Boost Revenue: Understanding the Lifetime Value of a Customer SaaS

Learn how to maximize the lifetime value of a customer SaaS with proven strategies. Increase retention and growth today!

In the SaaS world, it's easy to get fixated on the wrong things. But if you want to build a business that lasts, you need to look beyond the immediate wins and focus on what truly matters: the lifetime value of a customer (LTV).

Put simply, LTV is the total revenue you can reasonably expect to earn from a single customer for as long as they stay with you. It’s not just a number; it’s a forecast of your company's long-term health and a crucial signal of its potential for sustainable growth.

Why LTV Is Your SaaS Growth Compass

Many SaaS founders get sidetracked by vanity metrics—things like sign-ups, monthly active users, or social media buzz. While these can feel good, they don’t tell the whole story. They show you what’s happening right now, but they can't predict your financial future.

This is where LTV steps in as your most reliable guide.

Think of it as a strategic compass. It doesn’t just report on past results; it points your entire company toward smart, profitable decisions. Once you know what a customer is worth over their entire lifecycle, you can make much better calls on everything from your marketing budget to your product roadmap.

To help clarify the core ideas we'll be discussing, here’s a quick rundown of the essential LTV concepts.

Core LTV Concepts at a Glance

A quick summary of the essential components of SaaS Customer Lifetime Value discussed in this guide.

| Concept | What It Measures | Why It Matters for SaaS |

|---|---|---|

| Lifetime Value (LTV) | The total revenue a business can expect from one customer. | Determines long-term profitability and the upper limit for acquisition spending. |

| Customer Acquisition (CAC) | The total cost to acquire a new customer. | Must be lower than LTV to ensure a sustainable business model. |

| LTV to CAC Ratio | The relationship between customer value and acquisition cost. | The single most important indicator of a SaaS company's financial health and scalability. |

| Customer Churn | The rate at which customers cancel their subscriptions. | Directly impacts LTV; reducing churn is the fastest way to increase it. |

| Average Revenue Per User (ARPU) | The average revenue generated per customer per period. | A key input for calculating LTV and tracking the value of your customer base over time. |

Understanding these components is the first step toward using LTV to drive real, sustainable growth for your business.

The LTV and CAC Balancing Act

The true magic of LTV happens when you pair it with its other half: Customer Acquisition Cost (CAC). This is the total amount you spend on sales and marketing to land one new customer. The relationship between these two metrics is the cornerstone of any healthy SaaS business.

When this balance is off—when it costs more to acquire a customer than they're ultimately worth—you're on a fast track to failure. This is the classic "growth at all costs" trap that has sunk countless startups.

By keeping a close eye on your LTV to CAC ratio, you ensure your growth is not just rapid, but profitable. It's a discipline that reinforces the absolute importance of building a strong customer relationship as the foundation for long-term success.

Guiding Your Business Strategy

A solid grasp of your SaaS customer lifetime value gives you the clarity to answer the big questions that shape your strategy. It empowers you to make data-driven decisions across the company.

- Marketing Spend: How much can we really afford to spend to land a new customer and still come out ahead?

- Customer Segmentation: Which of our customer segments are the most valuable? Where should we focus our time and energy?

- Product Development: What features will make our customers happier and encourage them to stick around longer, ultimately boosting their LTV?

- Retention Efforts: How much should we be investing in customer success to lower churn and protect our most important revenue streams?

Ultimately, LTV isn't just a finance metric; it’s a unifying goal for your entire team. This kind of alignment is a core tenet of modern growth strategies. You can see this principle in action in our deep dive on product-led growth, a model where delivering incredible customer value is the engine for both acquisition and retention.

Alright, you know why SaaS customer lifetime value matters. But how do you actually figure it out? Let's roll up our sleeves and get into the numbers. While there are a few ways to slice it, a couple of core formulas will give you the clarity you need to start making smarter decisions.

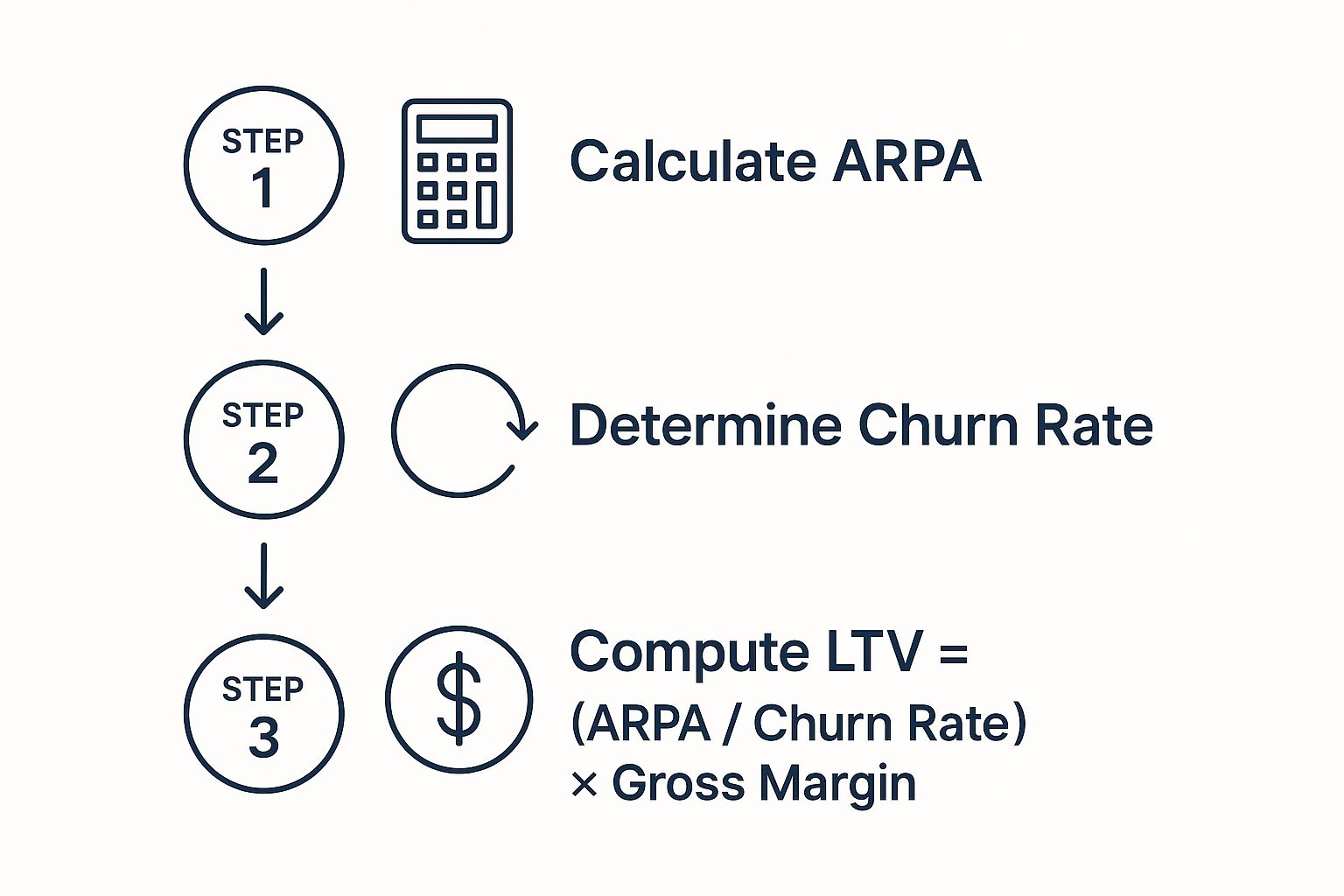

This visual gives a great overview of how to think about LTV, not just as a revenue metric, but as a profitability one.

As you can see, the real story of LTV emerges when you factor in your gross margin to understand the actual profit each customer brings in.

The Foundational LTV Formula

The quickest and most common way to get a baseline LTV involves just two metrics you should already be tracking: Average Revenue Per Account (ARPA) and your customer churn rate.

LTV = Average Revenue Per Account (ARPA) / Customer Churn Rate

Let's quickly define those terms:

- Average Revenue Per Account (ARPA): This is simply the average amount of money you make from each customer, usually on a monthly or yearly basis. Just take your total Monthly Recurring Revenue (MRR) and divide it by your total number of customers. Easy enough.

- Customer Churn Rate: This is the percentage of your customers who hit the cancel button during a specific timeframe, like a month. If you lose 2 out of 100 customers in June, your monthly churn rate is 2%.

Let's put this into practice with a fictional company, "SyncUp SaaS." If their ARPA is 100 and their monthly customer churn is 5%, their basic LTV is ****2,000 ($100 / 0.05). This is a solid starting point, but it's missing a huge piece of the puzzle: profitability.

A More Accurate LTV Calculation

That first formula is great for a back-of-the-napkin calculation, but it tells you what a customer will pay you, not what you'll keep. To get a much more realistic picture, you need to bring Gross Margin into the equation.

This leads us to a much more insightful formula:

LTV = (ARPA / Customer Churn Rate) x Gross Margin %

Let's revisit SyncUp SaaS. We know their ARPA is $100 and their churn is 5%. Now, let's say their gross margin is 80%. This means 20% of every dollar they bring in immediately goes to the costs of keeping the lights on and serving their customers.

Plugging this in, their LTV is now 1,600 ((100 / 0.05) x 0.80).

That $400 drop is a big deal. It’s the difference between revenue and actual profit, and it can completely change how you approach everything from your marketing budget to your hiring plans.

Why Segmenting Your LTV is Non-Negotiable

Calculating one LTV for your entire company is a decent health check, but the real magic happens when you start segmenting. Let's be honest: not all customers are created equal. An enterprise client on your top-tier plan is worlds apart from a small business on your entry-level plan.

To find your hidden pockets of growth, you have to calculate LTV for different customer cohorts.

- By Pricing Tier: What's the LTV of a Basic vs. a Pro vs. an Enterprise customer?

- By Acquisition Channel: Are customers from paid ads more or less valuable than those who found you through organic search?

- By Company Size: How does LTV differ between startups, mid-market businesses, and large corporations?

Drilling down to this level of detail shows you exactly which customer segments are your cash cows. It allows you to double down on the acquisition and retention efforts that will actually move the needle. For modern SaaS companies, LTV isn't a static number; it's a dynamic tool. As explored in these SaaS LTV insights, top-performing companies are using advanced analytics to get far more accurate predictions than older models allowed.

When you stop looking at a single, blended LTV, you transform the metric from a simple number into a strategic roadmap that points directly to your most valuable customers.

Decoding the LTV to CAC Ratio

Knowing your customer lifetime value is powerful, but that metric doesn't tell the whole story on its own. Its real magic is revealed when you pit it against your Customer Acquisition Cost (CAC). This comparison, the LTV to CAC ratio, is the ultimate health check for your SaaS business model.

It cuts straight to the most important question you can ask: Is our growth engine actually sustainable?

Think of it this way. You’d never invest 100 in a stock if you only expected to get ****50 back. The same exact logic applies to acquiring customers. If you're spending 500 to bring a new user through the door (your CAC) but their total value to your business is only ****300 (their LTV), you're literally paying to shrink your company.

The LTV to CAC ratio turns vague feelings about your marketing performance into a hard number you can track, analyze, and improve. More than any other metric, it tells you how efficient your sales and marketing really are.

What is a Good LTV to CAC Ratio?

While every company's situation is different, the SaaS world has a pretty clear benchmark for what "good" looks like. In short, a healthy LTV to CAC ratio is 3:1 or higher. For every dollar you spend to get a customer, you should be making at least three dollars back over their lifetime.

To make this more concrete, here’s a quick look at what different ratios signal about your company’s financial footing.

LTV to CAC Ratio Health Check

This table breaks down what each ratio means for your business, moving from a critical warning sign to a signal of incredible efficiency.

| LTV:CAC Ratio | Business Health Status | Strategic Implication |

|---|---|---|

| Below 1:1 | Critical Condition | You're losing money on every single customer you acquire. This is a five-alarm fire requiring immediate, drastic changes to your model. |

| 1:1 | Breaking Even | You get back exactly what you spend. While not a loss, it leaves zero profit for reinvesting in growth, R&D, or your team. You're treading water. |

| 3:1 | Healthy and Sustainable | This is the gold standard. It proves you have a solid, profitable growth engine with enough margin to fuel expansion and weather downturns. |

| Above 4:1 | Excellent Efficiency (Potential for Faster Growth) | Your acquisition model is incredibly efficient. This might even be a sign you're underinvesting in marketing and could grow much faster. |

Hitting and staying above that 3:1 sweet spot is how you know you have a viable business. It’s the proof that your marketing isn't just generating sign-ups—it's acquiring genuinely profitable customers who fuel your long-term success.

Industry Benchmarks and Context

That 3:1 guideline is a fantastic starting point, but the "perfect" ratio isn't one-size-fits-all. It can swing quite a bit depending on your specific industry, target market, and business model. To get an accurate picture, you first need to nail down your Customer Acquisition Cost, which can be tricky. Tools like social media campaign cost estimators are a great help in breaking down those expenses.

Recent data shows just how much these benchmarks can vary from one vertical to another.

What does this tell us? While 3:1 is a healthy floor, some sectors can achieve much higher levels of efficiency. Knowing where your industry typically lands gives you the right context to set realistic goals and diagnose your company’s financial health with much greater accuracy. This kind of detailed analysis is core to how we approach our own transparent pricing at SigOS, ensuring the value you receive always aligns with the cost. You can learn more at https://www.sigos.io/pricing.

Actionable Strategies to Increase Customer LTV

Knowing your LTV is one thing; actually making it grow is another. Increasing the lifetime value of a customer in SaaS isn’t about finding a single magic bullet. It's about a consistent, deliberate effort to improve the customer journey at every stage. This is where you put the data to work.

Ultimately, boosting LTV boils down to two simple goals: keep your customers happy so they stay longer (retention) and help them get more value so they spend more (expansion). Here are five proven strategies to help you do just that.

Master the First Impression with Proactive Onboarding

The first few moments a new user spends with your product are make-or-break. If they feel lost or overwhelmed, they're likely to churn and never look back. A fantastic onboarding experience, however, lays the groundwork for a long, profitable relationship.

Your goal isn't to show them every bell and whistle. It's to guide them to that "aha!" moment—the instant they see how your product solves their problem—as fast as humanly possible.

To create a world-class onboarding flow, focus on these moves:

- Guided Product Tours: Forget generic overviews. Build interactive walkthroughs that lead users through the exact steps needed to get their first win.

- Welcome Email Sequences: Set up an automated email series that offers quick tips, links to helpful guides, and checks in on their progress.

- In-App Checklists: Give new users a simple list of setup tasks. It feels like a game and provides a clear path to getting started successfully.

A customer who gets real value from your product in their very first session is exponentially more likely to become a long-term fan. That initial success is the foundation you build their entire lifetime value on.

Drive Expansion Revenue Through Smart Upselling

Once a customer is up and running, the journey has just begun. The next step is to grow with them. Upselling—inviting them to upgrade to a more powerful plan—is one of the best ways to boost LTV. The secret is to be helpful, not just salesy.

The best upsell opportunities come from the customer's own usage and evolving needs. It’s all about offering more value right when they need it most.

Think about a project management tool. A team might start on a basic plan but eventually hit their user limit as the company grows. That's the perfect time to show them a contextual prompt about upgrading to a plan with unlimited users and advanced reporting.

Increase Order Value with Strategic Cross-Selling

Where upselling is about a better version of the same product, cross-selling is about offering a related product that solves a different, but adjacent, problem. For a SaaS business, this often looks like selling add-ons or separate modules that enhance the core tool.

A marketing automation platform, for instance, could cross-sell a specialized analytics dashboard or a landing page builder. The new tool adds a ton of value without replacing what the customer already loves.

A smart cross-selling strategy is built on understanding your customer’s workflow inside and out. By looking at how they use your product, you can spot who would benefit most from another solution and make the offer at just the right time.

Align Price with Value to Optimize Your Model

Your pricing is easily one of the most powerful levers you have for influencing LTV. Too many SaaS companies underprice their software, leaving a massive amount of revenue on the table. Your price shouldn't be based on your competitors—it should be based on the tangible value you create for your customers.

This is where a value-based pricing model shines. It connects the cost of your product directly to the results it delivers. For example, you could base your pricing on the number of contacts in a CRM, the amount of data processed by an analytics tool, or the number of active projects in a collaboration platform.

This approach has a growth engine built right in: as your customers find more success and grow their own business, their subscription scales with them. It perfectly aligns your success with theirs, creating a true win-win that naturally drives up LTV over time.

Build Loyalty with an Exceptional Customer Experience

At the end of the day, every single interaction a customer has with your brand shapes their decision to stay or go. The surest path to a higher LTV is to reduce churn, and the best way to do that is by delivering a consistently amazing customer experience. To ensure your efforts are on the right track, it's wise to follow established customer retention best practices.

A great experience is so much more than just a solid product. It also includes:

- Responsive Support: Offering fast, friendly, and genuinely helpful support whenever and wherever your customers need it.

- Proactive Communication: Keeping users in the loop about new features, upcoming maintenance, or helpful tips to get more out of the product.

- Community Building: Creating a space, like a forum or user group, where customers can connect, share ideas, and learn from one another.

When you consistently deliver value and make customers feel seen and supported, you earn a level of loyalty that turns them into true advocates. This not only maximizes their LTV but also kicks off a powerful word-of-mouth engine for your business.

Using SigOS to Automate and Optimize LTV

Figuring out the lifetime value of a customer in SaaS is a beast. If you're wrestling with spreadsheets and pulling data by hand, you know the drill: it’s slow, full of potential errors, and you’re probably missing the most important insights buried deep in the numbers. This is exactly why a dedicated platform isn't just a nice-to-have; it's essential for getting ahead of the curve.

SigOS is built to do all that heavy lifting. Instead of you spending days wrangling data, the platform hooks directly into the tools you already use, giving you a real-time, unified view of customer value. That automation is the first, crucial step toward finding those game-changing strategic insights.

The real magic, though, is in the segmentation. With SigOS, you can instantly slice and dice your data to see how LTV differs across all your customer groups.

- By Plan Type: Is your Enterprise plan really bringing in a higher LTV than your Pro plan once you account for the extra support costs?

- By Acquisition Channel: Are the folks finding you through organic search sticking around longer and upgrading more often than those you're paying for with ads?

- By User Cohort: How does the LTV of customers who joined in Q1 look compared to your Q3 sign-ups?

This kind of detail lets you move past a single, often misleading, company-wide LTV. It helps you pinpoint which segments are actually driving your profits and which are a drain on resources. That means you can make much smarter calls on where to put your marketing and product development dollars.

From Historical Data to Predictive Power

Looking at past performance is one thing, but winning in SaaS is all about what’s coming next. SigOS uses predictive analytics to look into the future, forecasting revenue and flagging churn risks before they hit your bottom line. By analyzing behavioral patterns, it can tell you which customers are on track to upgrade, which might downgrade, and which are heading for the door.

This completely changes the game. You're no longer just looking in the rearview mirror; you’re seeing what’s up ahead on the road.

By forecasting future LTV with a high degree of accuracy, you can make forward-looking budget allocations and strategic pivots based on data, not just intuition. It's about knowing where your revenue will be in six months, not just where it was last quarter.

Imagine getting an alert that a high-value customer cohort is showing early signs of logging in less. With that heads-up, your customer success team can jump in with targeted support or a re-engagement campaign, saving revenue you would have otherwise lost.

A Practical Example: InnovateCloud

Let’s look at a fictional SaaS company, 'InnovateCloud.' They were growing their user base but couldn't figure out why their overall LTV was stuck. After plugging in SigOS, they found a critical insight that their manual spreadsheets had completely missed.

The real-time LTV:CAC dashboard showed them that customers coming from their content marketing channel had a 35% higher LTV and a 50% lower churn rate than customers from paid search campaigns. On the surface, the paid search customers looked great—they converted fast—but they almost never upgraded and were gone within six months.

Armed with this data, InnovateCloud redirected a huge chunk of their marketing budget from paid search over to content creation. They also used SigOS's churn prediction alerts to flag at-risk enterprise clients, letting their success team swoop in with extra support.

The result? Within a single quarter, they boosted their overall LTV by 18% and saw a major improvement in profitability—all because they could finally make decisions based on automated, actionable insights.

Common Questions We Hear About SaaS LTV

Once you start digging into SaaS metrics, you'll find that some questions about customer lifetime value come up over and over again. It's totally normal. Getting a solid handle on these concepts is the key to turning LTV from a confusing acronym into a powerful tool for growth. Let's walk through some of the most common ones.

How Often Should We Be Calculating LTV?

This is a great question, and the honest answer is: it depends on your stage. This isn't a "set it and forget it" metric.

For most established SaaS companies, running the numbers monthly is the perfect rhythm. It gives you enough data to see real trends in churn and expansion without getting bogged down in analysis paralysis. Plus, it lines up neatly with your MRR reporting.

Now, if you're an early-stage startup or you're in the middle of a massive growth spurt, you might want to look at it weekly. Things are changing so fast—new customers are flooding in, you're shipping features constantly—that a weekly pulse check can help you stay agile and make smarter decisions on the fly.

The real secret is consistency. Whether you choose a weekly or monthly cadence, stick to it. This transforms LTV from a static number into a living trend line, showing you the real-time health of your customer relationships.

Is It Possible for LTV to Be Negative?

Absolutely, and it’s a five-alarm fire for your business. A negative LTV means you're actually losing money on a customer over their entire time with you. It happens when your acquisition and service costs are higher than the revenue they ever bring in.

Think about it like this: you spend 500 on marketing to land a new customer. They sign up for your ****50/month plan but cancel after just two months. You've only made 100 in revenue, meaning you've lost ****400 on that relationship, and that’s before you even factor in the cost of providing the service.

A negative LTV isn't just a bad number; it's a symptom of a deeper problem. It could be pointing to:

- Poor product-market fit: You're attracting people who just don't get long-term value from your product.

- Unsustainable marketing: You're paying way too much to get customers in the door (a sky-high CAC).

- A broken onboarding experience: New users are getting confused or frustrated and bouncing right away.

What's the Biggest Mistake Companies Make with LTV?

This one is easy. The single most dangerous mistake is calculating one single, blended LTV for the entire business and calling it a day. This approach lumps all your customers together—your massive enterprise accounts, your mid-market clients, and your small business users—into one average number that doesn't truly represent any of them.

A blended LTV is a smokescreen. It hides the brilliant successes and the costly failures. It might mask that one segment of customers has an incredible LTV of 10,000, while another is barely breaking even at ****500. Without slicing up the data, you’re essentially flying blind.

To get insights you can actually use, you have to calculate LTV by cohorts. Group your customers by pricing plan, by the marketing channel that brought them in, by company size, or even by the first feature they used. This is how you discover who your most profitable customers really are and where you should be focusing your energy.

How Does Net Revenue Retention Impact LTV?

Think of Net Revenue Retention (NRR) as a powerful engine that can supercharge your LTV. While LTV gives you the big picture of a customer's total value, NRR zooms in on how revenue from your existing customers changes over a set period, like a year.

NRR is a tug-of-war between two forces:

- Revenue Churn: Money you lose when customers cancel or downgrade.

- Expansion Revenue: Extra money you make when customers upgrade, add more seats, or buy other products from you.

When your NRR is over 100%, you’ve hit a special kind of magic. It means your expansion revenue is more than making up for any churn. For instance, an NRR of 110% means your business grew by 10% from your current customer base alone, without signing a single new logo.

This has a massive, compounding effect on LTV. A customer who not only sticks around but also spends more with you over time is exponentially more valuable. That’s why focusing on smart upselling and cross-selling to boost your NRR is one of the most direct paths to driving up your LTV.

Ready to stop guessing and start knowing? SigOS transforms your raw customer data into a clear, automated LTV dashboard. See which customers are driving your growth, predict churn before it happens, and make strategic decisions with confidence. Discover how SigOS can optimize your revenue at https://sigos.io.

Ready to find your hidden revenue leaks?

Start analyzing your customer feedback and discover insights that drive revenue.

Start Free Trial →