SaaS Growth Guide: customer acquisition customer retention

Discover how to optimize customer acquisition customer retention in SaaS with proven growth tactics to balance CAC and LTV.

At its heart, the difference between customer acquisition and customer retention is straightforward. Acquisition is all about bringing new people in the door, while retention is about convincing the ones you have to stick around. True, sustainable growth in SaaS isn't a matter of picking one—it's about finding the right blend of both to build a profitable, resilient business.

The SaaS Dilemma: Balancing Acquisition and Retention

Every SaaS leader eventually faces the same critical question: where do we put our growth dollars? This constant push-and-pull between chasing new customers and nurturing existing ones is what separates the companies that scale from those that fizzle out.

For a startup just getting off the ground, the game is all about acquisition. You need to get your name out there, gain traction, and prove your product has a place in the market. But as your business grows up, that intense focus has to evolve.

Long-term success isn’t an "either/or" proposition. It's a strategic balancing act, and it all starts with a solid grasp of the numbers that drive your business.

Foundational Growth Metrics

Two metrics form the bedrock of any smart growth strategy: Customer Acquisition Cost (CAC) and Customer Lifetime Value (LTV).

- Customer Acquisition Cost (CAC): This is the total price you pay—in marketing, sales efforts, ad spend, and commissions—to land one new paying customer. Think of it as your entry fee for each new relationship.

- Customer Lifetime Value (LTV): This metric forecasts the total revenue you can reasonably expect from a single customer over the entire time they do business with you. A high LTV is a clear sign of a product that delivers real value and builds loyalty.

Getting a handle on the relationship between CAC and LTV is absolutely non-negotiable. For a SaaS business to be healthy, its LTV needs to be substantially higher than its CAC. The industry benchmark is a ratio of at least 3:1. This fundamental balance is what fuels profitability over the long haul.

Comparing Acquisition and Retention

To make informed, data-driven decisions, you need to see how these two growth strategies stack up against each other across different parts of the business.

| Business Dimension | Customer Acquisition | Customer Retention |

|---|---|---|

| Primary Goal | Attract and convert new leads into paying customers. | Nurture and engage existing customers to ensure they stay. |

| Key Metrics | CAC, Conversion Rate, Lead Velocity Rate. | LTV, Churn Rate, Net Revenue Retention (NRR). |

| Associated Costs | Typically higher; involves marketing, advertising, sales outreach. | Significantly lower; focuses on support, success, and product value. |

| ROI Timeline | Shorter-term, focused on immediate revenue from new sign-ups. | Longer-term, focused on compounding revenue and profitability. |

The Evolving Economics of SaaS Customer Growth

Let's get straight to the point: the old playbook of "growth at all costs" is broken. For years, the SaaS world was obsessed with acquiring new customers, but a crowded market has completely changed the game. The cost of getting a new user through the door is skyrocketing, forcing smart leaders to ask a tough question: where does our growth budget really make a difference?

This isn't just a minor shift. It’s a fundamental economic reality. When everyone is fighting for the same eyeballs, ad channels get clogged and expensive. This pressure turns every new customer into a high-stakes investment, making it absolutely critical that they stick around long enough to pay off.

Deconstructing Customer Acquisition Cost

Your Customer Acquisition Cost (CAC) is the total price tag for winning a single new customer. Don't just think about ad spend. This includes everything: your marketing team's salaries, sales commissions, the tools you use—all of it. Knowing your CAC is the first step to grasping the true cost of your growth engine.

The math is simple enough:

CAC = (Total Sales & Marketing Costs) / (Number of New Customers Acquired)

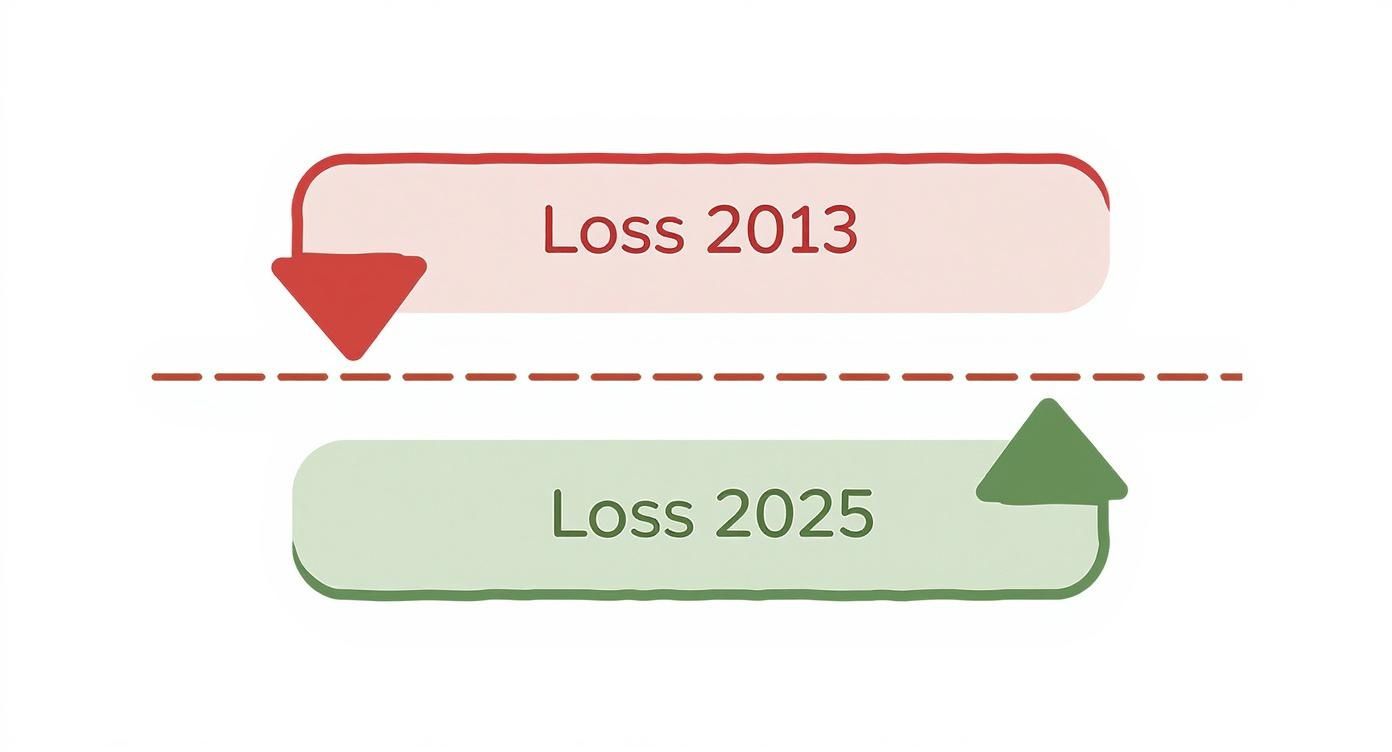

But the forces driving that number up are anything but simple. Just look at the e-commerce world for a cautionary tale. Acquisition costs have ballooned, with many online stores now losing an average of $29 per new customer. That's a jaw-dropping 222% increase in losses compared to 2013. This trend sends a clear message: building a business solely on acquiring new customers is a fast track to burning cash.

The Compounding Power of Retention Economics

While acquisition costs are a constant battle, the math behind retention paints a much prettier picture. The star of this show is Customer Lifetime Value (LTV), which is the total revenue you can expect from a single customer over their entire relationship with you. A healthy SaaS business lives and dies by its LTV-to-CAC ratio, aiming for a healthy 3:1 or better. For a deeper dive, check out our complete guide on calculating the lifetime value of a customer in SaaS.

But the real power of retention isn't just in a single metric. It’s in the compounding returns. Acquisition gives you a one-time sugar rush of revenue, while retention builds a solid, growing foundation.

Imagine two SaaS companies. They both have 100 customers, each paying $1,000 a year.

- Company A has a 5% monthly churn rate.

- Company B has a 3% monthly churn rate.

That small difference adds up, and fast. After just one year, Company B—with its slightly better retention—will have kept nearly 20 more customers and be generating substantially more recurring revenue than Company A. Over time, that gap becomes a chasm. This is precisely why elite SaaS businesses treat retention not as a damage-control tactic, but as their primary engine for sustainable, long-term profit.

Strategic Comparison of Acquisition and Retention

When it comes to building a SaaS business that lasts, you can't just think "acquisition vs. retention." It’s not a cage match. Instead, think of them as two sides of the same coin, both essential for sustainable growth. While they both drive revenue, they work on completely different timelines, speak to different people, and are measured with wildly different yardsticks. Getting these distinctions right is crucial for knowing where to put your money as your company matures.

A common mistake is to simply ask which one is "cheaper" or "better." The truth is, it's all about context. If you're an early-stage startup with a handful of users, you have no choice—you have to pour everything into acquisition. On the flip side, a mature company sitting on a large customer base will find its biggest wins in retention and expansion. The real insight comes from breaking them down by what they actually do for the business.

This infographic paints a stark picture of just how expensive the acquisition game has become, showing the net loss per new customer back in 2013 versus what’s projected for 2025.

The numbers don't lie. Relying purely on acquisition is becoming a fast track to burning cash as markets get more crowded and competitive.

The Audience: Strangers vs. Known Customers

At its core, the biggest split between customer acquisition and customer retention is who you're talking to. Acquisition is all about marketing to strangers. These are people who might not know your brand exists, or worse, don't even realize they have a problem your software can solve. Your job is to grab their attention, show them the light, and convince them to take a leap of faith.

Retention, however, is a conversation with people you already know. You have their data. You've seen how they use your product. You know what got them to sign up in the first place. The goal isn't to get them to try you out; it's to prove their initial decision was a brilliant one and to keep delivering value. This completely changes the game from mass appeal to highly personal, value-first engagement.

The Metrics: Quick Wins vs. Long-Term Value

The scorecards for these two strategies couldn't be more different. Acquisition is measured by metrics that track front-end activity and the initial sale.

Acquisition Metrics Hinge On:

- Customer Acquisition Cost (CAC): The bottom-line cost to get one new customer in the door.

- Conversion Rate: The percentage of prospects or trial users who pull out their credit card and become paying customers.

- Lead Velocity Rate (LVR): The speed at which you’re growing your pipeline of qualified leads month over month.

Retention metrics, on the other hand, are all about the long-term health and profitability of your entire customer base.

Retention Metrics Hinge On:

- Customer Lifetime Value (LTV): The total revenue you can expect from a single customer over their entire time with you.

- Churn Rate: The percentage of customers you lose in a given period. This is the silent killer of many SaaS companies.

- Net Revenue Retention (NRR): The holy grail. This metric shows the recurring revenue from existing customers, factoring in upgrades, downgrades, and churn. An NRR over 100% means you’re growing even without signing a single new customer.

The Playbook: Tactics and Team Skills

The day-to-day work of acquisition and retention is handled by different teams with unique talents. Acquisition is traditionally the playground of marketing and sales pros who are masters of casting a wide net and closing deals.

Common Acquisition Plays:

- Content Marketing & SEO

- Paid Advertising (PPC, Social Ads)

- Outbound Sales & Cold Outreach

- Affiliate and Partner Programs

Retention is where product, customer success, and support teams really shine. Their work is all about improving the user experience and building genuine relationships. A great example is a product-led growth model, which uses the product itself as the primary driver for both signing up new users and keeping them happy. You can dive deeper into how to build a successful product-led growth strategy in our guide.

Common Retention Plays:

- A killer, personalized onboarding experience

- Proactive customer support that solves problems before they happen

- In-app messaging and feature announcements

- Customer feedback loops and building a strong community

Putting it all side-by-side really clarifies how different the operational focus is.

A Strategic Breakdown of Acquisition vs Retention

This table breaks down the fundamental differences in approach, helping you see where each strategy fits within your broader business goals.

| Business Dimension | Customer Acquisition Focus | Customer Retention Focus |

|---|---|---|

| Primary Goal | Attract and convert new leads into paying customers. | Deepen engagement and maximize the value of existing customers. |

| Communication Style | Broad, persuasive messaging aimed at generating initial interest. | Personalized, contextual communication based on user behavior. |

| Time to ROI | Shorter; revenue is realized at the point of initial conversion. | Longer; ROI compounds over months or years through loyalty and expansion. |

| Risk Profile | Higher; marketing spend may not convert, and new customers may churn quickly. | Lower; you are investing in a proven audience that has already demonstrated commitment. |

Ultimately, the smartest companies see that acquisition and retention aren't competing for budget—they're partners in a growth loop. A great acquisition process doesn't just bring in bodies; it brings in the right customers who are set up for long-term success. And in turn, an amazing retention experience creates loyal advocates who become your most powerful (and cheapest) acquisition channel through word-of-mouth. The real challenge isn’t choosing one over the other, but mastering the handoff between them as you grow.

How Real SaaS Companies Balance Their Growth Strategy

Knowing the theory behind the customer acquisition vs. customer retention debate is one thing, but seeing it play out in the real world is where the lessons really stick. Let's walk through a practical case study of a fictional B2B SaaS company, SigOS, as it navigates the classic growth journey—from an aggressive land-grab to a more sustainable, retention-led model.

Like any startup, SigOS began with a clear mission but a tiny user base. Their first priority was simply to survive, which meant getting their product into as many hands as possible, as quickly as possible. Those early days were a blur of acquisition-focused activities designed to build a market presence and prove their solution had legs.

Their initial strategy was a textbook go-to-market push. They poured their resources into top-of-funnel marketing to spark awareness and drive trial sign-ups, clawing out an essential foothold in a crowded space.

Phase 1: The Acquisition Onslaught

For the first eighteen months, the SigOS growth team had tunnel vision: bring new users through the door. Their resources were channeled into avenues that promised the fastest path to conversion, even if the cost per lead was steep.

This all-out acquisition approach included:

- Aggressive Content Marketing: They churned out a steady stream of blog posts, whitepapers, and guides targeting high-intent keywords to capture organic search traffic.

- Targeted Paid Search: A hefty chunk of their budget was allocated to Google Ads campaigns, zeroing in on prospects actively searching for solutions just like theirs.

- Webinar Funnels: SigOS hosted bi-weekly webinars to showcase their product's value, using them as a powerful lead magnet to grow their email list and book demos.

And it worked. SigOS successfully scaled its user base from a few dozen beta testers to several thousand paying customers. But as the company grew, a troubling pattern started to emerge in the data: their churn rate was creeping up.

Phase 2: The Strategic Pivot to Retention

That rising churn was a wake-up call. The cost of acquiring each new customer was getting higher, and losing them after only a few months was making their growth model feel like a house of cards. The leadership team saw the writing on the wall—their "leaky bucket" would eventually drain their resources, no matter how many new customers they poured in.

So, SigOS made a deliberate choice to rebalance its efforts. While acquisition was still on the radar, customer retention became a primary goal, championed by a newly empowered customer success team. They came to grips with a fundamental SaaS truth: keeping a customer happy is far more profitable than constantly replacing them.

Implementing a Retention-First Playbook

Making the switch from a pure customer acquisition mindset to a balanced customer retention strategy wasn't just a change in philosophy; it required concrete initiatives designed to deliver ongoing value and build real relationships.

First, they completely overhauled their onboarding process. Gone was the generic product tour. Instead, new users received a data-driven, personalized onboarding experience that pointed them directly to the features most relevant to their stated goals. This focus on an immediate "aha!" moment helped slash early-stage churn by over 15% in the first quarter alone.

Next, they built out a proactive customer success program. The team started using product usage data to spot accounts at risk of churning—those with dropping engagement or low feature adoption. They then reached out with targeted support and training before a customer had a chance to get frustrated.

Finally, SigOS created a tight feedback loop that funneled customer input directly into the product roadmap. Using their own AI-driven intelligence platform, they analyzed support tickets, call transcripts, and survey responses to pinpoint the most requested features and urgent pain points. This ensured their development efforts were always aligned with what existing customers actually needed, making the product stickier with every update.

This transition didn't just stop the bleeding; it turned their customer base into a powerful growth engine, unlocking new revenue from expansions and word-of-mouth referrals.

Building a Unified, Customer-Centric Growth Engine

Sustainable growth doesn't come from a clever marketing plan or an aggressive sales quota. It’s built when every single team in your company is rowing in the same direction. The best SaaS companies I've seen have torn down the old walls separating customer acquisition and customer retention, viewing them instead as two sides of the same coin—a single, continuous customer journey.

This means getting away from the siloed thinking where marketing obsesses over lead volume, sales just chases the close, and customer success is left to clean up any messes. A unified approach gets everyone focused on shared goals that span the entire customer lifecycle, from the very first ad a person sees to the moment they become a long-term advocate for your brand.

The real goal here is a frictionless experience, where the promises made during the sales process are not only met but exceeded after the contract is signed.

Aligning Teams Around Shared Lifecycle Goals

Genuine alignment always starts with shared metrics. When your marketing, sales, and customer success teams are all judged by numbers like Net Revenue Retention (NRR) or Customer Lifetime Value (LTV), their priorities can't help but snap into focus. Marketing is no longer just about generating any lead; it's about attracting prospects who have the highest potential to stick around.

Salespeople stop trying to close every possible deal and start concentrating on closing the right deals, which makes the handoff to the success team infinitely smoother. This kind of structure naturally encourages collaboration and forces everyone to take a more holistic view of customer health.

For example, at SigOS, we use AI to analyze sales call transcripts, looking for specific language that correlates with a higher risk of post-sale churn. We feed that data right back to the sales team—not to punish them, but to help them refine how they qualify prospects and set better expectations. It's a small change that directly improves retention outcomes down the road.

A unified growth engine doesn't just track metrics; it creates a feedback loop where post-sale insights actively inform and improve pre-sale strategies. This transforms customer retention from a reactive function into a proactive driver of smarter acquisition.

The Onboarding Handoff Is Everything

The single most critical moment in the entire customer journey is the handoff from acquisition to retention, which almost always happens during onboarding. This is the make-or-break point where a customer's initial excitement either cements into long-term loyalty or sours into buyer's remorse.

Delivering immediate, tangible value in those first few sessions is arguably the most powerful retention tactic you have. It validates their decision to buy from you and proves your marketing wasn't just empty talk. A great onboarding experience isn't about a feature tour; it's about racing the user to their first "aha!" moment. To nail this, you need a deep understanding of the key customer retention metrics that signal early engagement and success.

Weaving a Frictionless Customer Experience

A truly customer-centric mindset means looking at every single interaction from the customer's point of view. This takes a lot of empathy and a real commitment to stamping out friction wherever you find it. While price and rewards programs are still table stakes, the overall experience is quickly becoming just as important.

Recent survey data really drives this point home. While 55% of consumers still expect better deals and 50% want rewards for their loyalty, a huge chunk of them are prioritizing the experience itself. In the same survey, 28% said seamless interactions were a key reason to stay with a brand, and another 24% pointed to personalized offers. This tells us a smooth, tailored journey is now a major competitive advantage. You can dig into the full report on what drives customer loyalty on emarsys.com.

Ultimately, a unified growth engine completely redefines the finish line. The goal isn't just the initial sale; it's creating a loyal advocate who not only stays but also becomes your most powerful acquisition channel. This cycle—where happy, retained customers drive new acquisition—is the hallmark of a truly sustainable SaaS business.

Common Questions About Acquisition and Retention

When you're trying to grow a SaaS business, the tug-of-war between customer acquisition and customer retention is a constant. I've seen countless teams wrestle with the same core questions. While every company's situation is a bit different, the underlying principles are pretty universal. Let's break down some of the most common ones.

Which Is More Important for an Early-Stage SaaS?

If you're just starting out, acquisition is king. You can't retain customers you don't have, right? The initial grind is all about getting those first users in the door to prove you’ve actually built something people need—that all-important product-market fit.

But don't make the mistake of completely ignoring retention. Right from the get-go, you should be watching how those new users behave. Are they sticking around after the first week? Are they completing the onboarding? If your first batch of users churns out immediately, that’s a massive red flag. Pouring more money into marketing won’t fix a product that doesn’t deliver. Think of acquisition as laying the foundation, but early retention is the mortar that holds it all together.

How Do You Know When to Shift Focus from Acquisition to Retention?

There’s no magic formula, but the data will tell you when it's time to pivot. A classic sign is when your Customer Acquisition Cost (CAC) starts climbing, but your Customer Lifetime Value (LTV) isn't budging. You're basically paying more and more for customers who aren't delivering more value. That's a losing game.

The real alarm bell rings when your churn rate overtakes your acquisition rate. At that point, you’re not just growing slowly—you're shrinking. Your "leaky bucket" is losing water faster than you can pour it in, and you have to prioritize plugging the holes.

Another trigger is simply running out of runway in your target market. Once you’ve signed up a good chunk of your ideal customers, finding new ones gets a lot harder and more expensive. That's when your growth strategy has to shift inward, focusing on getting more from the customers you already have.

What Is a Good Customer Retention Rate for SaaS?

This definitely isn't a one-size-fits-all answer, as it can swing wildly based on your industry and price point. But for most B2B SaaS companies, aiming for an annual customer retention rate of 90% or higher is a solid goal. That works out to an annual churn of 10% or less.

If you're on a monthly subscription model, a healthy monthly churn rate is typically between 1% and 3%. The raw number is a good starting point, but the real insight comes from cohort analysis. This lets you track retention for different groups of customers over time. If your newer cohorts are sticking around longer than your older ones, you know your product and processes are improving.

Can a Strong Retention Strategy Improve Acquisition?

Without a doubt. In fact, this is how you build a truly efficient growth machine. When you nail retention, your happy, successful customers become your best sales team. They're the ones who will rave about you to their friends and colleagues, driving high-quality, word-of-mouth referrals that cost you practically nothing.

These advocates also give you powerful social proof. Think testimonials, glowing reviews, and compelling case studies. This kind of content builds immense trust with new prospects, making all of your other marketing efforts—from paid ads to blog posts—more credible and effective. Retention doesn't just stop churn; it actively feeds the top of your funnel.

At SigOS, we believe that sustainable growth comes from truly understanding your customers. Our AI-driven intelligence platform turns raw customer feedback into clear, actionable insights that drive revenue. We help you find out what keeps your users loyal and what makes them leave. Discover how SigOS can help you build a more durable, customer-centric business.