Calculating Lifetime Value SaaS a Practical Guide for Growth

A guide to calculating lifetime value SaaS. Move beyond simple formulas with cohort analysis and predictive models to boost retention and inform strategy.

Calculating lifetime value isn't just a financial exercise for your SaaS business—it's the bedrock of a smart growth strategy. A solid LTV number lets you justify marketing spend, zero in on the right acquisition channels, and build a product roadmap that actually moves the needle. Without it, you're just guessing.

This guide will break down the essential models for getting a real grip on this crucial metric.

Why An Accurate SaaS LTV Drives Smarter Growth

In the SaaS world, understanding Customer Lifetime Value (LTV) is what separates the companies that scale from those that stall. Think of it as a crystal ball: it predicts the total revenue you can realistically expect from a single customer over their entire relationship with you.

Without a firm handle on LTV, you’re flying blind. How much can you afford to spend to get a new customer? Which marketing channels are actually bringing in profitable users, not just vanity sign-ups? These are questions you can't answer without knowing what a customer is truly worth.

When you nail down your LTV, you turn abstract user behavior into a hard financial number. Suddenly, the work your product and growth teams do every day—shipping features, closing deals, answering support tickets—has a direct link to the bottom line. You can finally prove that keeping customers happy pays the bills.

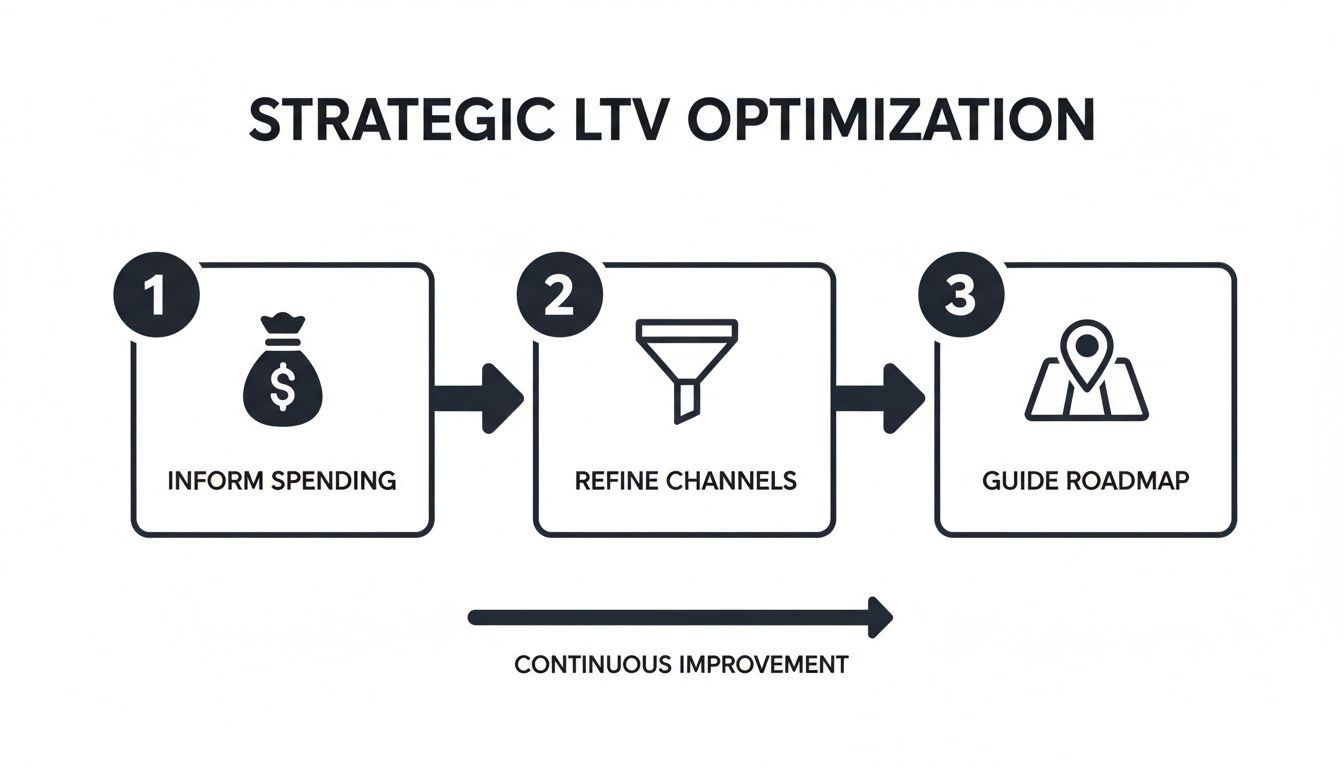

Informing Critical Business Decisions

A precise LTV is the core of healthy unit economics. It’s what allows SaaS product managers to confidently prioritize features that generate real revenue, not just buzz.

Let's say your Average Revenue Per User (ARPU) is 1,000 a year, your gross margin is a healthy 80%, and customers typically stay for about 36 months. A quick calculation shows your LTV is ****2,400 per customer ($1,000 * 0.80 * 3 years). This simple number is incredibly powerful.

With that clarity, you can:

- Justify Marketing Spend: You know exactly how high your Customer Acquisition Cost (CAC) can go while still maintaining profitability.

- Refine Acquisition Channels: Stop throwing money everywhere. Instead, double down on the channels that deliver customers with the highest LTV.

- Prioritize the Product Roadmap: Funnel development resources into features that are proven to boost retention or drive expansion revenue, directly increasing LTV.

The process creates a powerful feedback loop: better data leads to smarter decisions, which in turn improves your metrics and fuels sustainable growth.

This strategic cycle shows how a clear LTV calculation gives you the hard data needed to optimize spending, focus on high-value channels, and build a product that customers stick with for the long haul.

LTV isn’t just a metric to report—it's a compass for your entire growth strategy. It tells you where to invest, what to build, and which customers to chase for long-term success.

It's no surprise that entire executive roles, like the Chief Customer Officer, are now seen as the Executive Guardian of Customer Retention and Lifetime Value. Their job is to own this metric.

As we go through this guide, we'll unpack the different LTV models, from quick back-of-the-napkin formulas to sophisticated predictive analytics, so you can find the right approach for your stage.

A Quick Look at LTV Calculation Models

Choosing the right LTV model depends entirely on your company's stage, data maturity, and the specific questions you need to answer. Here’s a quick rundown to help you decide where to start.

| LTV Model | Best For | Key Data Inputs | Complexity Level |

|---|---|---|---|

| Simple LTV | Early-stage startups needing a quick benchmark. | ARPU, Churn Rate | Low |

| Gross Margin-Adjusted LTV | Businesses focused on profitability and unit economics. | Simple LTV inputs, Gross Margin % | Low |

| Cohort-Based LTV | Analyzing the impact of product/marketing changes over time. | Revenue per user, by monthly or quarterly cohort. | Medium |

| Predictive LTV | Mature businesses with rich behavioral data and a need for forward-looking forecasts. | Transaction history, user behavior signals, demographics. | High |

This table gives you a starting point. While a simple formula is great for a quick health check, a cohort-based analysis will give you a much more nuanced view of your business's trajectory. We'll dive into how to execute each of these next.

Your Starting Point: The Simple LTV Formula

Every SaaS founder needs a quick way to gauge the health of their business, and the simple LTV formula is the perfect place to start. It’s the back-of-the-napkin calculation that gives you a directional sense of what a customer is worth.

While it has its limits, this formula is the foundation for any deeper analysis. Think of it as your baseline—a critical first step before you get into more complex models.

The formula itself couldn't be simpler: just divide your Average Revenue Per Account (ARPA) by your Customer Churn Rate. But the magic is in getting those two inputs right.

Nailing Down Average Revenue Per Account

First up, you need to figure out what an average customer actually pays you in a given period. This is your Average Revenue Per Account (ARPA).

To get your ARPA, you take your total Monthly Recurring Revenue (MRR) and divide it by your total number of active customers. It sounds simple, but you have to be precise with what you include.

- Total MRR: This isn't just base subscriptions. Make sure you're including all recurring revenue, like expansion MRR from upsells or add-on features.

- Total Active Accounts: Count only your paying customers for that period. Don't let free trial or freemium users who haven't converted skew your numbers.

Let's say your company brought in 100,000 in MRR last month from 500 customers. Your ARPA is a clean ****200 ($100,000 / 500).

Accurately Measuring Your Churn Rate

The other half of the equation is your Customer Churn Rate—the percentage of customers who leave you in a given timeframe. It's the nemesis of growth and a metric every SaaS leader obsesses over.

To calculate your monthly customer churn, divide the number of customers who canceled during the month by the number of customers you had at the very beginning of that month.

So, if you started the month with those 500 customers and 15 decided to cancel, your monthly churn rate is 3% (15 / 500). One crucial detail: always make sure the timeframes for your ARPA and churn match up. Monthly ARPA needs a monthly churn rate.

Putting the Formula into Practice

Okay, let's plug our numbers into the simple LTV formula.

Simple LTV = ARPA / Customer Churn Rate

Using the figures from our example:

- ARPA: $200

- Churn Rate: 3% (or 0.03 as a decimal)

The math looks like this: **200 / 0.03 = **6,667.

That $6,667 is a powerful number. It tells you that, on average, you can expect a new customer to generate that much revenue over their entire time with you. This immediately informs how much you can afford to spend to acquire them in the first place.

A healthy rule of thumb in SaaS is to keep your LTV at least 3 times higher than your Customer Acquisition Cost (CAC). With an LTV of 6,667, you’ve got a healthy acquisition budget of up to ****2,222 per customer.

The Strengths and Weaknesses of Simplicity

This formula is popular for a reason. It's fast, easy to calculate, and gives everyone from marketing to finance a tangible number to work with. For early-stage startups just getting a handle on their metrics, it's invaluable.

But that simplicity is also its biggest blind spot. This model operates on a few shaky assumptions that can be dangerous if you don't acknowledge them:

- It Assumes Everyone is the Same: The formula creates a single "average" customer, completely ignoring the vast differences between your user segments.

- It Ignores Time: It pretends your business is static, failing to account for future pricing changes, product improvements, or shifts in churn behavior.

- It Masks Key Differences: A high-value enterprise client is lumped in with a small business on your lowest-tier plan. Their real LTVs are worlds apart, but this formula averages them together.

Relying solely on this number means you could miss critical trends. Maybe your churn is dropping for newer customers thanks to a slicker onboarding flow, but this simple LTV won't reflect that nuance.

It gives you a snapshot, not the full motion picture. That’s why we treat it as a starting point, not the final word. To get the real story, we need to dig deeper with more advanced methods like cohort analysis.

Gaining Deeper Insights With Cohort Analysis

The simple LTV formula gives you a useful, high-level snapshot, but it has a massive flaw: it treats all your customers as one monolithic group. To really understand the health and trajectory of your business, you have to move beyond averages and start segmenting your users. This is where cohort analysis becomes your most powerful tool for calculating lifetime value.

Instead of lumping everyone together, a cohort analysis groups users by a shared characteristic—most commonly, their sign-up date. You’d create a "January 2024" cohort, a "February 2024" cohort, and so on. This simple act of grouping unlocks a much richer story about your business.

By tracking each cohort’s behavior and revenue over time, you can see exactly how changes to your product, pricing, or onboarding process impact long-term value. It’s like watching different vintages of wine mature—each one tells a unique story based on the conditions when it was created.

Structuring Your First LTV Cohort Analysis

Getting started with cohort analysis isn't nearly as intimidating as it sounds. The main goal is to build a table where each row represents a customer cohort (like users who signed up in January) and each column represents time passing (Month 1, Month 2, Month 3, etc.).

Here’s a practical way to structure it:

- Define Your Cohorts: Group all new paying customers by the month they started their subscription. The January cohort is everyone who converted to a paid plan that month.

- Track Cumulative ARPA: For each cohort, calculate the average cumulative revenue per account for each month since they joined. For the January cohort, Month 1 is their average spend in January; Month 2 is their average cumulative spend by the end of February, and so on.

- Visualize the Data: Lay this out in a spreadsheet or your analytics tool. You'll start to see patterns emerge almost immediately.

This approach transforms LTV from a single, static number into a dynamic view of how customer value actually evolves. To really nail the mechanics, a detailed guide on performing a cohort retention analysis can sharpen your skills even further.

Uncovering Actionable Business Narratives

The real magic of cohort-based LTV is its ability to answer critical business questions and show the direct impact of your decisions. Averages hide these truths, but cohorts bring them to light.

Imagine your team shipped a major new feature in March designed to boost user engagement. A simple, sitewide LTV calculation might not show any immediate impact.

A cohort analysis, however, would likely paint a much clearer picture:

- The January and February cohorts might show a stable, predictable LTV trajectory, business as usual.

- But the April and May cohorts—the first users to get the new feature from day one—might show a noticeably higher cumulative revenue by their third or fourth month.

Suddenly, you have clear, quantitative proof that the feature is driving real value and improving long-term retention. That kind of insight is gold for your product and marketing teams.

Cohort analysis transforms your LTV from a simple financial metric into a powerful diagnostic tool. It tells you not just what your LTV is, but why it's changing.

This level of detail is crucial because small improvements in retention have an outsized impact on the bottom line. Research consistently shows a mere 5% increase in customer retention can boost profits by 25% to 95%. When you also consider that the top 20% of customers often generate 80% of revenue, you can see why segmenting and understanding your high-value cohorts is essential for smart resource allocation.

Going Beyond Sign-Up Dates

While grouping by sign-up date is the perfect starting point, it's just the beginning. You can apply the same principles to almost any customer segment to unlock even deeper insights.

Try creating cohorts based on:

- Acquisition Channel: What’s the LTV of customers from organic search versus paid ads? This helps you pour your marketing budget into the most profitable channels, not just the ones driving the most sign-ups.

- Initial Plan: Do customers who start on your Pro plan ultimately have a higher LTV than those who start on the Basic plan? This can directly inform your pricing and go-to-market strategy.

- Key Feature Adoption: Group users by whether they used a specific "sticky" feature within their first 30 days. You might find this cohort has a dramatically higher LTV, giving you a clear mandate to drive new users toward that feature during onboarding.

By slicing your data in these ways, you shift from a reactive understanding of LTV to a proactive one. You’re no longer just measuring the past; you’re identifying the specific levers you can pull to build a more valuable customer base for the future.

Forecasting Future Value With Predictive LTV Models

While simple formulas and cohort analysis are great for looking in the rearview mirror, predictive LTV models are all about what’s ahead. This is where LTV calculations get really powerful, moving beyond educated guesses based on past trends to data-driven forecasts of what a customer will be worth.

Essentially, a predictive model uses your historical data, customer behavior patterns, and a bit of machine learning magic to forecast how much revenue an individual customer or account is likely to generate over their entire lifetime with you. It stops lumping everyone into an average and starts building a unique profile for each user.

This approach is a complete game-changer. You're no longer just reacting to what happened last quarter; you're proactively making decisions based on what a customer's future value looks like.

The Key Ingredients for Predictive Models

A predictive model is only as good as the data you feed it. The accuracy hinges entirely on the quality and variety of your inputs. These models dig much deeper than simple payment history, pulling from a rich mix of behavioral signals and customer attributes.

Here’s what typically goes into the mix:

- Behavioral Signals: This is the goldmine. It’s all about how people actually use your product—which features they've adopted, how often they log in, session duration, and even how many support tickets they’ve filed.

- Firmographic Data: For B2B SaaS, this is crucial. Think company size, industry, location, and maybe even the tech stack they're using.

- Transactional History: This covers everything from the plan they started on to their history of upgrades, downgrades, and any add-on purchases they've made along the way.

By crunching all these variables, the model starts to spot hidden patterns. It might discover that customers who integrate your product with another specific tool in their first week are 80% less likely to churn and ultimately have a 2.5x higher LTV. That's an insight you can act on.

Turning Insight Into Proactive Action

The real magic of predictive LTV isn't just getting a more accurate number—it's what you do with it. These forward-looking insights allow your teams to make much smarter, more targeted decisions that directly fuel growth.

For example, a model might flag an account that’s showing early signs of declining engagement, even if they're still paying on time. This is a classic leading indicator of churn. It gives your customer success team a heads-up to step in, offer help, and potentially save an account you would have otherwise lost.

On the flip side, sales and marketing can use predictive LTV scores to prioritize their pipeline. Instead of chasing every lead with the same energy, they can focus on prospects that look a lot like your existing high-value customers. That’s a direct path to a more efficient acquisition engine.

Predictive LTV models shift your focus from simply measuring value to actively shaping it. You can identify your future VIPs on day one and nurture them accordingly.

This kind of data-driven forecasting is quickly becoming a major advantage. In a maturing SaaS market, the ability to accurately predict customer value is a huge factor in company valuation. Companies with strong, predictable LTV growth can command 40% higher multiples during funding rounds. It's been shown that AI-enhanced predictions are 25% more accurate, and firms that get personalization right see a whopping $20 ROI for every dollar invested. You can explore more data on how LTV calculations influence SaaS strategy.

Choosing the Right Predictive Approach

Getting started with predictive modeling doesn't mean you need to go out and hire a team of data scientists tomorrow. The complexity can range from simple regression models you can build in a spreadsheet to sophisticated machine learning platforms.

Here are a few common ways to tackle it:

- Regression Analysis: This involves using statistical methods to find relationships between certain actions (like daily logins) and their eventual lifetime value. It's a great starting point.

- Probability Models: Frameworks like Buy-Till-You-Die (BTYD) are built specifically to forecast future transactions and customer behavior.

- Machine Learning Platforms: If you have enough data and the right resources, dedicated platforms can build and deploy complex models that continuously learn and get smarter over time.

The right tool really depends on your team's skills and the volume of data you're sitting on. Many companies start with simpler models and work their way up as they become more comfortable with the data. For a deeper look at the tools out there, check out our guide on the best predictive analytics software.

Ultimately, predictive LTV is about making your entire business more intelligent. It gives you the foresight to put your resources where they’ll generate the highest future returns, ensuring you're not just growing, but growing profitably.

Putting LTV to Work With Gross Margin and CAC

A high LTV figure can feel great, but on its own, it’s often just a vanity metric. Knowing a customer is worth $7,000 in lifetime revenue is one thing, but it tells you nothing about your actual profitability.

To make LTV truly useful, you have to connect it to your unit economics. That means bringing two other critical metrics into the picture: Gross Margin and Customer Acquisition Cost (CAC). Without them, you might be celebrating a big LTV number while your business is quietly leaking cash.

From Revenue LTV to Profit LTV

The simple LTV formulas we've covered so far are based on revenue. But it costs money to deliver your service—think server hosting, customer support team salaries, and third-party software licenses. This is your Cost of Goods Sold (COGS), and what's left over is your Gross Margin.

Adjusting your LTV for Gross Margin gives you a much more honest view of what each customer is truly worth to your bottom line.

The formula is pretty straightforward:

Gross Margin-Adjusted LTV = (ARPA / Churn Rate) * Gross Margin %

Let’s say your SaaS has a Gross Margin of 80%. If your simple, revenue-based LTV was 6,667, your new, more realistic LTV is actually ****5,333 (6,667 * 0.80). That ****1,334 difference is the cost of serving the customer. Ignoring it can lead you to overspend massively on growth.

The All-Important LTV to CAC Ratio

Once you have a profit-based LTV, the next step is to compare it to what you spent to get that customer in the first place—your Customer Acquisition Cost (CAC). This simple ratio is probably the most important health check for any SaaS business.

Your CAC includes everything you spend on sales and marketing to land a customer: ad spend, commissions, salaries for the go-to-market team, you name it. Divide all that by the number of new customers acquired in a given period, and you have your CAC.

The LTV:CAC ratio tells you if your growth engine is sustainable or running on fumes.

The gold standard for a healthy SaaS business is an LTV:CAC ratio of at least 3:1. This means for every dollar you spend acquiring a customer, you're getting at least three dollars back in lifetime profit.

If your ratio is below 1:1, you're in trouble—you’re losing money on every single new customer. If it’s hovering somewhere between 1:1 and 3:1, you’re profitable, but you probably don't have enough margin to really pour fuel on the fire.

What Your LTV to CAC Ratio Is Telling You

Understanding your LTV:CAC ratio is crucial because it’s not just a number; it’s a direct signal telling you what to do next. Different ratios call for completely different strategic actions.

Here’s a practical breakdown of how to interpret your ratio and what moves to make.

What Your LTV to CAC Ratio Is Telling You

| LTV:CAC Ratio | Business Health Signal | Recommended Action |

|---|---|---|

| Below 1:1 | Unsustainable Model: You're losing money with every new customer sign-up. | Hit the brakes. Immediately pause or drastically rethink your current acquisition strategy. Fix the leak before you sink. |

| 1:1 to 3:1 | Breaking Even or Low Profit: Your model works, but you lack the capital efficiency for aggressive growth. | Time to optimize. Focus on improving conversion rates, testing lower-cost acquisition channels, or finding ways to increase customer retention. |

| 3:1 or Higher | Healthy and Scalable: You have a strong, profitable growth engine. The math works. | Press the accelerator. You've found a winning formula, so increase investment in your proven acquisition channels to scale growth confidently. |

| 5:1 or Higher | Potentially Under-investing: This is a good problem, but you may be growing too slowly and leaving market share for competitors to grab. | Get more aggressive. Consider increasing your marketing and sales budget to capture more of the market while the opportunity is there. |

This isn't just theory; it's the framework that drives real-world budget and strategy decisions every day in successful SaaS companies. If you're looking to explore these metrics further, our guide on the lifetime value of a customer in SaaS is a great place to continue.

To get even smarter about this, you can actively improve your ratio from the top of the funnel. A great way to do this is by implementing a system for What Is Lead Scoring. By focusing your sales and marketing efforts on leads who most resemble your high-LTV customers, you can lower your CAC and improve your ratio from the very beginning.

Common LTV Calculation Mistakes to Avoid

Knowing the formulas is one thing, but getting a number that's actually useful for making decisions is another beast entirely. It's surprisingly easy to calculate an LTV that looks right on a spreadsheet but is dangerously misleading in the real world. I've seen countless SaaS teams stumble into the same traps, leading to flawed data and misguided strategies.

Let's walk through the most common pitfalls so you can steer clear of them and make sure your LTV is a reliable guide for growth.

Failing to Segment Your Customers

One of the biggest mistakes I see is lumping all customers into one big bucket. You calculate a single, company-wide LTV that averages everyone together—from a solo founder on your cheapest plan to a massive enterprise client with every premium add-on.

This blended number is practically useless. Why? Because the go-to-market motion, support costs, and ultimate value of these segments are worlds apart. This oversight completely masks who your most profitable customers are, preventing you from doubling down on the acquisition channels that bring them in.

Mismatching Timeframes and Metrics

This next one is subtle but can wreck your entire calculation. You have to be meticulous about matching the timeframes for your inputs. If you’re using Monthly Recurring Revenue (MRR) to figure out your average revenue, you absolutely must use a monthly churn rate.

It sounds obvious, but people often grab an annual churn figure and plug it into a monthly revenue formula. The result? A wildly inflated LTV that gives you a false sense of security about your unit economics. Make sure your revenue, churn, and acquisition costs are all singing from the same monthly or annual hymn sheet.

Pro Tip: An LTV based on mismatched timeframes isn't just inaccurate; it’s a license to overspend. You'll end up justifying a higher CAC with a fictional LTV, which is a fast track to burning through your cash reserves.

Forgetting About Profitability

Finally, many teams stop their calculation at revenue. They get a big, impressive top-line LTV and call it a day. But a high-revenue customer isn't always a high-profit one.

Think about it: what if that customer requires a ton of hand-holding from your support team? Or what if their usage consumes a disproportionate amount of server resources? Forgetting to factor in your Cost of Goods Sold (COGS) and gross margin is a major blind spot.

To get a number that’s truly actionable, you need a profit-based LTV. This is the only figure you should be comparing against your Customer Acquisition Cost (CAC). Without this adjustment, you aren't measuring the true economic value a customer brings to your business—you're just looking at the sales receipt.

Avoiding these common mistakes will help you move from simply knowing how to calculate lifetime value in your SaaS to strategically understanding it.

Got Questions About SaaS LTV? We've Got Answers.

When you start digging into Lifetime Value, a few common questions always seem to pop up. Let's tackle them head-on, because getting these details right is crucial for using LTV to make smart decisions.

What's a Good LTV to CAC Ratio for a SaaS Business?

The classic benchmark everyone aims for is 3:1. In simple terms, this means you're making three dollars back for every dollar you spend to win a new customer. It’s a solid sign of a healthy, sustainable business model.

If your ratio starts dipping below that, especially if it's heading toward 1:1, warning bells should be going off. You're essentially paying to acquire customers who won't ever turn a profit.

On the flip side, don't get too comfortable if your ratio is something crazy like 5:1 or higher. While it looks fantastic on paper, it often means you're under-investing in marketing and sales. You could be growing much faster and are likely leaving a huge opening for a competitor to swoop in.

How Often Should We Be Calculating LTV?

LTV isn't a metric you calculate once and frame on the wall. It's a living number that reflects the current state of your business. Your pricing evolves, churn rates change, and you expand into new markets.

For most SaaS companies, running the numbers on a quarterly basis is a great rhythm. It keeps you in touch with trends without getting bogged down in constant analysis. If you're an early-stage startup in hyper-growth mode, you might even want to check it monthly.

Why Bother with Gross Margin? Can't I Just Use Revenue?

This is a big one. Relying on a revenue-based LTV is a classic mistake, and it can be a costly one. It paints an overly optimistic picture because it completely ignores the costs required to actually serve your customers.

Think about it:

- Server and hosting fees

- Customer support team salaries

- Subscriptions for third-party tools (e.g., payment gateways, data services)

By subtracting these Cost of Goods Sold (COGS), you get a profit-based LTV. This number tells you the true economic value each customer brings to your business over their lifetime, which is the only figure you should use to guide your strategy.

Unlock the real story behind your customer feedback. SigOS uses AI to analyze support tickets, sales calls, and usage data, turning qualitative noise into revenue-driving signals. Prioritize your roadmap with confidence and build what customers will pay for. Discover how much churn is costing you.