A Guide to Customer Retention Metrics

Unlock business growth with our guide to customer retention metrics. Learn to track, analyze, and act on key data to boost loyalty and profitability.

Customer retention metrics are the vital signs of your business. They're the key performance indicators (KPIs) that tell you how good you are at keeping the customers you’ve worked so hard to win. Think of them less as complex formulas and more as a direct window into the health of your customer relationships and the long-term sustainability of your revenue.

Why Customer Retention Metrics Are Your Growth Engine

For years, the go-to line about customer retention has been the same old cliché: "it's cheaper than acquisition." While that’s absolutely true, it barely scratches the surface. Focusing only on getting new customers without understanding who stays—and why they stay—is like pouring water into a leaky bucket.

Imagine your customer base is the water in that bucket. Every new sale adds a satisfying splash. But hidden holes, like a clunky onboarding process, frustrating support issues, or a competitor’s shiny new feature, are constantly draining that water away. Those leaks are your customer churn. You can keep pouring water in faster (i.e., cranking up your acquisition spend), but you’ll never actually fill the bucket.

Customer retention metrics are the tools you use to find and patch those leaks. They turn vague hunches about customer happiness into cold, hard data, pointing you directly to where you're losing valuable relationships and, ultimately, revenue.

The Financial Power of Loyalty

The real impact of retention goes way beyond just saving a few bucks. Your loyal, long-term customers are the true economic engine of your company. That's why it's so important to start by understanding what a customer retention metric is and how it works as a performance indicator for your business.

Once you see these metrics for what they are, their financial power becomes impossible to ignore. A landmark study from Bain & Company revealed that a mere 5% increase in customer retention can skyrocket profits by anywhere from 25% to 95%. Why? Because existing customers tend to buy more over time, they cost less to support, and they become your best marketing channel through word-of-mouth referrals.

Moving Beyond Numbers to Insights

At the end of the day, tracking these metrics gives you a clear story about your product's real-world value and the quality of your customer experience. They help you answer the questions that really matter:

- Are we actually solving the right problems for our customers?

- Does our onboarding process truly set people up for success?

- Which types of customers are most likely to leave us?

- Where are our biggest opportunities to increase customer lifetime value?

This guide will walk you through the essential metrics, breaking down the formulas and showing you how to apply them with real-world examples. By the end, you'll see these numbers not as a chore, but as a clear roadmap to building a more profitable, resilient, and customer-obsessed business.

The Four Essential Customer Retention Metrics

Now that we know why retention is the secret sauce for growth, it's time to get our hands dirty. To move from theory to practice, we have to translate all that customer behavior into cold, hard data. This is where the four core customer retention metrics come in.

Think of them as the main gauges in a pilot's cockpit. Each one tells you something different but equally critical about how you're flying. One shows your speed, another your altitude, and so on. You need to watch all of them to fly safely. It's the same for your business—to steer toward growth, you need a clear view of your Customer Retention Rate (CRR), Customer Churn Rate, Customer Lifetime Value (CLV), and Net Promoter Score (NPS).

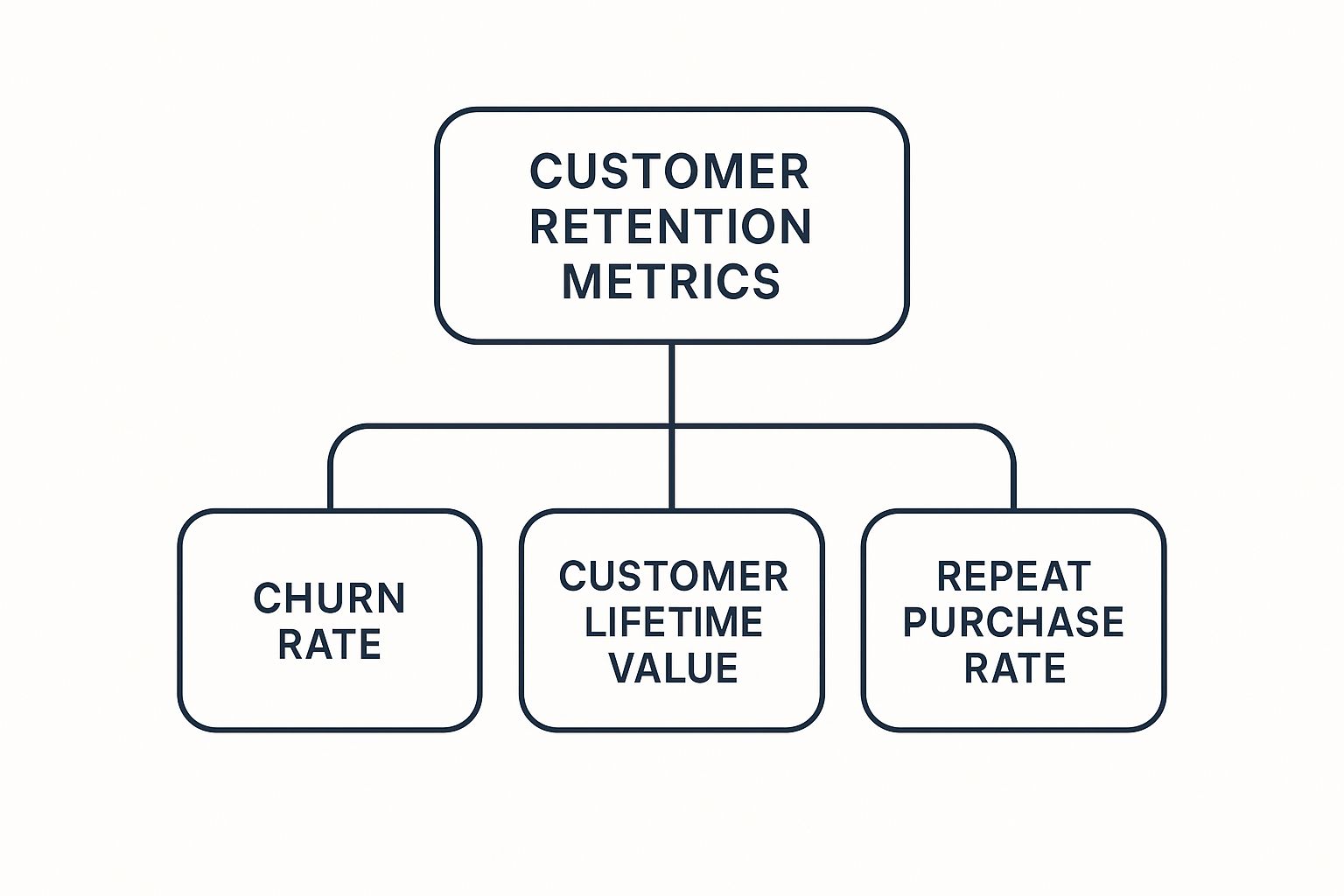

This infographic gives a great high-level look at how these foundational metrics fit together to build a solid retention strategy.

As you can see, metrics like churn and lifetime value are the pillars holding up all of your other retention efforts.

Before we dive into each one, here's a quick summary of what they are and why they matter.

Key Customer Retention Metrics at a Glance

| Metric | Formula | What It Tells You |

|---|---|---|

| Customer Retention Rate (CRR) | [ (E - N) / S ] * 100 | What percentage of existing customers are sticking with you? |

| Customer Churn Rate | ( L / S ) * 100 | How quickly are you losing customers? |

| Customer Lifetime Value (CLV) | (Avg. Purchase Value) x (Avg. Purchase Frequency) x (Avg. Customer Lifespan) | How much is a single customer worth over their entire relationship with you? |

| Net Promoter Score (NPS) | % of Promoters - % of Detractors | How happy are your customers, and how likely are they to recommend you? |

This table provides a snapshot, but the real power comes from understanding the story behind each number. Let's dig in.

1. Customer Retention Rate (CRR)

Your Customer Retention Rate is the most direct way to measure how well you're holding onto your customers. It answers a simple but profound question: "Of all the customers we had at the start of the month, how many are still here at the end?" It’s your main loyalty gauge.

Calculating CRR is pretty straightforward. Just pick a time period—let's say a quarter—and follow these steps:

- Step 1: Count the customers you had at the very start of the quarter (S).

- Step 2: Count the customers you have at the very end of the quarter (E).

- Step 3: Count the new customers you signed up during that quarter (N).

The formula is: CRR = [ (E - N) / S ] * 100

2. Customer Churn Rate

Customer Churn Rate is the other side of the CRR coin. It tells you the percentage of customers who jumped ship during a specific period. If retention is about who stays, churn is about who leaves. Think of it as the leak in your bucket—this metric tells you how fast the water is draining out.

A high churn rate is a red flag, often pointing to problems with your product, customer service, or the overall value you’re providing. It’s one of the most-watched metrics out there, especially for subscription businesses. For a more detailed look, you can read our complete guide to churn rate analysis.

To calculate it, you just need two numbers:

- The number of customers lost during a period (L).

- The number of customers you had at the start of that period (S).

The formula is simply: Churn Rate = ( L / S ) * 100

Going back to our SaaS company, they started with 500 customers and ended with 460 of that initial group (since 580 total - 120 new = 460). That means they lost 40 customers (500 - 460).

- Churn Rate = (40 / 500) * 100

- Churn Rate = 8%

You'll notice that the 8% churn rate and the 92% retention rate add up to a perfect 100%. They are two different lenses for looking at the exact same loyalty picture.

3. Customer Lifetime Value (CLV)

Customer Lifetime Value is all about looking at the big picture. It predicts the total amount of money your business can expect to make from a single customer over their entire time with you. This moves you away from thinking about one-off sales and toward building long-term, profitable relationships.

CLV helps you answer critical questions like:

- How much can we afford to spend to acquire a new customer?

- Which types of customers are our most valuable over the long haul?

- Where should we focus our retention budget to get the best return?

Calculating CLV can get really complex, but a simple and powerful formula works wonders for most businesses:

CLV = (Average Purchase Value) x (Average Purchase Frequency) x (Average Customer Lifespan)

Let's use an e-commerce coffee subscription box as an example:

- Average Purchase Value: The typical customer spends $40 on each order.

- Average Purchase Frequency: Customers usually get a box 12 times a year (monthly).

- Average Customer Lifespan: On average, a customer sticks around for 3 years.

CLV = 40 x 12 x 3 = 1,440

This tells the coffee company that their average subscriber is worth $1,440 in revenue. That's a powerful number to know when making decisions about marketing budgets or how much to invest in the customer experience.

4. Net Promoter Score (NPS)

While the first three metrics are all about the money, Net Promoter Score is about emotion and loyalty. It measures how likely your customers are to recommend you to other people, which is one of the strongest predictors of future growth.

NPS boils down to a single, elegant question: "On a scale of 0-10, how likely are you to recommend our company to a friend or colleague?"

You then sort the responses into three buckets:

- Promoters (Score 9-10): These are your die-hard fans. They'll keep buying from you and will actively spread the word, bringing you new business.

- Passives (Score 7-8): They're happy enough but not blown away. These customers are susceptible to being wooed by a competitor.

- Detractors (Score 0-6): These are unhappy campers. They can actively hurt your brand with negative reviews and bad word-of-mouth.

The formula is super simple: NPS = % of Promoters - % of Detractors

How to Benchmark Your Retention Rates

So, you’ve calculated your retention metrics. Now comes the big question every founder and product manager asks: "Is my retention rate any good?"

The answer isn't a simple yes or no. A "good" retention rate isn't a magic number that fits every business. It's a moving target, and its value depends entirely on your industry, business model, and even the nature of your product.

Trying to compare your retention rate to a completely different industry is like judging a fish on its ability to climb a tree. It's a pointless and discouraging exercise. A media company with an 84% retention rate is killing it, while an e-commerce store hitting 35% might actually be leading its category. Context is everything.

This is where benchmarking comes in. It gives you the perspective you need to set realistic goals, see how you stack up against your direct competitors, and build a retention strategy that actually makes sense for your market. Without it, you’re just chasing numbers in a vacuum.

Factors That Influence Retention Benchmarks

Before you even glance at a list of industry averages, you need to understand why they vary so wildly. Several core business traits naturally create different expectations for customer loyalty.

- Purchase Frequency: Think about it. A local coffee shop should have a much higher repeat purchase rate than a company selling mattresses, where a customer might only buy once a decade.

- Contract Lengths: B2B SaaS companies that lock in customers with annual contracts are going to have inherently higher retention than a month-to-month consumer app with zero commitment.

- Switching Costs: How big of a headache is it for a customer to leave you? Switching banks is a pain—you have to transfer funds and update auto-payments. But switching music streaming services? That’s easy.

- Product vs. Service: A service-based business, like a financial advisor, often builds deep personal relationships that drive loyalty. This is a very different dynamic than a purely transactional product business.

Figuring out where your business lands on these spectrums is the first step to finding a truly meaningful comparison point.

Setting Realistic Goals With Industry Data

Once you have that context, you can start digging into industry-specific data to get a real sense of your performance. This simple step keeps you from chasing impossible targets and helps you recognize your actual wins.

Take the brutally competitive world of software-as-a-service (SaaS). Global benchmarks show that only 39% of users are still active after one month, and that number drops to 30% after three months. These numbers point to a steep, early drop-off that’s common for digital products, especially when it’s easy for users to jump ship. You can dig deeper into these user retention rate benchmarks for the tech industry to see how you compare.

This context is crucial. A SaaS founder staring at a 39% one-month retention rate isn't necessarily failing. They're just facing a standard industry challenge that calls for a smarter strategy—one focused on a killer onboarding experience that proves the product’s value, fast.

Average Customer Retention Rates by Industry

To give you a starting point, we've put together a comparative look at typical annual customer retention rates across various major sectors. This isn't meant to be a rigid scorecard. Instead, use it as a guide to understand where your business fits into the broader landscape.

| Industry | Average Retention Rate |

|---|---|

| Media & Professional Services | 84% |

| Automotive & Transportation | 83% |

| Insurance | 83% |

| IT Services | 81% |

| Construction & Engineering | 80% |

| Financial Services | 78% |

| Retail (General) | 63% |

| Hospitality, Travel, Restaurants | 55% |

After looking at these numbers, remember that the most important benchmark is your own past performance. Is your retention rate better this quarter than it was last quarter? Aim for steady, incremental improvement. When you combine industry data with a relentless internal focus on growth, you can build a customer retention engine that truly lasts.

Diving Deeper: Advanced Metrics for True Customer Insight

Once you've got a handle on the big four foundational metrics, it's time to add more specialized tools to your analytics kit. While things like CRR and churn are great for a high-level health check, a handful of advanced metrics can paint a much richer, more detailed picture of how your customers are behaving.

These metrics help you move beyond just knowing if customers are sticking around to understanding how and why they stay engaged.

Think of it this way: your basic metrics are like a car's speedometer and fuel gauge. They tell you if you're moving and when you're about to run out of gas—essential, but limited. Advanced metrics are the engine diagnostics, giving you the details on oil pressure, combustion efficiency, and gear performance. They reveal the underlying habits that dictate long-term success.

Getting this deeper view is critical for pinpointing specific problems. For instance, a solid overall retention rate might be masking a worrying trend of high-value customers buying less and less over time. Advanced metrics are what help you catch these subtle but crucial patterns before they do real damage to your bottom line.

Repeat Purchase Rate

For any business that isn't a one-and-done sale—like e-commerce, retail, or most service-based companies—the Repeat Purchase Rate (RPR) is absolutely essential. It simply measures the percentage of your customers who have come back to buy from you more than once. This is a direct reflection of customer satisfaction and how well your product fits the market.

A high RPR is proof that you're delivering enough value to bring people back for a second, third, or fourth purchase. It’s a clear signal that their first transaction wasn't just a fluke; you've built a relationship worth continuing.

To figure it out, just pick a time period and track two numbers:

- The number of customers who bought from you more than once.

- The total number of unique customers who bought anything in that same period.

The formula is straightforward: RPR = (Customers Who Purchased More Than Once / Total Customers) * 100

A strong RPR is the first domino to fall in building a high Customer Lifetime Value. Repeat business is the engine of long-term profitability, and you can learn more by checking out our guide on how to calculate customer lifetime value.

Purchase Frequency

So, RPR tells you if customers come back. The next logical question is, how often do they come back? That's where Purchase Frequency (PF) comes in. This metric calculates the average number of orders a customer places within a specific timeframe, usually a year. It's a fantastic indicator of customer habit and loyalty.

When you see purchase frequency climbing, it’s a great sign that your product is becoming a staple in your customers' lives or workflows.

For a subscription coffee company, a high purchase frequency is the holy grail. It means their coffee isn't just a random purchase—it's a daily ritual. That's a deep-seated habit that’s incredibly tough for competitors to break.

Calculating PF is super simple:

PF = Total Number of Orders in a Period / Total Number of Unique Customers in that Period

Let's say your online store processed 5,000 total orders from 2,000 unique customers last year. Your Purchase Frequency would be 2.5. This tells you that your average customer buys from you about two and a half times per year. Keeping an eye on this number every quarter can reveal some powerful trends.

Customer Satisfaction Score

Finally, we shift from tracking what customers do to what they think with the Customer Satisfaction Score (CSAT). Similar to its cousin, NPS, CSAT is a survey-based metric that gets right to the point by asking customers how they feel. The key difference is that CSAT is usually much more immediate and tied to a specific transaction.

It's typically based on a single, simple question asked right after a key moment, like after a support ticket is closed or an order is delivered: "How satisfied were you with your experience today?"

Customers then respond on a simple scale, usually from 1 to 5.

- Very Unsatisfied

- Unsatisfied

- Neutral

- Satisfied

- Very Satisfied

To get your score, you only focus on the positive responses: the "Satisfied" (4) and "Very Satisfied" (5) answers.

CSAT = (Number of Satisfied Customers / Total Number of Survey Responses) * 100

So, if you got 200 survey responses and 150 of them were a 4 or a 5, your CSAT score would be a healthy 75%. This kind of real-time feedback is incredibly valuable for spotting friction in your customer journey and giving your teams the data they need to make immediate improvements.

Translating Retention Metrics into Actionable Strategy

It’s one thing to collect a bunch of customer retention metrics. It’s a whole different ballgame to actually use them to drive real-world change. Data just sitting on a dashboard is pure potential. You only unlock its true value when you translate those numbers into a concrete playbook for strategic action.

Think of your metrics as a diagnostic report from a doctor. The numbers tell you what’s wrong, but they don't automatically write the prescription. Your job is to connect each insight to a specific, targeted initiative that can measurably improve the health of your customer relationships and, ultimately, your bottom line.

This is how your analytics transform from a passive reporting tool into an active engine for growth. It’s all about creating a direct, unbreakable line between a data point and a business decision.

From NPS Scores to Proactive Outreach

Let's walk through a common scenario. You run your latest Net Promoter Score (NPS) survey and see a concerning spike in 'Detractors'—those customers who scored you between a 0 and 6. This is a flashing red light on your dashboard, signaling a whole segment of unhappy users who are at a high risk of churning.

Instead of just shrugging and noting the drop, you can build a proven feedback loop to tackle it head-on. This isn't just damage control; it’s a golden opportunity to turn a negative experience into a loyalty-building moment.

Action Plan for NPS Detractors:

- Immediate Personal Follow-Up: Set up an automated alert for your customer success team. A real person—not a generic template—should reach out within 24 hours to understand the "why" behind their low score.

- Root Cause Analysis: Start tagging and categorizing the feedback. Is the problem tied to a specific feature? A recent pricing change? A frustrating support interaction? You're looking for patterns across all the Detractor feedback.

- Close the Loop: Once you’ve identified a problem and started working on a fix, let the customer know. A simple message like, "Thanks to your feedback, we've prioritized a fix for this issue," shows you're actually listening and makes them feel heard.

Responding to a Declining Customer Lifetime Value

A downward trend in Customer Lifetime Value (CLV) is another critical alarm bell. If your CLV is shrinking, it means customers are either spending less, leaving sooner, or both. This metric hits your long-term profitability right where it hurts and demands a strategic response focused on deepening the relationships you already have.

A falling CLV is a clear signal to boost engagement and find new ways to deliver value. It’s the perfect time to explore some of the most effective customer retention best practices that build loyalty for the long haul.

Here are two targeted tactics you can deploy right away:

- Launch a Tiered Loyalty Program: Give your most valuable customers the VIP treatment with exclusive perks. This could be early access to new features, a dedicated support channel, or special discounts tied to their spending history.

- Develop a Targeted Upsell Strategy: Dive into the usage data of your highest-CLV customers. Pinpoint the features they rely on most, then create campaigns to introduce lower-value customers to these same powerful workflows. You're showing them a clear path to getting more value.

Data is the starting line, not the finish line. The goal is to create a clear, repeatable process where every metric you track has a corresponding strategic action ready to be deployed.

Contextualizing Your Retention Strategy

Your response has to be tailored to the unique dynamics of your industry. For example, as of 2025, media and professional services enjoy impressive retention rates of 84%. This is largely due to high switching costs and the deep value of established relationships. On the flip side, industries like hospitality and travel see a much lower average of just 55%.

This context is everything. A restaurant with a 60% retention rate is actually crushing it and should double down on what’s working. But a media company at 70% is lagging way behind and needs to urgently figure out why customers are leaving.

By connecting specific, metric-driven insights to real-world business initiatives, you give your team the power to make smarter, evidence-based decisions. This proactive approach is how you stop just patching leaks and start building a ship that's truly unsinkable.

Got Questions About Customer Retention Metrics? You're Not Alone.

Knowing the formulas is one thing, but actually using these metrics in the real world is where the rubber meets the road. It’s totally normal to wonder how often you should be checking these numbers, what a “good” retention rate even looks like, or where to start without feeling overwhelmed. Let's tackle those common questions head-on.

Think of this as your practical playbook. We're moving past the textbook definitions and into the stuff that helps you make smart, confident decisions. No more guesswork—just clear answers to help you build a retention strategy that actually works.

How Often Should We Be Tracking Our Retention Metrics?

There’s no magic, one-size-fits-all answer here. The right rhythm for tracking your metrics really depends on your business model and how often your customers naturally interact with you. The key is to find a cadence that lets you spot important trends without drowning in meaningless daily fluctuations.

Here’s a simple way to think about it:

- SaaS and Subscription Businesses: For you, weekly or monthly tracking is usually the sweet spot. Because your revenue is recurring, even small dips in engagement or retention can snowball if you don't catch them early. Staying on top of things is critical.

- E-commerce and Retail: A monthly or quarterly review of metrics like Repeat Purchase Rate and Customer Lifetime Value typically makes the most sense. This timing lines up nicely with your marketing campaigns, seasonal promotions, and inventory cycles.

- Big-Picture, Strategic Metrics: For heavy hitters like Net Promoter Score (NPS) or your overall Customer Lifetime Value (CLV), looking at them quarterly or semi-annually is perfect. These are your long-term health indicators, and this pace gives you enough data to see real trends and make major strategic shifts.

So, What Is a Good Customer Retention Rate?

This is the million-dollar question, isn't it? And the honest answer is always: it depends entirely on your industry. A retail business could be crushing it with a 60% retention rate, while a media company might be aiming for 85% to be considered a leader. There’s no universal benchmark.

The most important number to beat isn’t your competitor’s—it’s your own from last quarter. The real goal is steady, continuous improvement. Even a consistent 5% year-over-year increase can have a massive impact on your bottom line.

Your first step should be to find some industry averages to get a realistic baseline. But after that? Turn your focus inward. The most powerful path to sustainable growth is to consistently outperform your own past results.

We're Just Starting Out. Which Metric Should We Focus on First?

If you're new to tracking retention, my advice is simple: don't try to boil the ocean. Start with the most foundational metric there is: Customer Retention Rate (CRR).

CRR is the perfect jumping-off point. It’s straightforward to calculate, and it gives you an immediate, high-level pulse check on your business. It answers the most basic, crucial question: "Are the customers we worked so hard to get actually sticking around?" Nailing this one metric gives you a solid foundation to build upon.

Once you’ve got a handle on CRR, a natural progression looks like this:

- Next, calculate its opposite, Customer Churn Rate, to get a clear picture of who is leaving.

- Then, move on to Customer Lifetime Value (CLV) to understand the dollar value of keeping those customers.

- Finally, start layering in qualitative metrics like NPS to understand the why behind all the numbers.

How Can We Boost Retention if We're on a Tight Budget?

You don't need a massive budget to make a real dent in your churn rate. In fact, some of the most effective retention strategies cost very little and are all about strengthening the human connection with your customers.

Focus on proactive communication and actually listening to the feedback you're already getting. Simple things—like a personalized thank-you email after a purchase or a genuinely useful newsletter—can build incredible loyalty. But the single most powerful, cost-effective retention tool you have is taking action on customer feedback. When people see you’re listening, they feel valued, and valued customers stick around.

Ready to turn customer feedback into revenue? SigOS is an AI-driven platform that analyzes support tickets, sales calls, and usage data to pinpoint the exact issues driving churn and the feature requests that unlock major growth. Stop guessing and start prioritizing with data. Learn more about SigOS.

Ready to find your hidden revenue leaks?

Start analyzing your customer feedback and discover insights that drive revenue.

Start Free Trial →