Factors:

- Market share

- Brand equity

- Customer loyalty

- Profit margins

- Product quality

Plotting products on this 3x3 grid results in nine boxes, which are grouped into three primary strategic zones: Invest/Grow, Selectivity/Earn, and Harvest/Divest. This level of detail allows for much more refined strategies than the four broad buckets of the BCG model. A sophisticated product intelligence platform can provide the data needed to accurately assess these multiple factors.

This matrix helps you tackle more complex situations. For instance, a product with average strength in a highly attractive market might warrant selective investment—a strategic choice that’s much clearer here than in the simpler BCG framework. To make these calls effectively, you need solid insights on ROI and impact analysis. Ultimately, these frameworks provide the structure to turn raw data into a clear path forward.

For a clearer understanding, let’s compare these two powerful frameworks side-by-side.

BCG Matrix vs GE/McKinsey Matrix Comparison

| Feature | BCG Matrix | GE/McKinsey Matrix |

|---|---|---|

| Structure | 2x2 grid (four quadrants) | 3x3 grid (nine boxes) |

| Dimensions | Relative Market Share, Market Growth Rate | Business Unit Strength, Industry Attractiveness |

| Complexity | Simple, easy to visualize and apply. | More complex, uses multiple factors for each axis. |

| Strategic Guidance | Four broad strategies (Invest, Harvest, Analyze, Divest). | More nuanced strategies across three zones (Grow, Select, Harvest). |

| Best For | Quick portfolio assessments and resource allocation decisions. | In-depth strategic planning where multiple factors influence success. |

While the BCG Matrix offers a quick and effective snapshot, the GE/McKinsey Matrix provides the granular detail needed for more complex portfolios and markets. The right choice depends entirely on your specific strategic needs.

Smart Prioritization and Resource Allocation

This is where the rubber meets the road. Prioritization is the moment your grand strategic vision collides with the hard reality of finite resources. You simply can't chase every shiny object or fund every great idea, which is why you need a disciplined, objective way to decide what gets the green light.

Without a solid system, decisions often get made based on the "loudest voice in the room," where a compelling personality wins out over genuine strategic value. Effective product portfolio management is all about moving past this. It turns a potential political battle into a data-driven exercise. The entire point is to consistently aim your most valuable assets—your team's time and your company's cash—at the projects with the highest potential return.

This means getting beyond simple ROI calculations and adopting a much more structured approach.

Moving Beyond Gut Feel with Scoring Models

One of the best tools for bringing objectivity into the conversation is a weighted scoring model. It’s a powerful method that forces you to define what "value" actually means for your organization and then score every potential project against that same, consistent scale.

Instead of just slapping a "high," "medium," or "low" label on an idea, you break down its potential into several key criteria. Each of these criteria is then assigned a weight based on its strategic importance, which ensures that your final priorities are a direct reflection of your business goals.

Some of the most common scoring criteria include:

- Strategic Alignment: How well does this idea actually support our main business objectives?

- Revenue Impact: What's the real potential for new revenue or up-sell opportunities here?

- Customer Value: Does this solve a huge, nagging pain point for a valuable customer segment?

- Cost of Delay: What’s the financial or competitive hit we’ll take if we don't do this project now?

- Resource Effort: How much time, money, and development effort will this really take?

Once you score each initiative against these weighted factors, you get a clear numerical score. This makes it incredibly easy to rank your entire backlog and builds a transparent, shared understanding of why certain projects are at the top of the list.

Balancing Risk and Reward

Let's be honest, not all projects are created equal. Some are safe, incremental tweaks to existing products. Others are bold, risky bets on entirely new markets. A healthy, resilient portfolio needs a good mix of both.

A simple risk-reward matrix is a fantastic visual tool for managing this balance. You just plot each potential project on a 2x2 grid, with one axis representing its potential reward (like revenue or market share) and the other representing its level of risk (like technical uncertainty or market adoption).

This quickly sorts your initiatives into four buckets:

- High Reward, Low Risk (Top Bets): These are your no-brainers. Fund them and get them started immediately.

- High Reward, High Risk (Big Bets): These are your innovative gambles. Pursue a select few, but make sure you have a clear plan to validate your assumptions along the way.

- Low Reward, Low Risk (Incremental Gains): These are small, easy wins. Fit them in when you have spare capacity.

- Low Reward, High Risk (Avoid): These projects offer very little upside for a lot of potential pain. Steer clear.

This kind of visualization stops you from becoming too risk-averse or, on the flip side, betting the entire farm on too many long shots. In recent years, this balanced approach has become absolutely critical. In the consumer products industry, for instance, companies are reshaping their offerings by strategically investing in innovation while divesting from underperforming areas to adapt to rapid market changes. You can discover more insights on consumer product strategies on deloitte.com.

The core of smart prioritization isn't just about picking winners; it's about building a balanced portfolio that can deliver value today while positioning you for success tomorrow.

The Reality of Capacity Planning

Even with a perfectly prioritized list of projects, you can't execute if you don't have the people to do the work. This is where capacity planning comes in, and it's a step many teams miss. It’s the simple but crucial process of matching the resource needs of your prioritized projects with the actual availability of your teams.

A classic mistake is to allocate team members at 100% to project work. This leaves zero room for bug fixes, team meetings, unexpected problems, or the simple friction of switching between tasks. A much more realistic approach is to plan for around 75-80% allocation to dedicated project work. That buffer is what gives you predictability and helps you avoid burning out your team.

By laying your prioritized roadmap over a clear view of your team's capacity, you can spot potential bottlenecks before they bring everything to a grinding halt. This allows you to make informed trade-offs—like delaying a lower-priority project or bringing in new talent—to keep your most important work on track. This is the final, practical step that connects your strategic priorities to the reality of getting things done.

How AI Is Shaping Modern Portfolio Management

The future of product portfolio management is already here, and it runs on intelligent data. For decades, portfolio decisions came down to a mix of historical data, gut feelings, and some seriously educated guesses. Today, Artificial Intelligence (AI) is taking the mystery out of these strategic choices, moving the whole discipline from reactive course correction to proactive, data-informed strategy.

Think of it this way. A traditional portfolio manager was like a ship’s captain navigating with a paper map and a compass. They were reliable tools, but they only showed what was already known. An AI-powered manager is like a captain with a global satellite system, real-time weather models, and predictive analytics that can forecast unseen currents. They can simulate a dozen routes to find the safest and fastest one.

That’s what AI brings to product portfolio management. It’s not about replacing human strategists. It’s about giving them superpowers—arming their intuition with predictive insights that were once completely out of reach.

Unlocking Predictive Insights

The single biggest change AI brings to the table is its ability to look forward, not just backward. Modern AI tools can chew through enormous, messy datasets—everything from customer support tickets and sales call transcripts to market reports and competitor announcements—and spot emerging patterns long before they become obvious trends.

This capability is a game-changer for strategic planning. It helps teams zero in on what will actually drive revenue. It's no surprise that 76% of product leaders expect to increase their AI investments by 2025. This shift allows for smarter decisions that directly align product roadmaps with what the market truly wants. To get a better sense of where things are headed, you can read more about these future-facing portfolio management trends on greenprojectmanagement.org.

Instead of waiting for the next quarterly report, AI models deliver a constant stream of intelligence.

- Market Trend Forecasting: Spotting the next big customer need or tech shift that could open the door for a new product.

- Churn Prediction: Identifying at-risk customer groups by catching subtle changes in their behavior, giving you a chance to step in before they leave.

- Revenue Opportunity Sizing: Putting a real number on a new feature idea by connecting customer requests to their actual spending patterns.

Automating Complex Analysis and Simulation

Beyond just predicting what might happen, AI also automates the incredibly tedious work of analysis. It can run thousands of simulations to model how different portfolio decisions could play out. This helps leaders see the likely financial impact of a strategic bet before committing a single dollar of real capital.

By simulating scenarios—like shifting budget from a stable Cash Cow to a high-potential Question Mark—AI gives decision-makers a data-backed preview of the outcome. It turns what used to be a high-stakes gamble into a calculated risk.

This automation frees product leaders from the spreadsheet-filled grind of data wrangling. With AI handling the analytical heavy lifting, people can focus on what they do best: thinking about competitive strategy, talking to customers, and setting a long-term vision. Making better, faster choices is the heart of AI-powered decision-making in modern business.

In the end, AI isn't just another tool in the box; it's a fundamental shift in how product portfolios are built and managed. It gives organizations the power to create more resilient, profitable, and future-proof product lines by translating massive amounts of data into clear, actionable intelligence. For the first time, teams can confidently answer the most important question of all: "What should we build next to make the biggest possible impact?"

Navigating the Common Pitfalls of Portfolio Management

Getting product portfolio management right isn't a one-time setup; it’s a continuous journey, and like any journey, there are plenty of bumps in the road. The toughest challenges usually aren't about technology. They're about people, culture, and old habits that are hard to break. Getting past them means knowing what to look out for and having a plan.

Too many organizations run on gut feelings and opinions because they lack objective data. This gets even worse when data is stuck in silos—sales has its numbers, marketing has theirs, and engineering has a completely different set—making a single, clear view of the portfolio almost impossible to achieve. Without one source of truth, getting everyone on the same page feels like a constant struggle.

Overcoming Internal Resistance and Politics

Let's be honest: one of the biggest hurdles is navigating internal politics. When portfolio decisions threaten team budgets, headcount, or someone's favorite "pet project," you can expect pushback. It’s tough when a senior leader's pet initiative just doesn't stack up against the objective criteria.

The best way to defuse this is to create a transparent governance process that everyone agrees on beforehand. This means setting up a dedicated portfolio council with leaders from across the business who review every idea against the same strategic checklist.

This simple step accomplishes a few critical things:

- It takes the decision away from one person: The conversation shifts from "what I think" to "how this aligns with our agreed-upon framework."

- It creates shared ownership: When sales, marketing, and engineering are all in the room, they're more likely to buy into the final decisions.

- It gives you a solid reason for your choices: You have a clear, data-backed answer when someone asks, "Why are we funding this project and not that one?"

The Challenge of Retiring Legacy Products

Saying goodbye to an old product can be surprisingly emotional. Teams often feel a deep sense of ownership, and even a small group of loud customers can make sunsetting a product feel like a massive risk. This emotional tie creates "zombie products"—underperforming assets that are no longer a strategic fit but keep draining time, money, and energy.

The real cost of a zombie product isn't just the money spent to maintain it; it's the opportunity cost. Every engineer stuck on a legacy system is one less engineer building your next big thing.

A pragmatic fix is to establish clear, non-negotiable performance triggers. For instance, if a product dips below a certain profit margin, user engagement level, or strategic alignment score for two quarters in a row, it automatically goes up for a formal retirement review. This takes the emotion out of it and makes it a standard business process.

Establishing a Cadence for Review

Finally, a lot of portfolio management efforts fizzle out from simple inconsistency. A big planning session once a year just isn't enough to keep up with the market. Without a regular rhythm of review, the portfolio can drift way off course from the company’s actual strategy.

The most effective solution is to lock in a mandatory quarterly portfolio review. This regular check-in ensures the portfolio is a living, breathing tool, not a dusty document on a shelf. It creates a recurring time to reassess priorities, shift resources based on fresh data, and make sure every single project is still pulling its weight. By embedding these reviews into the rhythm of the business, you build a culture that's resilient, adaptive, and always focused on what matters most.

Got Questions? We’ve Got Answers.

Diving into product portfolio management for the first time? It's natural to have a few questions. We've put together some straightforward answers to the things people ask us most.

So, What's the Real Goal Here?

At its core, the main goal is to get the absolute most value out of your company's entire collection of products. It's not about trying to make every single product a runaway success.

It’s about making sure your whole product lineup works together as a balanced, strategic team. This means you're putting your resources in the right places to hit your company's big, long-term goals—making smart, data-backed calls on what to invest in, what to keep running, and what to gracefully retire.

How Is This Different From Regular Product Management?

It helps to think of it like this: are you focused on a single tree, or are you managing the entire forest?

- Product Management is all about a single product. The product manager lives and breathes the details of that one product's journey, from the first sketch to launch day and beyond. They are tending to a single tree.

- Product Portfolio Management is the 30,000-foot view of all your products. It’s about seeing how everything connects, managing the risks across the board, and deciding where your resources will have the biggest impact for the whole forest.

What Are the First Steps to Get Started?

Jumping in can feel like a huge task, but a few key moves will get you going. First, you need a clear picture of what you actually have—take inventory of every single product. Then, you need to draw a straight line from that portfolio to your company's biggest objectives.

The most important first move? Put together a governance team with people from different departments. This ensures your decisions are based on solid data and strategy, not just internal politics or one person's opinion.

Once you have that team, pick a simple framework to get a quick read on your portfolio's health. Something like the BCG Matrix is perfect for this. It gives you a snapshot that can spark the right strategic conversations.

Ready to stop guessing and start prioritizing with data? SigOS uses AI to analyze customer feedback and pinpoint the revenue-driving features and fixes your team should focus on next. See how it works at https://sigos.io.

Keep Reading

More insights from our blog

Ready to find your hidden revenue leaks?

Start analyzing your customer feedback and discover insights that drive revenue.

Start Free Trial →