Your Framework for Growth in a Shifting Economy

Build a powerful framework for growth with this guide. Learn how to diagnose, prioritize, execute, and iterate for sustainable success in any economy.

At its core, a framework for growth is simply a repeatable system that helps you figure out where the real problems are, decide what to work on first, and run smart experiments to see what actually moves the needle. It’s about ditching the guesswork and building a machine for sustainable expansion. Think of it less like a rigid, one-and-done plan and more like an adaptable engine for navigating the messy reality of the market.

Why You Need a Dynamic Framework for Growth Now

In today's shaky economic climate, just "winging it" isn't a strategy—it's a recipe for disaster. The old playbooks are gathering dust, and companies running on gut feelings alone are constantly playing defense, reacting to market shifts instead of driving them. This reactive posture is a huge risk when you're up against slow productivity, unpredictable customers, and cutthroat competition.

A solid framework for growth completely flips that script. It’s the difference between chaotic opportunism and strategic, deliberate action. We're not talking about some massive five-year plan that nobody looks at. We're talking about building a resilient, adaptable system—a true operational rhythm—that powers consistent, predictable progress.

The Problem with Improvisation

So many businesses jump from one project to the next, chasing the shiny new trend or listening to whoever shouts the loudest. The result? Scattered efforts, burned-out teams, and no clear idea of what's actually working. Without a guiding framework, it’s almost impossible to know if your big initiatives are truly making an impact or just keeping everyone busy.

This is a particularly dangerous game right now. With global economic growth for 2025 projected to be pretty sluggish thanks to weak investment, every dollar and every hour has to count. Projections are still sitting below the pre-pandemic average, which means you can't afford to waste resources. You can dig into some of the data behind these global economic outlooks and their impact on rsmus.com. A formal framework is your best defense, ensuring your limited budget and talent are aimed at the projects most likely to pay off.

Core Components of a Modern Growth Framework

A successful growth system really boils down to four interconnected pillars. Each one flows into the next, creating a continuous feedback loop of learning and improvement. This is what separates companies that thrive from those that just tread water.

To make this tangible, here's a breakdown of what each component looks like in practice.

| Component | Objective | Key Activities |

|---|---|---|

| Honest Diagnosis | Get a brutally honest picture of where you are right now. | Dig into sales data and analytics; run customer feedback surveys; conduct internal team interviews to find bottlenecks. |

| Strategic Prioritization | Decide where to focus your limited resources for the biggest wins. | Use scoring models like RICE or ICE to rank ideas; map initiatives against core business goals; kill projects that don't align. |

| Agile Execution | Run small, fast experiments to learn what works without betting the farm. | Launch A/B tests on landing pages; pilot new features with a small user segment; run short, two-week "sprints" to test a single hypothesis. |

| Constant Measurement | Track results and feed the learnings back into the system. | Define clear KPIs for every experiment; build dashboards that show real impact (not vanity metrics); hold regular review meetings to discuss what you've learned. |

These four stages aren't just a process; they form a cycle that builds momentum over time.

By building your own version of this structured yet flexible system, your business can face uncertainty with a clear head. You can finally stop guessing what might work and start building a repeatable process that consistently delivers results, turning market volatility from a threat into a serious competitive advantage.

Conducting Your Growth Diagnostic

You can’t build a solid growth framework on a foundation of guesswork. Before you can even think about where you’re going, you need a brutally honest, unfiltered look at where you are right now. This diagnostic phase is the bedrock of your entire strategy. It’s about getting past the vanity metrics to uncover the real story behind your numbers.

The goal here isn't just to hoard data; it's to paint a complete, multi-dimensional picture of your business. This means marrying the "what" with the "why."

Blending Hard Numbers with Human Stories

Your first job is to pull together two very different kinds of information. On one hand, you have the hard, quantitative data—the cold, hard numbers that tell you what is happening. This is your website analytics, sales figures, customer churn rates, and support ticket volumes.

But numbers alone can't give you the full picture. They don't explain why a customer churned or what frustration made them abandon their cart. For that, you need qualitative insights. This is the human element, the stories you gather from customer interviews, feedback surveys, sales call transcripts, and even casual conversations with your frontline support and sales teams.

This blended approach stops you from chasing ghosts. For example, you might see a 30% drop-off on your pricing page. The quantitative data flags the issue, but it’s only by talking to users that you learn they can’t figure out the real value difference between your pricing tiers. Now that's an insight you can act on.

Mapping the Entire Customer Journey

With your data sources in hand, it’s time to map the entire customer journey. I’m not just talking about the sales funnel; I mean from the very first spark of awareness to the point where a customer becomes a raving fan.

- Awareness: How do people first hear about you? What’s their gut reaction?

- Consideration: What problems are they trying to solve? Who else are they looking at?

- Conversion: What are the final barriers to signing up or making a purchase? Where’s the friction?

- Onboarding: What’s their first week like? Do they get to that "aha!" moment quickly, or are they left confused?

- Retention & Advocacy: What makes them stick around? What would it take for them to tell a friend about you?

By plotting out each stage and linking it to key metrics and customer sentiment, you can pinpoint exactly where things are breaking down. A classic mistake is to pour all your resources into acquisition while ignoring a leaky bucket in onboarding that silently loses you customers. The journey map shows you the whole system. For a deeper dive, understanding the principles of AI-powered decision-making in our article can give you a powerful new lens for interpreting this data.

Performing a SWOT Analysis That’s Actually Useful

Ah, the classic SWOT analysis (Strengths, Weaknesses, Opportunities, Threats). It's still a fantastic tool, but only if it’s grounded in reality, not wishful thinking. All the diagnostic data you just collected is the fuel for this.

| Category | Guiding Questions Based on Your Diagnostic |

|---|---|

| Strengths | What do our best customers consistently rave about in interviews? Which channels bring in the highest LTV customers? |

| Weaknesses | Where on the journey map do most people give up? What are the top 3 complaints in our support tickets? |

| Opportunities | Are there customer segments we're ignoring that keep popping up in feedback? What competitor weaknesses can we pounce on? |

| Threats | What new trends could make our core feature irrelevant? Which competitors are eating our lunch with our target audience? |

This isn’t some stuffy corporate exercise. It’s a practical way to synthesize what you've learned. A "weakness" is no longer just a hunch; it’s a 45% churn rate in the first month, backed up by qualitative feedback about a clunky user interface.

Ultimately, a thorough diagnostic gives you clarity. You’ll walk away with a prioritized list of real, evidence-backed problems and opportunities. Instead of your team debating what to do next, everyone will have a shared understanding of where the business is hurting and where the biggest levers for growth are waiting to be pulled. This foundation turns your strategy from a series of guesses into a sequence of calculated, high-impact moves.

Turning Business Insights into a Growth Roadmap

You've just finished the diagnostic deep dive, and now you’re sitting on a mountain of insights—friction points, hidden gems, and massive opportunities. This is the moment of truth. It's also where most growth strategies fall apart. A long list of brilliant ideas is useless without a system for deciding what to tackle first.

This is where your growth framework pivots from analysis to action. We're talking about turning that raw data into a strategic, get-it-done roadmap.

Without a clear way to prioritize, decisions get messy. They often fall victim to the "loudest voice in the room" syndrome, where gut feelings or someone's pet project wins out over data-backed opportunities. To sidestep this, you need to get everyone on the same page. This playbook for aligning sales, marketing, and customer experience for revenue growth) is a great resource for making sure every department is pulling in the same direction.

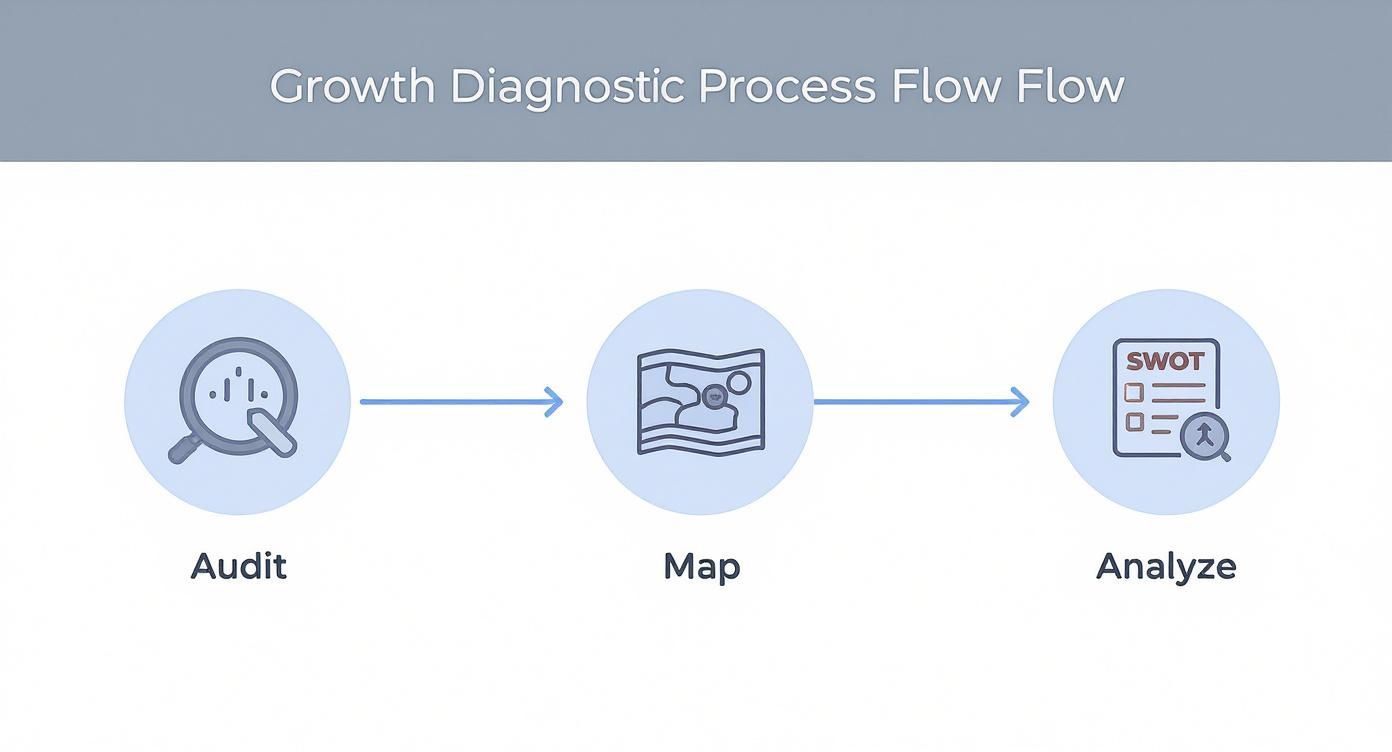

This flow from auditing to analysis is what ensures your prioritization is built on a solid foundation—a deep, shared understanding of the business landscape.

Introducing Prioritization Frameworks

To get past the subjective debates, you need a simple, objective scoring system. Two of the most battle-tested models out there are ICE and RICE. They give your team a common language to weigh vastly different ideas against each other, whether it's a small UX tweak or a major marketing campaign.

ICE Score

This is your quick-and-dirty model, perfect for early-stage teams or just getting an initial sort of your ideas. It's built on three pillars:

- Impact: How much will this move the needle on our key metric? (Score 1-10)

- Confidence: How sure are we about that impact? Is this based on hard data or just a hunch? (Score 1-10)

- Ease: How much work is this, really? Think time, resources, and technical debt. (Score 1-10, where 10 is super easy)

The final score is a simple average: (Impact + Confidence + Ease) / 3.

RICE Score

This model adds another layer of objectivity by factoring in "Reach," which makes it a much better fit for more mature products with an established user base.

- Reach: How many people will this actually touch in a given period? (e.g., 5,000 users per month)

- Impact: How much will this affect each person? (Use a scaled score: 3 for massive, 2 for high, 1 for medium, 0.5 for low)

- Confidence: How solid are your estimates? (Use percentages: 100% for high confidence, 80% for medium, 50% for low)

- Effort: How many "person-months" will this take? (e.g., 2 engineers for 1 month = 2 person-months)

You calculate the score with this formula: (Reach x Impact x Confidence) / Effort.

From Scoring to a Strategic Roadmap

Once you’ve scored your list of potential initiatives, just rank them from highest to lowest. That ranked list is the backbone of your new growth roadmap. It gives you a clear, defensible answer to the question, "What are we working on next, and why?"

This structured thinking is invaluable, especially when you’re navigating the bigger economic picture. For instance, forecasters expect real consumer spending in the United States to grow by 2.1 percent in 2025, which could open up new avenues for growth. At the same time, ongoing tariff policies are creating real supply chain headaches.

A solid prioritization framework helps you weigh initiatives like "overhaul inventory management" against "launch new consumer campaign" with much greater clarity. You can't afford to guess.

Putting this all into a clear document is the final, crucial step. A well-designed plan is everything. Our guide on creating a technical roadmap template offers a great structure that you can easily adapt for your growth initiatives. It will help keep both your technical and non-technical teams aligned.

Remember, your roadmap isn't a "set it and forget it" document. It should be a living, breathing plan that you review and update every quarter. This keeps your entire organization focused, agile, and ready for whatever comes next.

Putting Your Growth Experiments into Action

A perfectly prioritized roadmap is a great start, but it's still just a document. The real magic in a framework for growth happens when you start running experiments, learning from what they tell you, and feeding those insights right back into the system. This is where your strategy hits the pavement, turning plans into tangible results.

This phase is all about speed. You have to ditch the long, drawn-out development cycles. The best growth teams I've seen operate in short, agile sprints—usually just one or two weeks long—to test a single, tightly defined hypothesis. This rapid pace lets you fail fast, learn even faster, and double down on what’s working without burning months on a bad idea.

To pull this off, your team structure is everything. Siloed departments are the enemy here. Instead, you need a cross-functional "growth squad" with folks from product, marketing, engineering, and data all at the same table. This small, dedicated team has every skill it needs to ideate, build, launch, and analyze experiments without getting bogged down in red tape.

Setting Up for Success

Before you even think about launching a test, every single initiative needs a crystal-clear Key Performance Indicator (KPI). If you can't define success with one measurable metric, the experiment simply isn't ready. This isn’t just about accountability; it’s about having absolute clarity.

Let's say your hypothesis is: "We believe that adding social proof testimonials to our checkout page will increase the conversion rate for first-time buyers."

Here’s how you’d break that down:

- Initiative: Add three customer testimonials to the checkout flow.

- Primary KPI: Conversion rate from "start checkout" to "purchase complete."

- Success Metric: A 5% lift in the primary KPI with statistical significance.

This kind of precision leaves no room for debate on whether an experiment "worked." The data gives you a clean yes or no. For anyone new to A/B testing, getting a handle on statistical power is non-negotiable if you want to avoid making decisions based on random noise. Our guide on what is statistical significance can help you make sure your results are trustworthy.

Building a Dashboard That Actually Matters

This is where a lot of growth efforts fall apart. It's incredibly easy to get lost in a sea of data or, worse, focus on "vanity metrics" that feel good but don't reflect the health of the business. Your growth dashboard should be a ruthless source of truth, focused only on insights you can act on.

The trick is to know the difference between leading and lagging indicators. Leading indicators are the metrics that predict future success and that you can actually influence right now. Lagging indicators, on the other hand, report on what already happened.

Growth Metric Examples: Leading vs. Lagging Indicators

This table breaks down the difference with a practical SaaS example.

| Metric Type | Definition | Business Example (SaaS) |

|---|---|---|

| Leading Indicator | A predictive metric that can forecast future outcomes and is directly influenceable. | Daily Active Users (DAU). An increase here often predicts future revenue growth. |

| Lagging Indicator | An output metric that measures past performance and is hard to influence directly. | Monthly Recurring Revenue (MRR). This tells you what happened, but it's a result of past actions. |

Your dashboard has to prioritize leading indicators because they give you a real-time pulse on your experiments. If you run a test to improve user activation, you should be watching the "weekly new user activation rate," not waiting a month to see if MRR budged. As you get into this rhythm, mastering Conversion Rate Optimization (CRO) becomes an essential skill for turning your efforts into real outcomes.

Establishing a Rhythm of Accountability

Finally, a solid execution process runs on a consistent rhythm. The most effective growth teams I've worked with have a weekly or bi-weekly meeting cadence. These meetings are always kept short, sharp, and strictly data-driven.

A typical growth meeting agenda looks something like this:

- Review Last Cycle's Results: What did we learn from the experiments that just wrapped up?

- Analyze Key Metrics: How are our leading indicators trending? See any surprises?

- Launch This Cycle's Experiments: What are we testing next, and what are the hypotheses?

This constant loop of executing, measuring, and learning is the engine that drives your framework forward. It builds momentum, keeps the team focused on high-impact work, and makes sure every action is a deliberate step toward sustainable growth.

Keeping Your Growth Framework Resilient

Your growth framework doesn't operate in a bubble. A perfectly crafted internal strategy can get completely sideswiped by things you can't control—a sudden economic dip, new government regulations, or a shift in global trade. Building a resilient framework means creating a system that doesn't just weather these storms but actually sees them coming and adjusts course ahead of time.

Too many companies treat market intelligence like reading the morning paper—it’s interesting, but it doesn't connect directly to their daily work. A truly resilient framework does the exact opposite. It creates a direct pipeline, feeding external market signals right back into your planning and prioritization process.

This way, you aren't just reacting when a crisis is already making headlines. You’re making small, smart adjustments based on the earliest warning signs.

Monitoring the Macro Environment

To stay ahead of the curve, you need to keep an eye on a few key macroeconomic indicators. You don't need an economics degree, just a practical sense of what moves the needle for your business.

- Regional GDP Forecasts: This is your 30,000-foot view of economic health in your most important markets. Are they growing or shrinking?

- Consumer Confidence Index (CCI): This is a fantastic leading indicator. When people get nervous about the economy, their spending on non-essentials is often the first thing to dry up.

- Trade Policy Changes: A surprise tariff or a new trade agreement can radically change your supply chain costs, your access to certain markets, and the entire competitive landscape overnight.

Think of these as your strategic radar. A sharp drop in consumer confidence in a key market might be the signal to shelve a planned premium product launch. Instead, you could pivot to prioritizing an initiative that focuses on cost savings and delivering more value to your existing customers.

A resilient growth framework treats external market data not as interesting trivia, but as a critical input for its prioritization models. It forces the question: "Given this new information, are our current priorities still the right ones?"

This proactive mindset is what turns market volatility from a scary threat into a real competitive advantage. While your competitors are scrambling to figure out what's happening, you're already executing a plan that's built for the new reality.

A Real-World Scenario: Interpreting EU Economic Signals

Let's make this concrete. Imagine your company has a significant customer base in Europe. You'd want to be watching the economic forecasts for the region like a hawk.

Looking ahead, the European Union's economic outlook for 2025 shows a pretty sluggish path forward, with real GDP growth projected at just 1.1 percent across the EU. This slowdown is getting a heavy push from external factors, like higher tariffs and abrupt shifts in US trade policy, which are expected to shave off nearly 0.5 percent from growth. But there's a bright spot: real wages are expected to climb, restoring some lost purchasing power. For a deeper dive, you can check out the full Spring 2025 Economic Forecast on the European Commission's website.

So, what does a growth team do with this information?

- Tap the Brakes on Aggressive Expansion: With a low GDP forecast, now probably isn't the best time for a high-cost, high-risk market entry into a new EU country. The RICE score for that kind of initiative would take a hit, with "Reach" and "Confidence" scores dropping.

- Lean into Value-Based Messaging: Customers will have a bit more money in their pockets, but in a slow-growth climate, they'll be spending it wisely. This is the perfect time to run experiments testing new marketing messages that hammer home the ROI and total cost of ownership of your product. That's a high-priority initiative.

- Double Down on Customer Retention: When new customer acquisition slows down, keeping the ones you have is everything. You’d likely bump up the priority of projects aimed at improving the customer onboarding experience or launching a new loyalty program—anything that directly fights churn.

This isn't about slamming the brakes on all growth. It's about being smart and redirecting your team's energy toward initiatives that make sense for the current economic climate. By weaving this external intelligence into your process, your framework for growth becomes a dynamic, living system that helps you navigate uncertainty with confidence.

Common Questions on Building a Growth Framework

Even with a solid plan, shifting how your company operates will inevitably bring up some tough questions. A real framework for growth is more than just a new process—it’s a fundamental change in mindset and culture. Let’s walk through some of the most common hurdles I’ve seen leaders face and how to get past them.

Getting this right means wrestling with team dynamics, tight budgets, and the ever-present demand for results. So, it's completely normal to have questions as you move from a nice-looking slide deck to actually getting things done.

How Do I Get My Team to Buy In?

This is the big one, isn't it? If you're not careful, a new growth framework can feel like another flavor-of-the-month corporate initiative. The secret is to build it with your team, not hand it down from on high.

Don't show up with a perfectly polished framework and expect applause. Instead, pull your team into the diagnostic phase right from the start. Run workshops where everyone gets to flag the biggest bottlenecks and brainstorm opportunities. When people feel like they co-authored the problem statement, they'll be deeply invested in finding the solution.

The best way to create true believers is to deliver a quick, visible win. Dig into your prioritization model, find a small project with high impact and low effort, and knock it out of the park. When the team sees a structured experiment deliver a real, measurable result in just two weeks, they’ll be sold.

Can This Framework Work for a Small Business?

Absolutely. You could argue it's even more essential for a small business or startup where every single dollar and hour counts. The core ideas—diagnose, prioritize, execute—are universal. You just scale the application to fit your reality.

A smaller team might adapt the framework like this:

- Simpler Prioritization: Forget a complex RICE score. A basic ICE model (Impact, Confidence, Ease) is usually all you need to spark the right debates and make smart choices.

- Faster Cadence: Why wait two weeks? A nimble startup can run growth experiments every single week, tightening that feedback loop dramatically.

- Broader Roles: You probably don't have dedicated "growth squads." Your growth team might just be your product manager, lead marketer, and a developer carving out a few hours together each week.

The goal is the same no matter your size: focus your scarce resources on the handful of things that will actually move the needle. A framework just gives you the discipline to make that happen.

What Is the Biggest Mistake Companies Make?

The most common failure I see is treating the framework like a static, one-and-done plan. I've watched so many teams do an amazing job on the initial diagnosis, build a beautiful roadmap... and then let it collect dust in a shared drive. That completely misses the point.

A growth framework is not a project; it's a living system. Its real power comes from the continuous cycle of doing, measuring, and learning. If what you learned from last month's experiments isn't directly shaping this month's priorities, your framework is broken.

The best way to avoid this trap is to bake the review process right into your company's weekly routine. That growth meeting—whether it's weekly or bi-weekly—has to be a sacred, non-negotiable event on everyone's calendar. This is where the framework stops being a document and becomes a dynamic engine for growth. Success hinges on creating tight feedback loops where execution constantly refines strategy, making sure you adapt as fast as the market around you.

Ready to turn customer feedback into your biggest growth lever? SigOS uses AI to analyze support tickets, sales calls, and usage data, pinpointing the exact issues costing you revenue and the feature requests that will drive expansion. Stop guessing and start building what matters.