Top 12 Customer Insights Platforms to Watch in 2026

Discover the 12 best customer insights platforms of 2026. Compare features, pricing, and use cases to find the right tool to reduce churn and drive growth.

In today's competitive market, understanding your customers is the core engine of growth. But with feedback scattered across support tickets, sales calls, usage data, and social media, how do you find the signal in the noise? Most teams are drowning in data but starving for wisdom. The real challenge isn't just collecting feedback; it's identifying which pieces of that feedback correlate directly with churn risk, expansion opportunities, and revenue.

This is where modern customer insights platforms come in. These tools go beyond simple surveys and analytics, using AI and behavioral analysis to connect customer actions and words to concrete business outcomes. Making the right choice directly impacts your ability to prioritize features that drive engagement and retention. A key outcome of leveraging these insights is the ability to accurately calculate Customer Lifetime Value (CLV), providing a clear measure of long-term customer worth.

This guide cuts through the marketing hype to provide a detailed, feature-by-feature comparison of the 12 best customer insights platforms available today. We dive deep into the specific tools that Product Managers, CX leaders, and growth teams need to make data-driven decisions.

For each platform, you'll find:

- A concise overview and ideal use case.

- In-depth analysis of standout features and potential limitations.

- Screenshots and direct links to see the tool in action.

- Practical notes on integrations and data flow.

We'll explore their specific strengths, and most importantly, how to choose the platform that will help you prioritize development, reduce churn, and build a product that customers not only love but are willing to pay more for.

1. SigOS

Best for: Revenue-driven prioritization and churn prediction.

SigOS distinguishes itself from other customer insights platforms by moving beyond sentiment analysis to focus directly on financial impact. It’s an AI-driven product intelligence engine designed for SaaS companies that need to connect customer feedback directly to revenue outcomes. The platform continuously ingests qualitative and quantitative data from sources like support tickets, chat transcripts, sales calls, and product usage metrics.

Its core function is using behavioral analysis to surface the specific issues, bugs, and feature requests that correlate with churn, expansion opportunities, and dollar impact. Instead of just showing what customers are complaining about most, SigOS quantifies the financial risk or opportunity associated with each insight, enabling product and growth teams to prioritize development with unprecedented clarity. For instance, it can surface a minor bug that is only mentioned a few times but is a consistent precursor to high-value customers churning.

Key Features & Use Cases

- Revenue-First Prioritization: The platform’s standout capability is its ability to attach a dollar value to customer feedback. It generates a daily dashboard highlighting problems costing real money (e.g., "47K/mo risk") and feature requests likely to unlock large deals (e.g., "2.3M opportunity"). This allows teams to justify engineering resources based on measurable business value, not just the volume of complaints.

- Automated Behavioral Analysis: SigOS offers rapid, continuous analysis. With industry-leading processing speeds (site examples show over 1,000 items processed in under a minute), it quickly identifies emerging patterns that predict churn risk or high-value sales opportunities.

- Turnkey Integrations and Actionability: It integrates directly into existing workflows with tools like Zendesk, Intercom, Linear, Jira, and GitHub. This allows for the automatic creation of engineering tickets that are pre-populated with revenue-impact scores and contextual data, streamlining the path from insight to action.

- High-Confidence Signals: SigOS reports a strong correlation (approximately 87%) between its identified signals and actual customer churn, backed by case studies showing significant reductions in churn and multi-million dollar expansion wins.

Pricing and Implementation

SigOS does not list public pricing, indicating a focus on mid-market and enterprise SaaS companies where the ROI can be more clearly demonstrated. Prospective users can request a free trial or a free analysis of their existing data to evaluate the platform's potential impact. Implementation involves connecting data sources via its API-first design, which may require some initial engineering effort to configure.

Website: https://sigos.io

2. Qualtrics

Qualtrics is an enterprise-grade experience management (XM) platform that goes far beyond simple surveys, positioning itself as a comprehensive solution for large-scale research and operational Voice of the Customer (VoC) programs. It excels in unifying customer, product, brand, and employee insights into a single system of record. The platform’s strength lies in its ability to capture omnichannel feedback from surveys, calls, chats, and public reviews, then apply AI to analyze unstructured text and identify key themes.

This makes it an ideal choice for organizations needing robust governance, security, and workflow automation to close feedback loops across departments. For teams focused on strategic research, Qualtrics offers a powerful, self-serve plan that provides access to its advanced survey design, distribution, and analytics capabilities without requiring a full enterprise commitment. The platform’s extensive integration marketplace and mature compliance features (like GDPR and HIPAA) also make it a reliable choice for regulated industries.

Key Details & Use Cases

| Feature | Description |

|---|---|

| Ideal Use Case | Enterprise-level VoC programs, complex market research studies, and linking operational CX data (e.g., support tickets) to survey feedback. |

| Primary Strength | Its sheer breadth, combining strategic research tools with operational customer experience management in a secure, compliant environment. |

| Implementation Note | The full XM suite has a notable learning curve; new users should plan for enablement sessions to leverage advanced features effectively. |

| Pricing | Offers a "Strategic Research" self-serve plan. Full XM suite pricing is interaction-based and requires sales engagement for a custom quote. |

Pros:

- Deep functionality for both strategic research and operational CX.

- Mature integrations and compliance features suitable for large enterprises.

- A clear self-serve option for smaller, focused research teams.

Cons:

- The platform can be complex, with advanced features requiring training.

- Pricing for the full XM suite is opaque and requires direct sales contact.

Qualtrics's powerful analytics make it one of the leading customer insights platforms for organizations wanting to perform sophisticated voice of customer analysis and drive action.

**Learn more at: **qualtrics.com

3. Medallia

Medallia is an enterprise-focused customer experience (CX) platform built to capture and operationalize feedback in real-time across a wide array of channels. Its core strength lies in its ability to ingest signals from digital properties, contact centers, and physical locations, unifying them into a single view of the customer journey. The platform uses AI-powered text and speech analytics to automatically detect sentiment, effort, and emerging themes, turning unstructured feedback into actionable intelligence.

This makes Medallia particularly powerful for large organizations that need to drive immediate action based on customer sentiment. The platform excels at closed-loop feedback, with built-in case management and alerting workflows that route insights directly to frontline teams and managers. Its role-based dashboards ensure that from the C-suite to local branch managers, everyone has access to relevant data to improve their part of the customer experience. The unique Experience Data Record (EDR) pricing model also encourages businesses to capture a high volume of signals without being penalized per survey complete.

Key Details & Use Cases

| Feature | Description |

|---|---|

| Ideal Use Case | Large-scale, operational CX programs for retail, hospitality, finance, and B2B companies needing to manage multi-touchpoint customer journeys. |

| Primary Strength | Real-time feedback processing and robust, role-based workflows for closing the loop with customers at every level of the organization. |

| Implementation Note | Requires a dedicated implementation project; best suited for mature CX teams with executive sponsorship and clear operational goals. |

| Pricing | Enterprise-level pricing is based on Experience Data Records (EDRs) and requires direct engagement with the Medallia sales team for a quote. |

Pros:

- Excellent at capturing and acting on omnichannel feedback in real-time.

- Strong AI and analytics for processing unstructured voice and text data.

- EDR pricing model encourages collecting a broad set of customer signals.

Cons:

- Primarily designed for large enterprises, which may make it complex and costly for smaller businesses.

- Pricing is not publicly available and requires a sales consultation.

Medallia's operational focus makes it one of the top customer insights platforms for organizations committed to embedding customer feedback directly into their daily workflows.

**Learn more at: **medallia.com

4. Amplitude

Amplitude is a digital analytics platform designed for product and growth teams who need deep, quantitative insights into customer behavior. It moves beyond traditional web analytics to focus on event-based tracking, enabling teams to build detailed user journeys, funnels, and cohorts. The platform excels at answering complex questions about feature adoption, user retention, and conversion drivers, making it a cornerstone for product-led growth (PLG) strategies. Its integrated suite combines analytics with experimentation, feature flagging, and session replay, providing a unified toolkit for understanding and influencing user actions.

This makes Amplitude a powerful choice for organizations that want to tie specific user actions directly to growth metrics like activation, engagement, and monetization. With a generous free tier and transparent, event-based pricing for its paid plans, it offers a scalable entry point for startups and large enterprises alike. Its data-native options also allow it to run directly on top of a company’s existing data warehouse, enhancing security and data governance.

Key Details & Use Cases

| Feature | Description |

|---|---|

| Ideal Use Case | Product-led growth teams needing to analyze feature adoption, optimize user onboarding funnels, and measure the impact of A/B tests. |

| Primary Strength | A unified platform that combines deep event-based analytics with experimentation and session replay to connect insight to action. |

| Implementation Note | Success hinges on a well-planned event tracking schema; invest time upfront defining user actions and properties to ensure data quality. |

| Pricing | Offers a generous free plan for up to 10 million events/month. Paid plans (Plus, Growth) are based on Monthly Tracked Users or event volume. |

Pros:

- Transparent, low-entry pricing with a powerful free tier.

- Broad toolset combining analytics, experimentation, and feature flags.

- Good scaling options for event and user volumes.

Cons:

- Advanced governance and data modeling require careful setup.

- The feature boundaries between the Plus and Growth plans can be nuanced.

Amplitude is one of the top customer insights platforms for teams looking to understand user actions through what is behavioral analytics and connect those behaviors to business outcomes.

**Learn more at: **amplitude.com

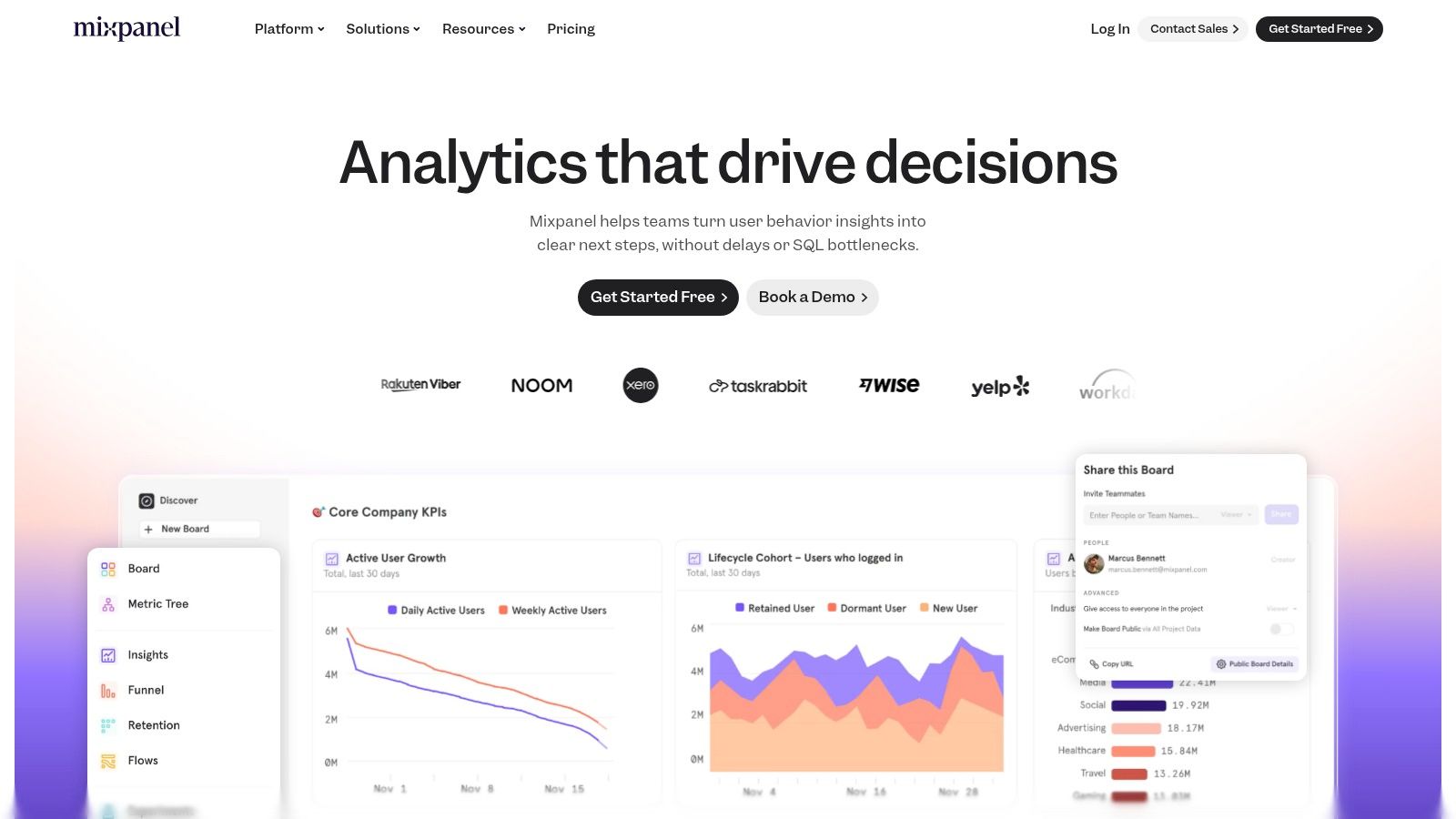

5. Mixpanel

Mixpanel is a self-serve product analytics platform designed to help teams understand user behavior and make data-driven decisions. It specializes in tracking how users interact with websites and applications, focusing on event-based data rather than page views. This approach allows product managers and growth teams to build powerful reports like conversion funnels, user flows, and retention analyses to pinpoint exactly where users engage or drop off.

The platform’s strength lies in its accessibility and speed to value. With transparent, usage-based pricing and a generous free tier, teams can get started quickly without significant upfront investment. Features like an AI-powered query builder (Spark) and session replay provide both quantitative and qualitative insights, making it a comprehensive tool for understanding the user journey. Its focus on behavioral cohorts and funnels makes it an excellent choice for optimizing product features and improving user retention.

Key Details & Use Cases

| Feature | Description |

|---|---|

| Ideal Use Case | Product teams in SaaS and mobile apps needing to analyze user funnels, track feature adoption, and measure the impact of product changes on retention. |

| Primary Strength | Its powerful and intuitive self-serve reports for funnels, flows, and retention, combined with a fast time to value and transparent pricing. |

| Implementation Note | Requires developer involvement to implement event tracking. A well-planned tracking schema is crucial for long-term data quality and usability. |

| Pricing | Offers a generous free plan for up to 20M events/month. Paid plans are usage-based and priced transparently online, with enterprise options available. |

Pros:

- Generous free quota and transparent usage-based pricing.

- Fast time to value for product managers and growth teams.

- Powerful core reports for behavioral analysis.

Cons:

- Very high event volumes can become costly on paid plans.

- Complex data models may require discipline to manage and maintain.

Mixpanel is one of the leading customer insights platforms for teams that need to perform detailed cohort retention analysis and understand user engagement at a granular level.

**Learn more at: **mixpanel.com

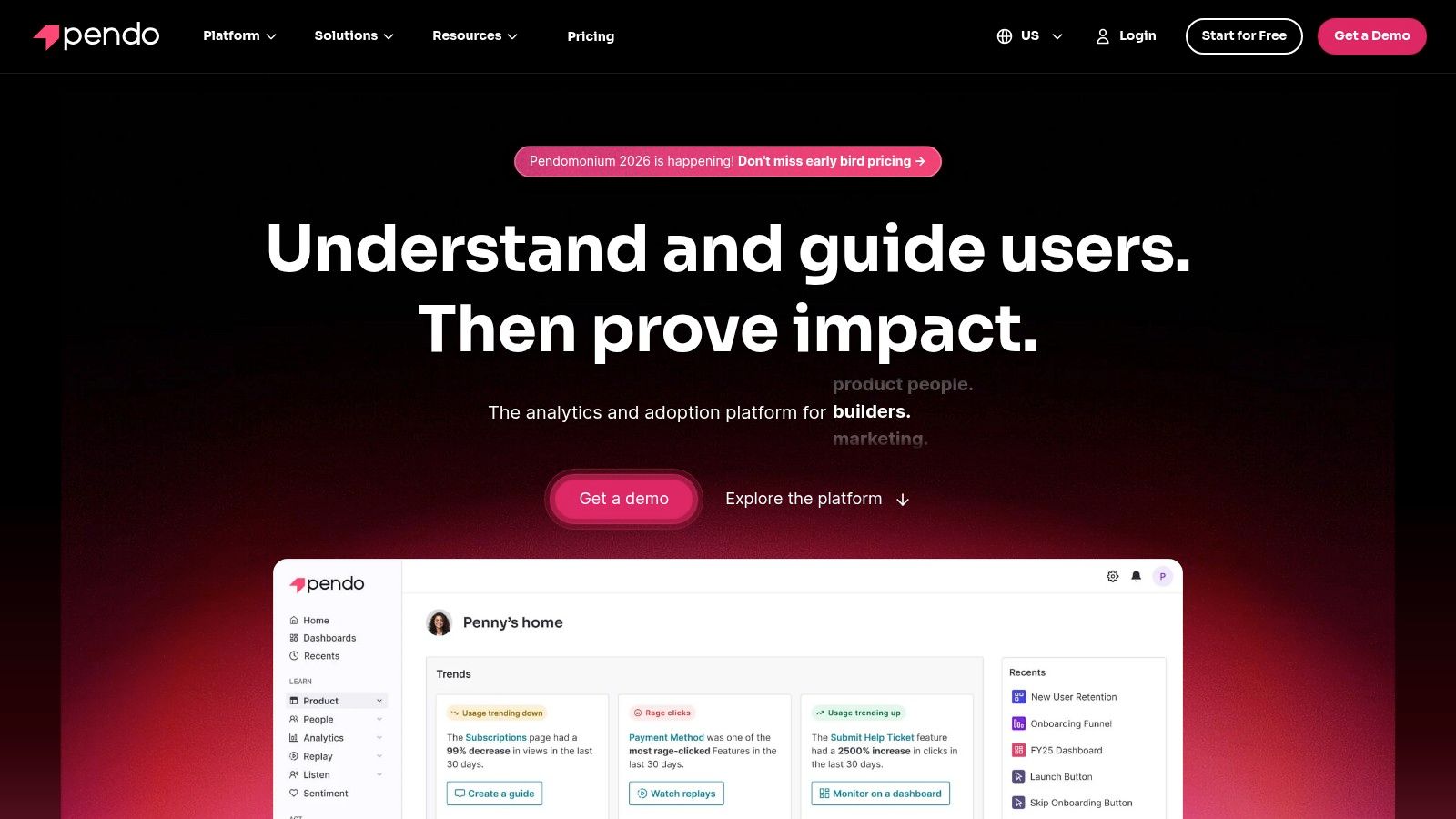

6. Pendo

Pendo is a product experience platform that focuses squarely on capturing user behavior and feedback inside your application. It combines quantitative usage analytics with qualitative in-app feedback tools, giving product teams a direct line of sight into how customers engage with their software. The platform excels at tracking feature adoption, analyzing user paths, and segmenting users based on their in-app actions. This allows teams to understand not just what users are doing, but also to ask "why" at the most relevant moment.

This dual-capability makes Pendo a powerful tool for driving product adoption, user onboarding, and feature announcements directly within the user experience. By deploying in-app guides, polls, and NPS surveys, product managers can nudge users toward key features and gather contextual insights without forcing them to leave the platform. Its free plan provides a great entry point for smaller teams to validate its core functionality before committing to a larger investment.

Key Details & Use Cases

| Feature | Description |

|---|---|

| Ideal Use Case | Understanding feature adoption, improving user onboarding flows, and collecting contextual in-app feedback from specific user segments. |

| Primary Strength | The tight integration of product usage analytics with in-app engagement tools (guides, polls, NPS) for a holistic view of the product experience. |

| Implementation Note | Proper implementation requires a developer to install the Pendo snippet; codeless feature tagging is powerful but benefits from a clear plan. |

| Pricing | Offers a free plan for up to 500 Monthly Active Users (MAU). Paid plans are custom-quoted based on MAU and feature tiers. |

Pros:

- Excellent combination of quantitative analytics and qualitative in-app feedback.

- Enables targeted user engagement to drive feature adoption and onboarding.

- Generous free plan allows teams to trial core features effectively.

Cons:

- The free plan is limited to 500 MAU and includes Pendo branding.

- Full pricing is not public and requires sales engagement for a quote.

Pendo is one of the essential customer insights platforms for product-led companies aiming to build better digital experiences based on direct user behavior.

**Learn more at: **pendo.io

7. Gainsight PX

Gainsight PX is a specialized product experience platform designed to connect product usage insights directly with customer success outcomes. It moves beyond generic analytics by focusing on how product adoption impacts customer health, retention, and expansion. The platform’s core strength is its ability to track detailed in-product user behavior and then empower teams to act on those insights with targeted in-app engagements, guides, and surveys.

This makes it an excellent choice for B2B SaaS companies where product adoption is a leading indicator of account health and renewal likelihood. By integrating natively with its parent Gainsight Customer Success platform, it creates a unified view that allows CS, product, and revenue teams to collaborate effectively. Teams can identify at-risk users struggling with features and proactively guide them, or spot power users who are prime candidates for upsells, all within a single ecosystem.

Key Details & Use Cases

| Feature | Description |

|---|---|

| Ideal Use Case | B2B SaaS companies aiming to align product analytics with customer success motions, improve user onboarding, and drive feature adoption. |

| Primary Strength | The tight, native integration between product analytics and a comprehensive customer success platform, enabling a holistic view of customer health. |

| Implementation Note | While powerful standalone, its maximum value is realized when paired with the broader Gainsight stack, which may require significant implementation. |

| Pricing | Pricing is available by request and tailored to company size and usage; no public pricing list is available. |

Pros:

- Tight alignment with and deep integration into customer success workflows.

- Combines quantitative analytics with qualitative in-app feedback and guidance tools.

- Enterprise-grade security, support, and integrations suitable for scaling companies.

Cons:

- Pricing is not transparent and requires direct sales engagement.

- The greatest value is often unlocked when used with the full Gainsight ecosystem.

Gainsight PX is one of the most effective customer insights platforms for organizations focused on operationalizing product data to drive retention and growth.

**Learn more at: **gainsight.com

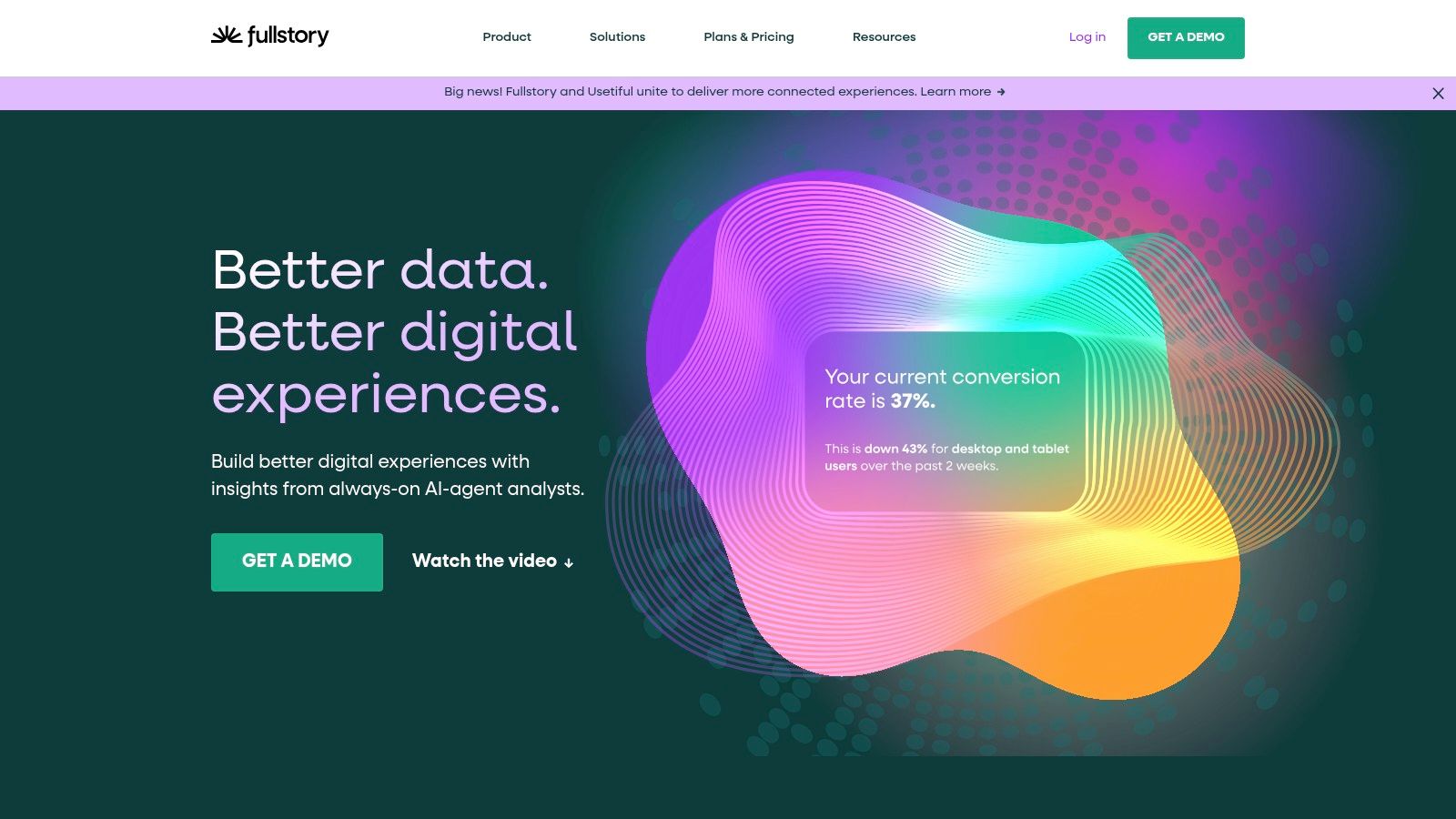

8. FullStory

FullStory is a digital experience intelligence (DXI) platform that bridges the gap between quantitative analytics and qualitative user understanding. It captures high-fidelity user sessions, allowing teams to replay exactly what users see and do on a website or mobile app. This pixel-perfect playback is combined with robust analytics tools to identify, quantify, and prioritize user friction points, from rage clicks to dead ends. The platform automatically indexes every user interaction, making it searchable without predefined event tracking.

This makes FullStory exceptionally powerful for product, engineering, and support teams that need to diagnose specific bugs, validate product hypotheses, or understand the "why" behind conversion drop-offs. Its AI-powered features and data warehouse sync capabilities allow for scalable analysis, moving beyond individual session reviews to uncover broader trends. For organizations focused on optimizing their digital product experience, FullStory provides the critical context that traditional analytics often miss, making it a key player among customer insights platforms.

Key Details & Use Cases

| Feature | Description |

|---|---|

| Ideal Use Case | Diagnosing user-reported bugs, optimizing conversion funnels, understanding user frustration, and validating new product feature adoption. |

| Primary Strength | The seamless combination of high-fidelity session replay (qualitative) with powerful behavioral analytics and search (quantitative). |

| Implementation Note | Ensure privacy controls are configured correctly from the start to exclude sensitive user data and maintain compliance. |

| Pricing | Offers a free plan with a generous session quota for evaluation. Advanced modules and enterprise plans require a custom quote from sales. |

Pros:

- Powerful blend of qualitative and quantitative insights in one platform.

- Excellent free plan allows for thorough evaluation before commitment.

- Auto-capture of all user events simplifies implementation and data exploration.

Cons:

- Advanced modules and enterprise features are gated behind sales-led pricing.

- Requires thoughtful governance and role-based access to manage data effectively at scale.

**Learn more at: **fullstory.com

9. Hotjar

Hotjar is a specialized experience analytics platform focused on revealing the "why" behind user behavior on a website. It uniquely combines quantitative and qualitative tools, giving product managers, UX designers, and marketers a direct line of sight into how users interact with their digital properties. The platform's core strength is its ability to visualize user journeys through heatmaps and session recordings, then complement that data with direct feedback from on-site surveys and feedback widgets.

This makes it an excellent choice for teams focused on website optimization, conversion rate improvement, and product discovery. Unlike enterprise-grade systems, Hotjar is designed for quick implementation and immediate value, with clear, public pricing that scales with traffic. New features like AI-powered summaries for session recordings and user interview scheduling tools further bridge the gap between behavioral data and direct customer voice, making it one of the most practical customer insights platforms for digital-first teams.

Key Details & Use Cases

| Feature | Description |

|---|---|

| Ideal Use Case | Optimizing website conversion funnels, identifying UX friction points on specific pages, and collecting in-context user feedback. |

| Primary Strength | Its all-in-one toolkit combining user behavior visualization (heatmaps, recordings) with direct feedback (surveys, widgets) in a single platform. |

| Implementation Note | Setup is straightforward via a small JavaScript snippet. Ensure user privacy settings are configured to mask sensitive data during recordings. |

| Pricing | Offers a free-forever basic plan. Paid plans are tiered based on session volume, with transparent pricing available on its website. |

Pros:

- Clear public pricing and extremely fast setup.

- A balanced, integrated toolkit ideal for UX and conversion-rate-optimization teams.

- AI-powered summaries help teams quickly digest session replay insights.

Cons:

- Its focus is web-centric, making it less suitable for broader multi-channel CX analysis.

- Advanced governance and enterprise security features are more limited than competitors.

- Higher traffic volumes can push customers into pricier tiers quickly.

Hotjar offers an accessible entry point into understanding user behavior and gathering qualitative insights directly from your website or app.

**Learn more at: **hotjar.com

10. Sprig

Sprig is a product experience insights platform designed to capture real-time, in-context feedback directly from users as they interact with a website or app. It specializes in delivering rapid insights through targeted micro-surveys, concept testing, and user interviews, allowing product teams to validate ideas and identify friction points without disrupting the user journey. The platform’s key differentiator is its ability to trigger research based on specific user actions, ensuring feedback is gathered at the most relevant moment.

This focus on in-product research makes it invaluable for teams needing to quickly understand user sentiment, test new features, and connect qualitative feedback to user behavior. Sprig uses AI to analyze open-text responses, automatically identifying themes and saving researchers significant time. By integrating with analytics platforms, it helps teams correlate what users say with what they do, providing a more complete picture to inform product decisions.

Key Details & Use Cases

| Feature | Description |

|---|---|

| Ideal Use Case | Product teams needing rapid, in-context feedback on feature adoption, user onboarding, or concept validation directly within the product flow. |

| Primary Strength | Its speed-to-insight, allowing teams to launch targeted in-product surveys and get analyzed results back in hours instead of weeks. |

| Implementation Note | Setup involves a lightweight SDK installation; effective use requires close collaboration between product, engineering, and research teams. |

| Pricing | A free plan is available for core features. Paid plans are based on feature sets and monthly tracked users, requiring a demo for full pricing. |

Pros:

- Designed for speed-to-insight within product flows.

- Excellent for gathering contextual feedback at the point of experience.

- Free plan available to explore core functionality.

Cons:

- Pricing for advanced features and higher user tiers is not public.

- Often used alongside broader analytics tools for deeper quantitative analysis.

Sprig’s focus on agile, in-context research makes it one of the most effective customer insights platforms for product managers aiming to build user-centric products.

**Learn more at: **sprig.com

11. UserTesting

UserTesting is a human-insights platform that enables organizations to get fast, video-based feedback from real people. It specializes in qualitative customer understanding, allowing teams to watch and listen as users interact with websites, apps, and prototypes. The platform's core strength is its ability to provide on-demand access to a global participant panel, facilitating both moderated and unmoderated usability tests and task-based studies.

This makes UserTesting an invaluable tool for product managers, UX designers, and marketers who need to validate ideas, identify friction points, and understand the "why" behind user behavior quickly. The platform provides study templates to accelerate research, while its AI-assisted insight tools and collaboration features help teams analyze video clips, create highlight reels, and share findings across the organization. For teams needing a direct line to qualitative user sentiment, it is one of the most effective customer insights platforms available.

Key Details & Use Cases

| Feature | Description |

|---|---|

| Ideal Use Case | Rapid usability testing, prototype validation, competitor analysis, and gaining deep qualitative understanding of user journeys and pain points. |

| Primary Strength | The speed of collecting rich, video-based qualitative feedback from a diverse, on-demand global panel. |

| Implementation Note | To get the most value, teams should create clear test plans and screener questions to ensure feedback comes from the target audience. |

| Pricing | Pricing is customized based on usage and features; requires direct engagement with the sales team for a quote. |

Pros:

- Extremely fast turnaround time for qualitative video feedback.

- Scales across organizations with seatless and unlimited plan options.

- Access to a large, diverse panel reduces recruitment time.

Cons:

- Pricing can be a significant investment, especially for high-volume testing.

- Careful planning is needed to mitigate potential biases from a professional tester panel.

**Learn more at: **usertesting.com

12. G2 (Consumer/Customer Insights Platforms category)

G2 is not a customer insights platform itself, but rather a comprehensive software marketplace and review site that serves as an essential research hub. Its dedicated category for consumer and customer insights platforms provides a meta-level view of the landscape, aggregating verified user reviews, feature comparisons, and market presence data. This makes it an invaluable first stop for teams building a shortlist of potential vendors. The platform’s strength is its structured, data-driven approach to software comparison, allowing users to filter solutions by company size, user satisfaction ratings, and specific functionalities.

Instead of providing direct insights, G2 provides insights into the tools themselves. It allows buyers to see how real users rate different platforms on ease of use, quality of support, and feature sets. This peer-driven validation is crucial for navigating a crowded market and identifying vendors that genuinely meet the needs of specific business segments, from agile startups to large enterprises.

Key Details & Use Cases

| Feature | Description |

|---|---|

| Ideal Use Case | Initial research and discovery phase, creating a vendor shortlist, and conducting side-by-side comparisons of leading customer insights platforms based on user reviews. |

| Primary Strength | The massive volume of recent, verified peer reviews and robust filtering capabilities that allow for efficient market evaluation and vendor comparison. |

| Implementation Note | G2 is a research tool, not a platform to implement. Use it to compare, but always follow up with direct vendor demos to validate features and fit for your specific needs. |

| Pricing | Free to use for research and comparison. Pricing information for listed platforms is often high-level and typically requires a direct quote from the vendor. |

Pros:

- Large volume of recent and vetted user reviews provides authentic feedback.

- Excellent for building a shortlist and making efficient side-by-side comparisons.

- Detailed filtering helps narrow down options for specific business sizes and needs.

Cons:

- Pricing information is often indirect, requiring users to request quotes from vendors.

- The depth and quality of individual reviews can vary significantly.

Learn more at: g2.com/categories/consumer-insights-platforms

Top 12 Customer Insights Platforms Comparison

| Product | ✨ Core / Unique | 💰 Value / Pricing | ★ Quality / Outcomes | 👥 Target Audience |

|---|---|---|---|---|

| SigOS 🏆 | ✨ Behavioral AI across support/sales/usage; revenue-impact scores; sub‑minute analysis; auto-issue creation | 💰 Quantifies $ impact (examples shown); free analysis trial; enterprise pricing | ★ ~87% churn-correlation; proven ARR recovery & expansion case studies | 👥 Product, growth & revenue teams (scaling SaaS, mid→enterprise) |

| Qualtrics | ✨ End‑to‑end VoC & research: surveys, omnichannel capture, text analytics, governance | 💰 Strategic & scale-focused; interaction-based/enterprise pricing; self-serve plan available | ★ Mature enterprise platform; strong compliance & governance | 👥 Enterprise CX, research, product teams |

| Medallia | ✨ Real-time multi‑touch feedback ingestion, speech/text analytics, case management | 💰 Operational CX value; EDR pricing (contact sales) | ★ Robust for large, multi‑touchpoint CX programs | 👥 Large enterprises, contact centers, ops teams |

| Amplitude | ✨ Event & user analytics + experimentation, feature flags, session replay | 💰 Free tier/low entry; MTU/event pricing scales with volume | ★ Quantitative PLG focus; transparent pricing & strong analytics | 👥 PLG product & growth teams |

| Mixpanel | ✨ Funnels, retention, cohorts, AI query builder (Spark), session replay | 💰 Transparent usage pricing; generous free quota; can be costly at very high volumes | ★ Fast time‑to‑value for PMs & growth teams | 👥 Product & growth teams, startups→scale |

| Pendo | ✨ In‑app guides, usage analytics, NPS, roadmapping & feedback modules | 💰 Free plan (limited 500 MAU); upgrades via sales | ★ Strong in-app adoption tooling; good for onboarding flows | 👥 Product teams focused on adoption/onboarding |

| Gainsight PX | ✨ Product analytics, in‑app guides, knowledge bot; integrated with Gainsight CS | 💰 Enterprise pricing by request; best value with Gainsight stack | ★ Enterprise-grade, CS-aligned adoption insights | 👥 Product + Customer Success teams (mid→enterprise) |

| FullStory | ✨ High-fidelity session replay, journey diagnostics, StoryAI insights | 💰 Free eval plan; advanced modules via sales | ★ Excellent qual+quant pairing; requires governance at scale | 👥 UX/product teams diagnosing digital friction |

| Hotjar | ✨ Heatmaps, session recordings, funnels, surveys, feedback widgets | 💰 Clear public pricing; quick setup; web-centric tiers | ★ Practical for UX & CRO; limited multi-channel depth | 👥 UX/CRO teams, website owners, SMBs |

| Sprig | ✨ In-product surveys, research automation, replays & targeting | 💰 Free plan to explore; full bundles via sales | ★ Fast speed‑to‑insight for product research | 👥 Product researchers and PMs |

| UserTesting | ✨ Moderated/unmoderated tests, video feedback, global panels & templates | 💰 Premium pricing via sales; on-demand panel costs | ★ Rapid qualitative insights; scalable testing offerings | 👥 UX researchers, designers, product & marketing teams |

| G2 (category) | ✨ Marketplace of vendor reviews, rankings, buyer guides, filters | 💰 Free to browse; vendors provide quotes / demos | ★ Large volume of vetted user reviews; variable depth | 👥 Buyers shortlisting vendors, procurement teams |

How to Choose the Right Platform and Start Driving Revenue

Navigating the crowded market of customer insights platforms can feel overwhelming, but making the right choice boils down to a single, critical question: What is the most urgent business problem you need to solve? We've explored a wide spectrum of tools, from comprehensive VoC giants like Qualtrics and Medallia to granular product analytics powerhouses like Amplitude and Mixpanel. Each serves a distinct purpose, and the best platform for your organization is the one that directly addresses your primary knowledge gap.

Your decision-making process should be a strategic exercise, not just a feature comparison. Start by diagnosing your biggest pain point. Are you struggling to understand why users drop off at a specific point in your funnel? A tool with session replay and heatmaps like FullStory or Hotjar might be your best starting point. Do you need to validate a new feature concept with your target audience before committing development resources? A qualitative insights platform like UserTesting or a micro-survey tool like Sprig will deliver the direct user feedback you need.

A Framework for Your Decision

To move from analysis to action, consider a three-step framework for selecting and implementing one of these powerful customer insights platforms:

- Identify Your Core Insight Category: First, pinpoint the type of data that will have the biggest immediate impact. Are you data-rich but insight-poor, drowning in support tickets and survey responses? Or are you flying blind, lacking the fundamental quantitative data on user behavior? Your answer will guide you toward a specific category:

- Quantitative Product Analytics (Amplitude, Mixpanel, Pendo): Choose these if your primary goal is to understand what users are doing inside your product, measure feature adoption, and optimize conversion funnels.

- Qualitative & User Research (UserTesting, Sprig): Opt for these when you need to understand the why behind user behavior, gather contextual feedback, and validate ideas directly with users.

- Behavioral & Session Replay (FullStory, Hotjar): These are ideal for identifying friction points, debugging issues, and seeing your product through your customers' eyes.

- Enterprise VoC & Experience Management (Qualtrics, Medallia): Select these for large-scale, multi-channel feedback collection and brand-level experience tracking, often involving surveys like NPS and CSAT.

- Align with Your Data Ecosystem: A tool is only as good as the data it can access and the workflows it can influence. Before committing, map out how a new platform will integrate with your existing stack (CRM, data warehouse, project management tools). How will insights flow from the platform to the product and engineering teams? A seamless integration is non-negotiable for turning insights into action. To get a clearer picture of this entire process, you might want to explore the best customer journey mapping tools available to visualize each touchpoint.

- Prioritize Revenue Impact: This is where a new generation of platforms like SigOS truly differentiates itself. While traditional tools provide dashboards and data points, SigOS connects those insights directly to financial outcomes. It answers the ultimate question for any product, growth, or success leader: “Of all the things we could build or fix, which one will most effectively reduce churn and drive expansion revenue?” By quantifying the financial impact of customer feedback, it transforms the product roadmap from a list of feature requests into a strategic, revenue-driven plan.

From Data Overload to Decisive Action

Ultimately, the goal of any customer insights platform is to close the loop between feedback and action. The most successful implementations are those that create a culture of customer-centricity, where data doesn't just live in a dashboard but actively informs daily decisions. Start small. Pick one key metric you want to improve, whether it's trial-to-paid conversion, a specific feature's adoption rate, or a segment's churn rate. Run a pilot with the platform best suited to influence that metric.

By moving beyond generic feedback collection and focusing on strategic, quantifiable insights, you can transform your customer voice from a reactive cost center into your most powerful engine for sustainable growth.

Ready to stop guessing and start prioritizing your roadmap based on revenue? SigOS ingests all your customer feedback and uses AI to tell you exactly what to build next to reduce churn and increase expansion. See how much revenue is tied to every feature request and bug report by scheduling a demo of SigOS today.

Ready to find your hidden revenue leaks?

Start analyzing your customer feedback and discover insights that drive revenue.

Start Free Trial →