Discover the customer insight platform that fuels growth

Unlock revenue by using a customer insight platform to unify feedback, predict churn, and prioritize your product roadmap.

Ever tried to pick out a single voice in a roaring stadium? That’s what it feels like to manage customer feedback. A customer insight platform is the tool that tunes out all that background noise, letting you zero in on the conversations that actually impact your bottom line.

From Customer Feedback Overload to Clear Revenue Signals

For most SaaS businesses, customer feedback is a firehose of information coming from all directions. You've got support tickets piling up in Zendesk, sales calls recorded in Gong, and user behavior tracked in your product analytics. Each system holds a tiny piece of the customer story, but with no way to link them together, you’re left guessing.

This scattered approach often leads to putting out fires instead of building a better product. The loudest, most persistent complaints tend to grab the engineering team's attention, even if they aren't the most critical issues affecting revenue.

The real challenge is weaving all this qualitative and quantitative feedback into a single, understandable story. A bug report might seem small on its own, but what if you knew it was connected to a dozen support tickets from your highest-value accounts? A feature request buried in an Intercom chat could be the one thing needed to close a massive expansion deal. Without that unified view, these crucial connections—and the revenue they represent—are easily missed.

Unifying Disparate Data Sources

This is where a modern customer insight platform comes in. It acts as a central intelligence hub, pulling in data from every customer touchpoint to create a single source of truth. It's not just about warehousing data; it's about deeply understanding the relationships between different signals.

The platform connects the dots between key sources like:

- Support & Ticketing Systems: Data from tools like Zendesk or Jira Service Management exposes real-time customer pain points.

- Communication Tools: Unfiltered feedback from Intercom chats and Gong call transcripts captures the authentic voice of the customer.

- Product Usage Logs: Analytics reveal how people actually use your product, showing where they find value and where they get stuck.

- CRM Data: Context from Salesforce or HubSpot adds the business layer, including account value, contract details, and renewal dates.

By bringing these streams together, the platform builds a complete picture of customer health, sentiment, and intent. To get a better handle on this foundational process, you can dig into our guide to effectively analyse customer feedback.

Turning Insights into Actionable Signals

The real magic happens when the platform starts quantifying the financial impact of qualitative feedback. It finally answers the questions that keep product and growth leaders up at night: Which bug is putting the most revenue at risk? Which feature request will unlock the most new business?

This technology turns a vague complaint into a hard number. Instead of just hearing that "some users are frustrated," you see that "this specific bug is currently impacting $50,000 in monthly recurring revenue."

This is the core of strategies like signal-based selling, where you prioritize work based on tangible customer signals and their direct connection to revenue. By doing this, a customer insight platform becomes your most powerful tool for cutting churn, building a roadmap that matters, and finding growth opportunities hiding in plain sight.

What a Modern Insight Platform Actually Does

A modern customer insight platform isn’t just another dashboard you glance at once a week. Think of it more like an intelligence operation working 24/7 behind the scenes, sifting through all the customer noise to give you clear, revenue-focused directives.

To really get what it does, it helps to break it down into its core jobs. Each one plays a critical role, and together they turn a messy avalanche of raw data into your most valuable strategic weapon.

Automated Data Aggregation

First things first, you have to gather the intelligence. This is the platform's automated data aggregation capability. It acts like a team of field agents, pulling in clues from every corner of your business.

We're talking about systematically gathering both structured and unstructured data from dozens of places—Zendesk tickets, Intercom chats, Gong call transcripts, product usage logs, you name it. A critical part of this is a solid Customer Data Platform (CDP) integration, which helps create that single source of truth. Without it, your customer story is just a bunch of disconnected chapters.

AI-Powered Pattern Recognition

Once all that data is in one place, the real analysis begins. This is where AI-powered pattern recognition comes in. Using advanced tech like Natural Language Processing (NLP), the platform digs through millions of data points to find emerging trends, strange anomalies, and hidden connections a human team could spend months trying to find.

It’s all about connecting the dots. For instance, the platform might notice that a seemingly minor bug mentioned in a few support tickets is also popping up in negative G2 reviews and, more importantly, correlates with a 5% increase in churn for a specific user segment. It finds the "why" behind the "what," bringing critical issues to the surface that would otherwise stay buried.

A customer insight platform goes way beyond simple keyword searches. It gets the intent, sentiment, and context behind the words, letting it tell the difference between a casual complaint and a high-priority fire that signals major churn risk.

This shift to deeper analysis is why the market is booming. Valued at 13.5 billion in 2025, the customer insight platform market is on track to hit ****25.9 billion by 2033, growing at a powerful 14.90% CAGR. Businesses are hungry for this kind of data-driven insight, as detailed in this comprehensive market report.

Revenue Impact Scoring

Spotting a pattern is one thing, but knowing how much money is on the line is a total game-changer. That’s the job of revenue impact scoring. This feature ties specific customer issues—like bugs, feature requests, or points of friction—directly to cold, hard financial metrics like MRR, churn risk, and expansion opportunities.

It's built to answer the questions that really matter:

- How much MRR is currently at risk because of this integration failure?

- Which feature request comes up most often from accounts worth over $1 million in ARR?

- What's the total expansion opportunity we could unlock if we built that upgrade customers are asking for?

This turns a subjective pile of feedback into an objective, prioritized to-do list. Product teams no longer have to guess what’s most important; they get a clear business case for every decision, making sure their work is always tied directly to revenue.

Seamless Workflow Integration

Finally, an insight is worthless if it just sits in a report. This is where seamless workflow integration comes in. The platform plugs directly into the tools your teams already live in every day, like Jira, Linear, or GitHub.

When the platform flags a high-impact bug, it can automatically create a Jira ticket that’s already filled out with all the crucial context: the revenue at risk, the specific customers affected, and even links back to the original conversations. This closes the loop between finding a problem and fixing it, slashing the time it takes to respond to your most important customer needs.

Comparing a Customer Insight Platform to Other SaaS Tools

It's easy to confuse a customer insight platform with other tools in your tech stack, but its job is fundamentally different. This comparison highlights the unique value it brings to the table against other common data tools.

| Tool Category | Primary Function | Typical Data Sources | Key Output |

|---|---|---|---|

| Customer Insight Platform | Identifies the "why" behind customer behavior and quantifies its revenue impact. | Support tickets, call transcripts, reviews, surveys, product analytics, CRM data. | Prioritized list of issues and opportunities ranked by revenue impact (e.g., "$50k in MRR at risk from this bug"). |

| CDP (Customer Data Platform) | Unifies customer data from multiple sources to create a single customer profile. | Website interactions, mobile app usage, marketing automation, CRM, POS systems. | A unified, persistent customer database for segmentation and personalization. |

| BI (Business Intelligence) Tool | Visualizes and reports on structured business data to track KPIs. | Databases, data warehouses, financial systems, sales data. | Dashboards and reports showing historical trends and performance (e.g., "Q3 churn rate was 4.2%"). |

| Feedback Management Tool | Collects and organizes direct customer feedback. | Surveys (NPS, CSAT), in-app feedback forms, online reviews. | A repository of qualitative feedback, often with basic sentiment analysis. |

While tools like CDPs and BI platforms are great at telling you what is happening, a customer insight platform is designed to tell you why it's happening and how much it's costing you. It bridges the gap between raw data and strategic, revenue-driven action.

How AI and Data Science Power Your Insights

A customer insight platform can feel like it has a crystal ball, pinpointing the exact issues that are costing you revenue. But there’s no magic involved. Underneath the hood, it’s a powerful combination of artificial intelligence and sophisticated data science models all working together. This is the engine that turns mountains of raw, messy customer feedback into a clear, prioritized action plan.

Think of the platform as an expert intelligence analyst. Its job isn’t just to gather intel but to understand context, find hidden connections, and forecast what's coming next. It does this by tackling three fundamental questions: What are customers really saying? How do their words connect to their actions? And, most importantly, what are they likely to do next?

The Art of Understanding Language with NLP

At the very heart of these platforms is Natural Language Processing (NLP). This is the tech that lets the system actually read and comprehend human language from all your customer channels—support tickets, call transcripts, app store reviews, you name it.

Forget simple keyword counting. Modern NLP models analyze sentiment, intent, and context. It’s the difference between a system knowing the word "broken" appeared 50 times and a system understanding that a key feature is broken, which is preventing a customer's team from completing a critical workflow.

Think of NLP as a multilingual translator who also happens to be an expert in psychology. It doesn't just convert words; it deciphers the underlying emotion and motivation, separating a minor annoyance from a deal-breaking complaint.

This core capability allows the platform to automatically categorize and tag feedback, spotting emerging themes long before a human team could ever hope to sift through all that data manually. For anyone looking to build better products, learning about the role of AI for product development can shed more light on just how powerful this is.

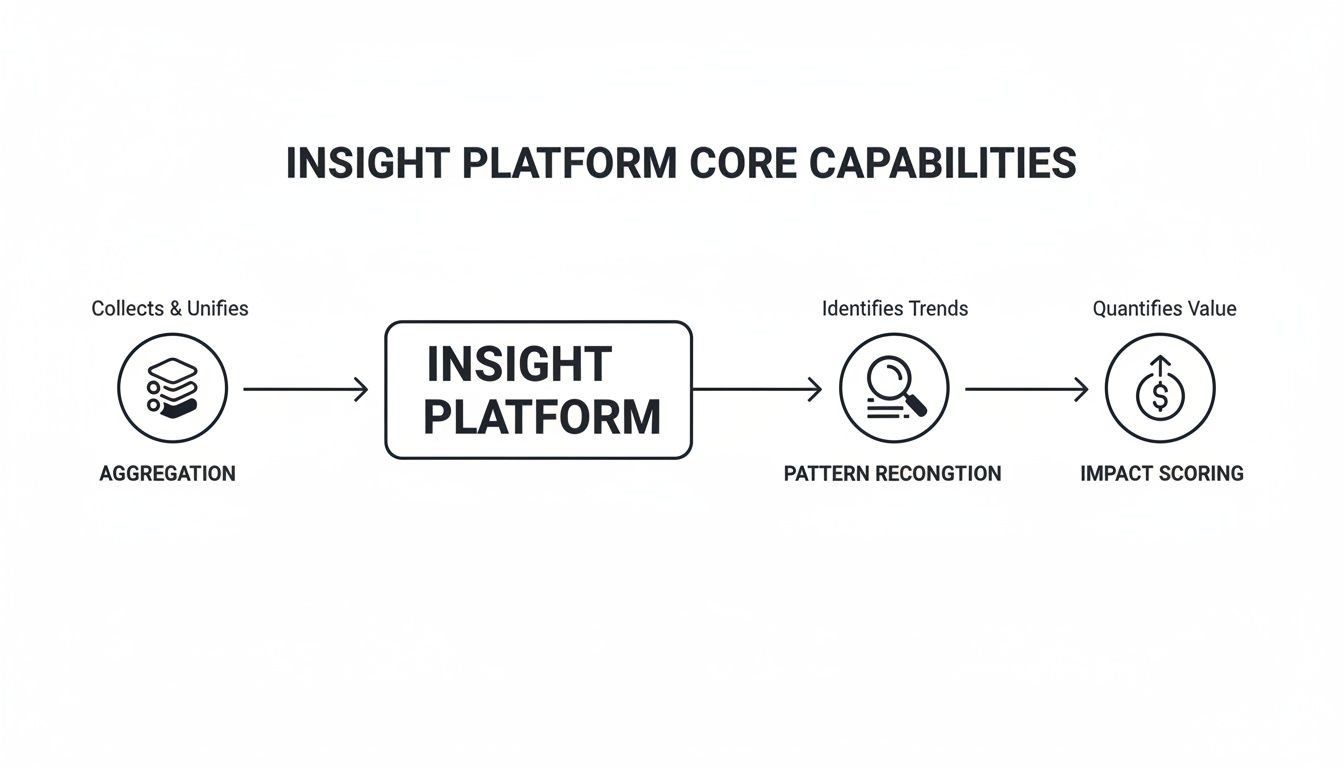

This diagram shows how these different capabilities work together to create real value.

As you can see, the process flows from collecting the raw data, to finding the patterns within it, and finally, to putting a dollar value on what you’ve found.

Connecting Words to Actions with Correlation Analysis

Understanding what customers say is only half the battle. The real breakthrough comes when you connect that feedback to what they do. This is where behavioral correlation analysis comes in, linking qualitative feedback to hard, quantitative product usage data.

The platform hunts for patterns, looking for how specific complaints or feature requests correlate with user actions. It might discover, for instance, that users who complain about "clunky reporting" in support tickets are 30% more likely to decrease their usage of the analytics module in the following week.

This analysis forges that crucial link between feeling and action. It proves a complaint isn't just noise—it's a leading indicator of disengagement or potential churn. By connecting these dots, the platform highlights the issues that have a direct, measurable impact on your bottom line.

Forecasting the Future with Predictive Modeling

The final, and arguably most powerful, layer is predictive modeling. This is where the platform starts to act like a weather forecast for your customer base, using historical data to predict future events.

Predictive models analyze thousands of signals—feedback sentiment, drops in product usage, support ticket frequency, and more—to calculate a churn risk score for every single account. These models are trained to spot the subtle combination of events that almost always precedes a customer cancellation.

The benefits here are huge:

- Proactive Intervention: It flags at-risk accounts before they give notice, giving your customer success team a fighting chance to step in and save the relationship.

- Opportunity Identification: It’s not all doom and gloom. The same models can predict positive outcomes, like identifying users whose behavior makes them prime candidates for an upsell.

- Data-Driven Prioritization: By forecasting the potential revenue loss tied to a specific bug, it gives your engineering team a clear business case for bumping that fix to the top of the list.

Brought together, these AI and data science layers are what give a customer insight platform its strategic power. It stops being a simple feedback box and becomes a predictive, revenue-focused intelligence engine.

Putting Insights Into Action with Real-World Use Cases

All the theory and technical specs in the world don't mean much if a platform can't deliver real-world results. The true test of a customer insight platform is its ability to turn data into action—the kind of action that protects revenue, drives growth, and solves painful business problems.

To show you exactly what this looks like, let's walk through three common scenarios. In each one, a customer insight platform helps a team move from a state of confusion to decisive action, creating a measurable win for the business.

Proactive Churn Prediction

The Problem: The customer success team is getting nervous. They’ve noticed a small but steady increase in cancellations from their mid-market customers. Exit surveys are no help, filled with vague reasons like "general dissatisfaction." They're flying blind, and they know more accounts are at risk if they can't find the root cause.

The Insight: The customer insight platform crunches thousands of data points from support tickets, product usage logs, and chat transcripts. It quickly flags a critical connection: accounts that filed a support ticket about a specific bug in the new reporting module were 30% more likely to cancel within the next 45 days. It wasn't just one thing; the AI connected the dots between support interactions, frustrated comments in chat logs, and a subtle drop-off in product use, all pointing back to this single bug.

The Action: Now they have a lead. The customer success team immediately springs into action with a targeted plan.

- First, they build a segment of all mid-market accounts that ran into the bug but haven't canceled yet.

- Next, they launch a proactive outreach campaign to this group, acknowledging the problem and giving a clear timeline for the fix.

- At the same time, the product team uses the platform's revenue impact score to bump the bug's priority with the engineering team.

The Outcome: The proactive communication cut churn within that at-risk segment in half over the next quarter. Better yet, engineering shipped a fix in the next sprint, stopping the problem at its source and preventing future churn.

Data-Driven Feature Prioritization

The Problem: It's roadmap planning time, and the product team is staring at a backlog of hundreds of feature requests. Everyone has a pet project. Sales wants an integration to help close bigger deals, marketing needs a feature for a new campaign, and engineering wants to tackle some technical debt. The meeting feels more like a political debate than a strategic planning session.

The Insight: The platform gets to work, analyzing sales call transcripts from Gong and notes in the CRM. It quickly uncovers a recurring theme: a request for a "bulk user management" feature has come up in five separate sales calls in the last month alone. The kicker? Each of those prospects represented a potential six-figure deal. The platform quantifies the opportunity, showing over $500,000 in potential new ARR is tied directly to this one feature.

The Action: Armed with this data, the product manager walks into the next roadmap meeting. The conversation instantly changes from "I think we should..." to "The data shows us..." The "bulk user management" feature, once buried deep in the backlog, is fast-tracked to the top of the priority list.

The Outcome: The new feature is built and shipped in three months. The sales team immediately re-engages those five prospects, closing three deals within weeks of the launch. The result? $320,000 in new ARR that was directly unlocked by listening to the customer's voice in the data.

This is a perfect example of why connecting feedback directly to revenue is changing the game. The global market for these platforms is expected to hit $3.1 billion by 2026, with a 20.6% CAGR. This explosion is fueled by the need to unify data from CRMs, support tools, and social media to tackle huge business challenges like customer retention. You can read more about these key market trends.

Quantifying the Dollar Value of Bugs

The Problem: Engineering flags a critical failure with a third-party API integration. From their perspective, it seems minor—it's only affecting a small fraction of the user base. They log a medium-priority ticket for it, slotting it behind bigger projects in the current sprint.

The Insight: The customer insight platform doesn't see it that way. It automatically cross-references the list of impacted users with CRM data to see who those users are. Within minutes, it generates an alert: this "minor" bug is currently jeopardizing $75,000 in MRR from some of their most valuable enterprise accounts.

The Action: The product manager gets the alert in real time via a Slack integration. They immediately share the revenue-at-risk report with the engineering lead. The conversation shifts instantly. Seeing the financial risk laid out in plain dollars and cents, the engineering team re-prioritizes on the spot.

The Outcome: A hotfix is deployed in less than 24 hours, restoring full service. The customer success team follows up with those high-value accounts to confirm the fix, turning a potential churn event into a moment that reinforces their commitment to customer stability.

Picking the Right Insight Platform: A Practical Guide

Choosing a customer insight platform isn't like buying off-the-shelf software. It's more like bringing on a new head of intelligence for your entire customer base. Get it wrong, and you're stuck with expensive shelfware. But get it right, and you've found a partner that can genuinely move the needle on your business goals. The key is to have a structured plan for evaluating your options, one that goes way beyond the sales deck.

You need to cut through the marketing fluff and ask the tough questions. A slick user interface means nothing if the platform can't integrate deeply with your tech stack or if its AI models are a black box you can't trust. This evaluation phase is where you lay the foundation for success, so let's dig into what really matters.

Your Evaluation Checklist

When you're sitting down to compare platforms, focus your energy on these four non-negotiable areas. Each one is a critical pillar for long-term success.

- Integration That Actually Works: Can the platform pull data from the tools you live in every day, like Zendesk, Salesforce, Gong, and Jira? And I don't mean surface-level connections. You need deep, native integrations that can access the rich, messy, contextual data where the real insights are hiding.

- Models You Can Trust: Don't be afraid to challenge vendors on their AI. Ask them point-blank: How accurate are your models for things like sentiment analysis or churn prediction? A good partner will be transparent about their performance metrics and be able to explain how their platform comes to a conclusion. If it feels like a total mystery box, that’s a red flag.

- Ironclad Security and Privacy: This is a big one. The platform will be handling your most sensitive customer information, so it absolutely must have certifications like SOC 2 and be GDPR compliant. A crucial question to ask is whether they need to train their AI models on your private data—a practice that can introduce serious privacy risks.

- Performance That Scales: Your data isn't going to shrink. As your company grows, will the platform keep up? Ask about its core architecture and how it handles millions of data points. The last thing you want is a tool that grinds to a halt right when you need it most.

The engine behind any great customer insight strategy is unified data, which is why the technology that powers it is seeing explosive growth. The Customer Data Platform (CDP) market, a core component, is expected to jump from 4.58 billion in 2026 to a staggering ****13.14 billion by 2031. That's a compound annual growth rate of 23.47%. You can explore the market drivers behind this trend in this detailed report.

How to Get Started: The Phased Rollout

Once you've made your choice, the temptation is to plug everything in at once. Resist that urge. A phased implementation is smarter, safer, and the fastest way to show value and get your team excited.

Start with one high-impact project. For most B2B SaaS companies, the richest, most honest feedback lives in your support tickets. Connecting a system like Zendesk or Intercom first is almost always the right move.

Here’s a simple, three-step plan to run your pilot:

- Step 1: Connect a Single Source: Start by integrating your main customer support tool. Let the platform analyze the last 90 days of support conversations to build a baseline.

- Step 2: Hunt for Quick Wins: Work with the vendor’s team to immediately identify the top 3-5 issues that are actively costing you money. It might be a persistent bug driving cancellations or a critical feature request holding up a major renewal.

- Step 3: Share the Proof: Take these findings to your leadership team. Nothing gets attention faster than showing a direct line from a customer complaint to a dollar amount. This is how you prove the platform’s ROI from day one and build the momentum you need for a full-scale rollout.

Calculating the ROI of Your Customer Insight Strategy

Putting money into a customer insight platform is a big move. Like any other major investment, you need to see a clear, measurable return. While the strategic perks are great, it’s the cold, hard financial outcomes that really build the business case. Thankfully, you don't need a PhD in finance to calculate the ROI.

You can pin down the value by focusing on three core business drivers that these platforms have a direct impact on. When you can connect platform insights to real dollars saved or earned, you'll have a rock-solid argument that gets everyone from the C-suite to the product team on board.

Quantifying Churn Reduction

One of the most immediate ways a customer insight platform pays for itself is by slashing customer churn. The platform spots the specific bugs, frustrating friction points, and missing features that are pushing your customers out the door. This lets you fix the problems before they pack their bags.

The math here is refreshingly simple:

- Identify the revenue at risk: Let's say the platform flags a bug affecting 100 accounts, and each of those accounts pays you 500/month. That's a total of ****50,000 in MRR on the line.

- Calculate saved revenue: If your team jumps on it and your proactive fix stops just 20% of those accounts from leaving, you’ve just saved 10,000 in MRR. Annually, that’s a ****120,000 win.

This isn’t just about improving a vague "customer health" score; it's about turning insights into a concrete financial victory you can take to the bank.

Accelerating Expansion Revenue

Good insights don't just stop the bleeding; they actively help you grow. By bubbling up the most requested features from your high-value accounts or spotting behaviors that scream "upsell opportunity," you can build a roadmap that directly fuels expansion.

A customer insight platform shifts the conversation from "what should we build next?" to "which feature will unlock the most expansion revenue this quarter?" It connects your roadmap directly to your financial goals.

Imagine this: the platform shows you that five enterprise prospects, with a combined potential value of 250,000 in ARR, are all blocked by the same missing integration. Building that feature is no longer just a product decision—it's a sales strategy. If that work helps you close just two of those deals, you've generated ****100,000 in new revenue, all thanks to listening to your data.

Measuring Operational Efficiency

Finally, don't sleep on the ROI that comes from pure operational efficiency. Just think about the collective hours your product managers, engineers, and success teams burn every week manually digging through feedback and trying to connect the dots across a dozen different tools.

A customer insight platform puts that entire process on autopilot.

- Product Managers: Instead of manually reading every support ticket, they get a prioritized, revenue-ranked list of what matters most. That's hours saved every single week.

- Engineers: They get bug tickets packed with context, including the financial impact, so they can squash the most expensive bugs first.

If the platform frees up just 10 hours per week for your product team, at an average loaded cost of 100/hour, you're looking at ****1,000 per week. That adds up to $52,000 a year in reclaimed productivity. To get more hands-on with these numbers, this return on investment template is a fantastic resource for building out your own business case.

Got Questions? We’ve Got Answers

Even when you see the value, a few questions naturally pop up. Let's tackle some of the most common ones we hear about customer insight platforms.

How Is This Different From a CDP?

It's a great question, and the distinction is crucial.

Think of a Customer Data Platform (CDP) like a meticulously organized library. It collects every piece of customer data you have—every book, if you will—and puts it all on the right shelf. It tells you what data you have.

A customer insight platform is the expert librarian who has read every single book. This librarian connects the dots between different stories, points out which narratives are costing you revenue, and identifies the plot twists that will lead to massive growth. It delivers the "why" and puts a dollar value on it.

How Technical Do I Need to Be to Use One?

This is the best part: these platforms are designed for business users, not a team of data scientists. While incredibly sophisticated AI is running under the hood, the person behind the wheel is the product manager, the customer success lead, or the growth marketer.

You should expect to:

- Easily navigate dashboards that automatically highlight the most pressing revenue-impacting issues.

- Read simple reports that draw a straight line from a specific bug or feature request to its impact on MRR.

- Connect your other tools and set up alerts without ever touching a line of code.

Is Our Company Data Safe?

Security isn't just a feature; it's the foundation. Any platform worth its salt is built with enterprise-grade security from day one and holds certifications like SOC 2 Type II.

Here’s a critical question you should ask any vendor: "Do you need to train your AI models on our private customer data?" Top-tier platforms don't. They deliver pinpoint accuracy without ever using your confidential information to train their global models.

This method keeps your data completely isolated and private. It's how you get powerful, actionable insights without compromising your company's security or your customers' trust.

Ready to stop guessing what your customers want and start building a roadmap based on real revenue impact? SigOS connects customer feedback directly to financial outcomes, giving you the clarity to slash churn and drive growth. Get a demo of SigOS today.

Keep Reading

More insights from our blog

Ready to find your hidden revenue leaks?

Start analyzing your customer feedback and discover insights that drive revenue.

Start Free Trial →