A Guide to Annual Recurring Revenue SaaS Growth

Unlock predictable growth for your business. This guide to annual recurring revenue SaaS covers calculation, key drivers, and actionable strategies.

If you're in the SaaS world, think of Annual Recurring Revenue (ARR) as your company's yearly salary. It’s the predictable, stable income that allows you to plan, hire, and build for the future. Unlike one-off sales, ARR is all about the consistent revenue you can expect from your active subscriptions over the next twelve months. It's the ultimate report card for a healthy subscription business.

What Is Annual Recurring Revenue And Why It Matters

Stripped down to its essence, annual recurring revenue in a SaaS business is the total value of your subscription revenue, normalized to a one-year period. It irons out the monthly bumps from new deals, renewals, and churn, giving you a clean, high-level view of where your business is heading. This isn't just another metric to track; it's the language of SaaS growth.

Imagine trying to build a house without a clear idea of your annual income. How could you possibly budget for the mortgage, materials, or contractors? ARR gives you that financial foundation, empowering leadership to make smart, confident bets on hiring, product development, and marketing.

The North Star Metric for SaaS Success

For investors, ARR is the number one indicator of a SaaS company’s health and potential to scale. A steadily growing ARR tells them you have a sticky product and a loyal customer base, which makes your business an attractive place to put their money. It's why SaaS valuations are so often tied to an ARR multiple—a company with 10 million in ARR might get valued at 7x, or 70 million.

But ARR does a lot more than just impress investors. It’s a workhorse metric.

- Financial Forecasting: It gives you a reliable baseline to project future revenue, which makes budgeting and resource planning far more accurate.

- Growth Measurement: When you track ARR growth quarter over quarter, you get a crystal-clear picture of your company's momentum.

- Strategic Planning: It helps everyone from the C-suite down to set realistic goals and align their efforts toward a single, shared target.

- Operational Health: If your ARR growth suddenly stalls or dips, it’s an early warning sign that something is wrong—maybe churn is too high, or you’re losing product-market fit.

When you truly understand ARR, you're doing more than just counting cash. You're measuring the vital signs of your entire business: its health, its momentum, and its future potential. It turns an abstract idea like "growth" into a concrete number that the whole company can rally behind, making it the one true North Star for any SaaS business serious about success.

How To Calculate Annual Recurring Revenue Accurately

Alright, let's move past the theory and get our hands dirty. Calculating your ARR can seem complicated, but it breaks down into two key approaches. One gives you a quick snapshot, and the other tells you the real story of your business's momentum.

To get a fast, back-of-the-napkin estimate of your ARR, you can simply annualize your Monthly Recurring Revenue (MRR). Think of it as taking your current month's pulse and projecting it out for the year.

The Basic ARR Formula:

Let's imagine a SaaS company we'll call "ConnectSphere." They have two plans: a Pro plan at 50/month and a Business plan at ****200/month. If they currently have 100 Pro customers and 25 Business customers, we can find their MRR pretty easily.

- Pro Plan: 100 customers x 50 = 5,000 MRR

- Business Plan: 25 customers x 200 = 5,000 MRR

- Total MRR = 5,000 + 5,000 = $10,000

With that, ConnectSphere’s basic ARR is **10,000 x 12 = **120,000. This is a handy number to have, but it's static. It doesn't capture the constant motion of a real SaaS business—the wins, the losses, and everything in between.

The Dynamic Formula For True Insight

To get a genuinely useful picture of your business's health, you need a formula that breathes. A dynamic calculation accounts for all the changes happening within your customer base, showing you how your revenue is shifting over time. It separates the forces of growth from the forces of decay.

The comprehensive ARR formula looks like this:

This formula breaks your revenue down into its core components, giving you a much clearer view of what’s really going on. Let's stick with our ConnectSphere example and assume they started the year with $120,000 ARR.

The Four Components of Annual Recurring Revenue

Your total ARR is constantly in flux, pushed and pulled by four key drivers. Understanding each one is like knowing which levers to pull to grow your company. Each piece of the puzzle tells a different story about your relationship with your customers and the market.

| ARR Component | Definition | Example |

|---|---|---|

| New ARR | The annualized revenue generated from brand-new customers joining within a specific period. This is your primary growth engine. | 10 new Pro customers (50/mo) and 5 new Business customers (200/mo) sign up, adding $18,000 in New ARR. |

| Expansion ARR | Revenue growth from your existing customer base. This includes upgrades, cross-sells, and add-ons. It's often the most efficient growth. | 20 existing Pro customers upgrade to the Business plan, adding $36,000 in Expansion ARR. |

| Churned ARR | The total annualized revenue you lose when existing customers cancel their subscriptions entirely. This is a direct hit to your bottom line. | 5 Pro customers and 2 Business customers cancel, resulting in a $7,800 loss from Churned ARR. |

| Contraction ARR | The revenue you lose when existing customers downgrade to a cheaper plan or remove seats/add-ons. It’s a subtle but important revenue leak. | 10 Business customers downgrade to the Pro plan, causing a $18,000 loss from Contraction ARR. |

Getting a handle on these moving parts is non-negotiable, especially churn. The SaaS market is on track to hit $300 billion in 2025, but with the average company losing 3.5% of its revenue to churn each month, small leaks can quickly become big problems. If you want to dig into the numbers, these SaaS statistics paint a clear picture of the market today.

So, let's plug all those numbers back into our dynamic formula to see where ConnectSphere landed at the end of the year:

120,000 (Starting) + 18,000 (New) + 36,000 (Expansion) - 7,800 (Churn) - 18,000 (Contraction) = 148,200 Ending ARR.

This final number, $148,200, isn't just a metric. It’s a story. It tells you exactly how much your sales team brought in, how much your product convinced existing customers to spend more, and precisely where you’re losing ground. It’s the kind of insight you can actually act on.

Understanding The Four Core Drivers Of ARR Growth

Your Annual Recurring Revenue is never a static number. It’s a living metric, constantly pushed and pulled by four critical forces.

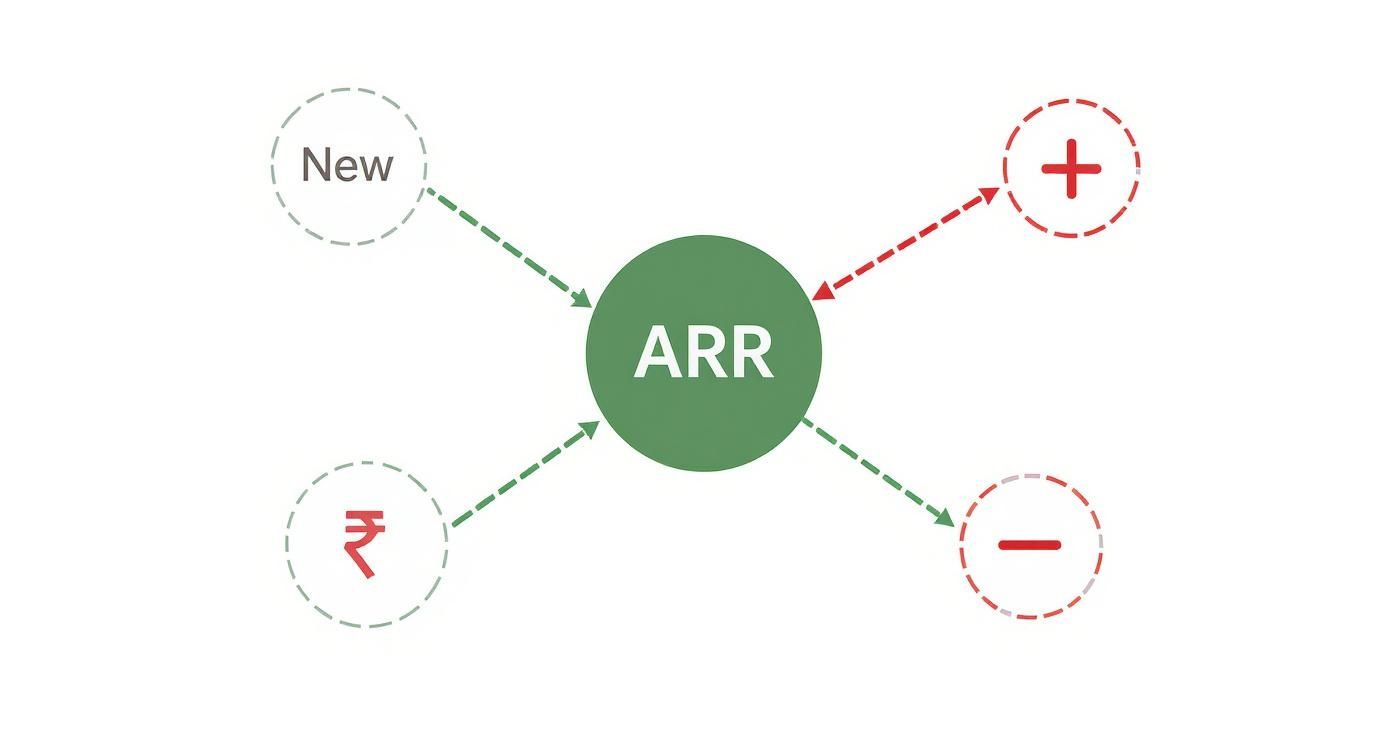

A great way to think about your ARR is like a big bucket of water. You have two faucets constantly filling it up, but you've also got two leaks trying to drain it. Mastering your annual recurring revenue for your SaaS means getting a handle on these flows—turning up the faucets and patching the leaks.

When you break down ARR into these four parts, you stop just watching your revenue and start actively managing the levers that control it. This is how you build a predictable, sustainable growth engine.

This infographic breaks down that constant push-and-pull on your total ARR.

As you can see, New Business and Expansion are your growth engines, adding to the top line. Churn and Contraction are the forces working against you. The combination of all four determines your net ARR growth.

New Business ARR: The Engine of Acquisition

New Business ARR is the most straightforward of the four. It’s the total annualized revenue you bring in from brand-new customers. For any early-stage SaaS, this is your lifeblood—it's pure, unfiltered growth. Every time a sales rep closes a deal or a new user subscribes to a paid plan, that’s New Business ARR.

It's simple math. If you sign ten new customers this month to an annual plan worth 5,000 each, you've just added ****50,000 to your New Business ARR. This metric is a direct report card on your sales and marketing efforts. It answers the question: are we good at getting new people in the door?

While crucial, relying only on new business gets expensive fast. The cost to acquire a customer (CAC) can be punishing, which is why the other growth drivers become so important as you scale.

Expansion ARR: The Secret to Profitable Scaling

This is where the real magic happens, especially for more mature SaaS companies. Expansion ARR (sometimes called "negative churn" when it outpaces churn) is the new recurring revenue you generate from your existing customers.

This growth comes from a few key places:

- Upsells: A customer moves from your "Pro" plan to your "Enterprise" plan.

- Cross-sells: A customer on your core platform buys your new reporting module.

- Add-ons: A customer adds five more user seats or buys more API credits.

Expansion ARR is incredibly powerful because it's so much cheaper to generate. You’ve already earned the customer’s trust and business. Now, you’re just delivering more value to them. A healthy expansion motion is the hallmark of a sticky product that customers truly grow with.

Churn ARR: The Unavoidable Leak

Churn ARR is the revenue you lose when a customer cancels their subscription and leaves for good. It's a fact of life in SaaS—you can't keep everyone forever. But it’s a leak you have to manage relentlessly.

If your Churn ARR starts to outpace your New Business and Expansion ARR, your company is shrinking. It doesn't matter how many new logos you're signing.

For instance, if five customers, each paying 10,000 a year, all cancel, you've just lost ****50,000 in Churn ARR. This is more than just a hit to your revenue; it's a massive red flag. High churn can point to deep problems with your product, onboarding, support, or overall value. To track and analyze these drivers, it helps to use reliable app performance statistics to spot trends before they become major issues.

Getting this number under control starts with understanding why customers are leaving. Our guide on https://www.sigos.io/blog/customer-retention-metrics offers a solid framework for monitoring and, ultimately, reducing churn.

Contraction ARR: The Silent Revenue Killer

Finally, there's Contraction ARR. This is the revenue you lose when existing customers downgrade to a cheaper plan, remove users, or reduce their usage. It's a much quieter leak than churn, but it can be just as corrosive over time.

Think about a customer who downgrades from a 500/month plan to a ****200/month plan. That single move just created 3,600 in Contraction ARR for the year (300/month x 12).

Contraction often signals that a customer isn't getting the full value from their current tier, or perhaps their own business needs have changed. While some contraction is normal, a rising rate tells you there might be a mismatch between your pricing and the value customers actually experience—a problem your product and customer success teams need to jump on immediately.

ARR Vs. MRR, ACV, And LTV Explained

The SaaS world loves its acronyms. It's easy to get lost in an alphabet soup of metrics, but the distinctions between ARR, MRR, ACV, and LTV aren't just academic—they're fundamental to understanding your company's health. Using the wrong one can send you down a rabbit hole of bad strategy.

Think of these metrics like different lenses for your camera. Each one brings a different part of your business into focus. The trick is knowing which lens to use for which shot to get the complete picture and make truly informed decisions about your annual recurring revenue SaaS strategy.

ARR and MRR: The Telescope and The Microscope

Let’s start with the most common mix-up: Annual Recurring Revenue (ARR) and Monthly Recurring Revenue (MRR). They're two sides of the same coin, but they tell very different stories.

- MRR (Monthly Recurring Revenue) is your microscope. It gives you that tight, granular, month-to-month view of your revenue. It's the metric you watch for the immediate impact of a marketing campaign or a pricing test. It’s the very pulse of your business.

- ARR (Annual Recurring Revenue) is your telescope. It zooms way out to show you the big picture and long-term trajectory. By looking at revenue on a yearly basis, ARR cuts through the monthly noise, making it perfect for strategic planning, investor updates, and setting those big, hairy, audacious goals.

ACV: The Size of The Deal

Next up is Annual Contract Value (ACV). This one trips people up because it sounds a lot like ARR, but it measures something else entirely. While ARR tracks only the recurring revenue from your subscriptions over a year, ACV measures the total average value of a customer contract over that same 12-month period.

The key difference usually boils down to one-time fees. Let's say a customer signs a one-year deal for 12,000 in subscription fees, plus a ****3,000 one-time implementation fee.

- Their ARR is $12,000. That's the predictable, recurring part.

- Their ACV for that year is $15,000. It includes everything.

ACV is incredibly useful for sales teams to track the total value of the deals they’re closing. But for measuring the core health of your predictable revenue engine, ARR is still the gold standard.

LTV: The Long Game

Finally, we have Lifetime Value (LTV), often called Customer Lifetime Value (CLV). If ARR is a snapshot of your health right now, LTV is a forecast of a customer's total worth over their entire relationship with you. It’s about predicting how much revenue a customer will generate before they eventually churn.

- ARR is a current metric, looking at existing contracts.

- LTV is a future-looking, predictive metric, based on things like average customer lifespan and revenue per account.

A healthy LTV is a sign of a sticky product and happy customers who will keep paying you for years. It's the North Star for figuring out how much you can really afford to spend to acquire a customer (your Customer Acquisition Cost, or CAC). You can get a much deeper look into this by calculating customer lifetime value for SaaS, which is critical for a sustainable growth strategy.

To tie it all together, here’s a quick cheat sheet to keep these metrics straight. Each one offers a unique and valuable piece of the SaaS growth puzzle.

SaaS Revenue Metrics At A Glance

| Metric | What It Measures | Typical Timeframe | Primary Use Case |

|---|---|---|---|

| MRR | Predictable revenue generated per month. | Monthly | Tracking short-term growth, operational trends, and tactical campaign impact. |

| ARR | Predictable revenue generated per year. | Annual | High-level strategic planning, investor reporting, and long-term goal setting. |

| ACV | The average value of a customer contract over one year. | Annual | Evaluating sales performance, deal size trends, and go-to-market motions. |

| LTV | The total revenue a single customer is expected to generate. | Entire Customer Lifespan | Determining customer acquisition spend (CAC) and long-term business viability. |

Getting comfortable with these distinctions means you can have much sharper conversations about your business. You can use MRR for operational agility, ARR for strategic direction, ACV for sales performance, and LTV for long-term investment decisions. They’re not just letters; they’re the language of SaaS growth.

Actionable Strategies To Increase Your SaaS ARR

Knowing what drives ARR is one thing. Actually moving the needle is a whole different ball game. Growing your annual recurring revenue for a SaaS business isn't about finding a single silver bullet; it's about a smart, multi-pronged attack on both sides of the growth equation—bringing in new revenue while fiercely protecting what you've already earned.

It's time to shift from just watching the numbers to actively changing them. This means rolling up your sleeves and putting specific tactics to work for each core driver: winning new customers, growing existing accounts, keeping the customers you fought hard to get, and softening the blow from downgrades.

Fueling The Engine With New Business ARR

Bringing in new customers will always be a cornerstone of growth, especially when you're just starting out. The real aim here isn't just growth, but building a predictable and scalable machine for acquiring new business.

Here’s how to get started:

- Refine Your Ideal Customer Profile (ICP): Stop trying to sell to everyone. Get laser-focused on who your best customers are—the ones with a high LTV and who stick around. Every dollar of your marketing and sales budget should be aimed squarely at this group.

- Optimize Your Sales Funnel: Every bit of friction in your funnel is a leak in your revenue bucket. Is your signup form a novel? Is your demo putting people to sleep? Use your analytics to pinpoint where you’re losing people and patch those holes immediately.

- Invest in a Strong Inbound Marketing Engine: Solve your ICP's problems with great content. When you educate and provide value, you build trust and draw qualified leads right to your doorstep, which naturally lowers your Customer Acquisition Cost (CAC) over time.

Unlocking Growth With Expansion ARR

Frankly, your existing customer base is a goldmine. It is always, always cheaper to sell more to a happy customer than it is to chase down a new one. This is all about delivering more value to the people who already trust you.

A key strategy is designing value-based pricing tiers. Structure your plans so that as a customer’s business grows, they naturally outgrow their current tier and move up to a higher one with more features, seats, or usage allowances.

Another powerful move is to automate your upsell triggers. For instance, when a user is constantly bumping up against a feature limit, an in-app prompt suggesting an upgrade is incredibly effective. It catches them at the exact moment of need.

The results of this focus are undeniable. Just look at Extreme Networks, which reported a 24.4% year-over-year jump in SaaS ARR, hitting $207.6 million in a single quarter. That growth came from a focused pivot to subscriptions and landing bigger deals, proving this model works. You can read more about Extreme Networks' ARR growth on CRN.com.

Protecting Your Base By Reducing Churn ARR

Let’s be clear: you can’t outrun high churn forever. It will eventually catch you and cripple your growth. Keeping customers on board is absolutely non-negotiable for healthy, long-term ARR. This demands a proactive, not reactive, approach to customer success.

The first 90 days are everything. A seamless, high-value onboarding experience is your best defense against early churn. If customers see the product's value right away, they're far more likely to stick around.

You should also be using customer health scores. By tracking things like product usage, how often they contact support, and survey feedback, you can spot at-risk accounts before they decide to leave. This gives your customer success team a chance to step in and save the account.

A rock-solid retention strategy is the bedrock of any successful SaaS business. For a deeper dive, check out our complete guide on how to reduce customer churn.

Mitigating The Impact Of Contraction ARR

Even your biggest fans might need to downgrade sometimes. Maybe their business is seasonal, or they got a bit too ambitious with their initial plan. The goal here is to handle this gracefully and, more importantly, learn from it.

When a customer asks to downgrade, treat it as a valuable intel-gathering mission. A short exit survey asking why they're cutting back is priceless. Are they not using key features? Is the price too steep for the value they're getting? This feedback is pure gold for improving your product and packaging.

You can also get creative with flexible plans. Instead of just a hard downgrade, could you offer to "pause" their account for a few months? Or maybe a custom plan that better fits their new reality? This can prevent them from dropping off completely and keeps the door wide open for them to expand again later. To keep your offerings competitive, using advanced competitor AI analysis tools can give you the insights needed to stay one step ahead.

The Future of SaaS ARR and Sustainable Growth

The old playbook for growing annual recurring revenue in SaaS is getting a major rewrite. For years, the focus was almost entirely on acquiring new logos. But the game has changed. The future belongs to companies that can not only win customers but master keeping and growing them.

Sustainable growth isn't about frantically pouring more water into a leaky bucket. It's about turning that bucket into a self-sustaining fountain.

This is where Net Revenue Retention (NRR) comes into the spotlight. NRR tells you how much recurring revenue you have today from a specific group of customers compared to what you had from that same group a year ago. It’s the ultimate health check, because it factors in both expansion revenue and churn.

When your NRR breaks past the 100% mark, you've hit a critical milestone. It means your existing customer base is growing on its own, even if you don't sign a single new deal. This is the secret sauce of a truly scalable SaaS business—your customers become your best growth engine.

New Frontiers in Expansion ARR

This pivot toward retention-led growth isn't happening in a vacuum. A couple of big trends are pushing it forward, and if you want to build a resilient business, you need to get ahead of them.

First up is the explosion of AI-powered features. SaaS companies are no longer just selling tools; they're selling outcomes powered by intelligent automation and predictive insights. These aren't just minor add-ons; they are high-value capabilities that give customers a compelling reason to upgrade, directly boosting your Expansion ARR.

The second major shift is the move toward usage-based pricing models. Instead of a simple flat fee, customers pay for what they actually use—whether it's API calls, data processed, or seats activated. This model perfectly aligns your revenue with the value your customers are getting. When they succeed and use your product more, your ARR grows right alongside them.

Getting the fundamentals of ARR right has always been important. But mastering the levers of expansion while keeping churn in check? That's no longer just good practice. It's the absolute foundation for building a valuable, future-proof SaaS company that can win for the long haul.

A Few Lingering Questions About SaaS ARR

Even when you've got the basics down, a few practical questions always seem to pop up when you start applying ARR in the real world. These are the kinds of things that come up in board meetings or during late-night planning sessions.

Let's dig into some of the most common ones.

Can a SaaS Company Be Profitable With a Low ARR?

It’s possible, but it’s definitely not the norm for a growth-minded SaaS company. A business could be profitable with a low ARR if its operating costs are incredibly lean. Another way this happens is if the company relies heavily on one-time revenue, like big setup fees, custom implementation projects, or a lot of consulting work.

For most venture-backed SaaS businesses, though, a low ARR is a major red flag. It usually points to a lack of traction or a real struggle to find product-market fit. In the SaaS world, investors almost always want to see strong, predictable revenue growth first; short-term profitability can wait.

Is ARR Only for SaaS Companies?

Not at all. While ARR is the native language of SaaS, it’s a crucial metric for any business that runs on subscriptions, especially those with annual contracts. The concept is valuable across a surprising number of industries.

- Media Companies: Think of streaming platforms or digital magazines that sell yearly subscriptions.

- Membership Services: This could be anything from a professional organization to a paid online community.

- Subscription Boxes: Any service that ships you physical products on a recurring annual plan.

For any business with a subscription model, ARR delivers the same powerful insights it does for SaaS: a predictable revenue forecast, a clear yardstick for growth, and a stable financial base for planning what's next.

If a business is mostly month-to-month, MRR is often the go-to metric for day-to-day decisions. But when it's time for bigger strategic conversations or valuation talks, ARR is still the king.

How Often Should You Actually Track ARR?

Okay, so ARR is an annual metric, but that doesn't mean you only look at it once a year. While it's officially reported quarterly and annually for investor updates and big-picture planning, the best teams are obsessed with its underlying components.

You should be looking at the drivers of ARR—new MRR, expansion revenue, churn, and contractions—on a weekly, if not daily, basis. This constant pulse-check is what lets you react quickly. You can catch a sudden spike in churn and figure out why it's happening right away, instead of discovering the damage a whole quarter later. This is how you proactively manage the health of your annual recurring revenue SaaS engine.

SigOS helps you move from reacting to reports to proactively driving ARR. By analyzing customer behavior and feedback in real-time, our AI-driven platform identifies the churn risks and expansion opportunities that directly impact your bottom line. Stop guessing and start prioritizing the work that grows your revenue. Learn more at https://sigos.io.